Extremely-Profitable Crypto Trader Still Bullish

The so-called “200M_trader,” a pseudonymous highly-profitable trader popularized by one now-infamous Bloomberg article, recently sat down with CCN in an exclusive interview to tout his/her/their opinions regarding the current Bitcoin (BTC) bear market.

While the Ethereum-centric trader made enough money to live an extravagant life, full of yachting on the Caribbean, sipping Sangrias on moonlit beaches, and rolling around metropolitan New York in exotics, ten times over, 200M_trader (whom I will refer to as 200M) still sees dramatic upside in cryptocurrencies. And as such, the trader remarked that he has continued to invest and accumulate while prices are relatively dreary.

In fact, 200M noted that it is just a matter of time before the “big players,” such as Wall Street hotshots and household names in legacy industries, make a viable foray into this industry, whether it be through Bakkt, a Bitcoin-backed ETF, Fidelity’s custody offering, or similar ventures, platforms, and services. The trading legend, known for scoring $283 million in a month (hence his name), elaborated:

The market has cycles, and it’s important to remember this during both the rapid growth and the strong downfall. It’s also just a matter of time when the big players will enter this market well and truly. We have this time for now and we need to act.

The anonymous trader subsequently stated that from his point of view, this sector has reached the point of critical mass, to which 200M referred to as “the point of no return,” whereas it is impossible for this paradigm-shifting innovation to not make a notable impact. 200M explained that while cryptocurrencies may not fully replace traditional instruments, this technology will change them fundamentally, allowing for more equality and access.

Bitcoin “Halvening” Hype Ensues

And, just like the hundreds of other prominent crypto pundits out there, 200M drew attention to the impending block halving. Like his fellow commentators, he too was overly bullish about the event, slated to occur during 2020.

200M noted that while Bitcoin won’t single-handedly get thrown into a price rally by the block reward halving, the auspicious happenstance should be a trigger for growth. More specifically, he stated that as we near the halvening, as it has been dubbed, the closer it is to the end of this crypto winter, deemed even “nuclear” or near-nuclear by some short-term cynics. So, with this in mind, he optimistically remarked:

I would advise you to count down the remaining days before halving, rather than count the number of days the bear market lasts, this figure will encourage optimism every day.

This comes after Moon Overlord, a leading crypto trader, touched on this subject matter on Saturday, taking to Twitter to note that block reward reductions and halvings “are the most bullish events in crypto history,” adding that now’s the time to pay attention and start accumulating.

As reported by Ethereum World News previously, the analyst claimed that as “Bitcoin has traditionally started pumping around one year on average before it’s halving date.” And as the next issuance shift is slated to occur during May 2020, BTC could begin trending higher in May.

But Overlord and 200M haven’t been the only industry insiders to see halvings and events of similar caliber as solely bullish for price action. Per previous reports from this outlet, Trader Jones, a crypto entrepreneur, writer, and businessman, drew attention to Bitcoin’s historical price action, just as his peer, Overlord, did. Jones noted that the current Relative Strength Index (RSI) readings and chart structures are similar to those seen at the end of 2015’s bear market, approximately a year prior to the previous halving.

And with this in mind, the trader noted exclaimed that “maybe the bottom is in.” Jones’ recent comment comes just a day after crypto-friendly entrepreneur Alex Melen astutely pointed out that the last time BTC bottomed is when the asset fell under its four-day 50 & 200 MA, adding that this same happening is occurring again.

Crypto Moustache, while relatively bearish in comparison to his fellow pundits, also expressed some semblance of bullish sentiment. Moustache noted that while another lower low is inbound, BTC could begin to run in late-2020, as the next halving event becomes six months away.

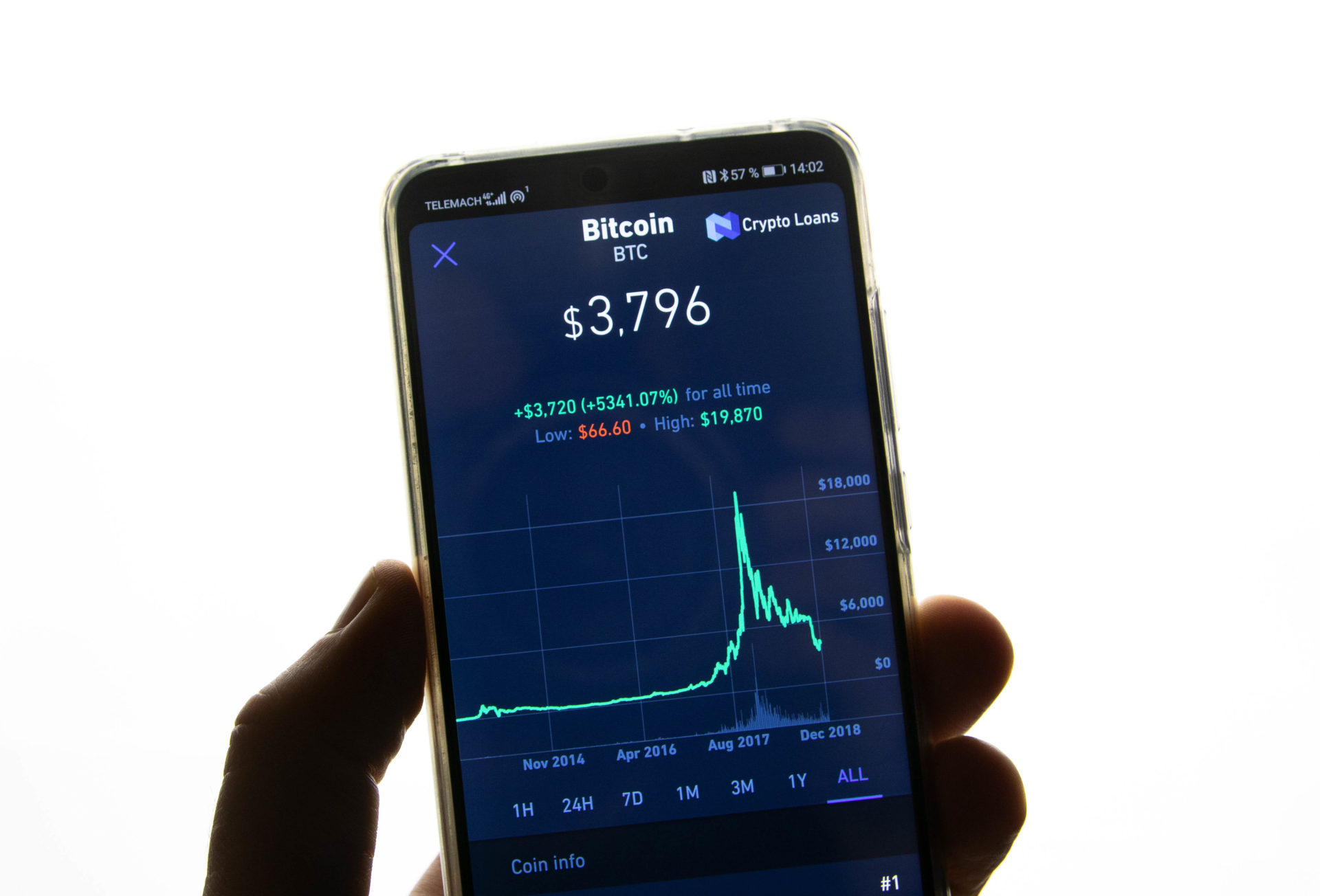

Title Image Courtesy of Marco Verch Via Flickr