Latest Bitcoin Cash News

It’s got to be pretty exciting to be a Bitcoin Cash holder. Hours after Avnet announced their partnership with BitPay, one of the world’s largest crypto processor, allowing their clients to settle with Bitcoin Cash and Bitcoin, Vardex Suisse—the Switzerland based blockchain and Point of Sale operator which is also a regulated firm which provides access to digital assets including Bitcoin and Litecoin in all of their ATMs, now supports Bitcoin Cash.

Read: CoinMarketCap Indices Listed on Bloomberg, Nasdaq

“When a customer elects to make a purchase with Bitcoin (BTC) or Bitcoin Cash (BCH), Avnet will work with BitPay to verify the funds, process the order and complete the transaction. Avnet and BitPay will also have the ability to manage and process cryptocurrency requests outside the US on a country-by-country basis”

Vardex Suisse has been working independently since 2017 and with an express objective of meeting customers’ demand through a reliable and easily accessible network, the provider is a member of the Financial Services Standards Association (VQF) as well as Crypto Valley Train Community.

Because they are keen on making crypto purchases as seamless as possible, Vardex has partnered with Post von Liechtenstein and taking advantage of favorable regulations in the country that has seen crypto businesses flourish. Interested users can buy Bitcoin Cash using fiat, wallets or credit cards.

Also Read: Crypto Scores Big-Name Backer in Chicago’s Mayor: “Alternative Currencies Will Happen”

BCH/USD Price Analysis

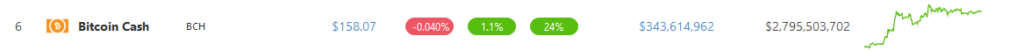

Bitcoin Cash (BCH) is a top performer in the top 10 adding 24 percent in the last week. Even though BCH buyers are in charge, there is strong sell pressure at $160, our immediate resistance level.

All the same, bulls are firm and have satisfactorily reversed losses of Feb 24, an important reference bar in the last month. Despite our optimism and expectation of higher highs towards $230, our ultimate target marking Dec 2018 highs, we shall adopt a wait and see approach aware that failure of buyers to build momentum and close above $170 is bearish for BCH.

Trend and Candlestick Formation: Bullish, Bear Breakout

From a top down approach, sellers are in control and yet to recover from the losses of mid-Nov 2018. That means, BCH/USD is trading within a bear breakout pattern.

However, from a second look, price action is trending within Dec 16-20 bull bars and the failure of sellers to close below $70 means buyers have a chance in the short-term. It has been affirmed by bulls finding support and bouncing off the 78.6 percent Fibonacci retracement level based on Dec 2018 high low.

If anything, this is bullish in the short-term and albeit the deep correction, BCH could rally to $230 but that is largely dependent on whether bulls clear our minor resistance level at $170 marked by the 38.2 percent Fibonacci retracement level of Dec 2018 high-low.

Volumes: Bearish

Although BCH buys have an upper hand, sustaining their momentum are low volumes. Four weeks later and bulls have managed to recover losses but accompanying volumes are low.

On Feb 24, volumes stood at 85k but Mar 16 bull bar was pumped by low volumes at 78k. What we need, for our bullish stance to hold true, is for prices to break above $170 with high participation exceeding 90k. That will confirm bulls of Feb 18 and might be the necessary impetus for a possible BCH rally.

All charts courtesy of Trading View—CoinBase

This is not investment advice. Do you research.