Regardless of transcending its 50-day moving average today, the bitcoin-US dollar (BTC/USD) exchange rate is experiencing serious difficulties picking up height.

At press time, the cryptocurrency is exchanging at $4143.19, down from a high of $4,269 prior today; it’s highest amount since September 12. Week-on-week, BTC is up 14%, while month-on-month it is as yet nursing 5.5% loss.

Still, with no clear adoption or technical drivers, there is cause for concern that a potential “bull trap” is developing. With prices neglecting to expand on the overnight bullish break, caution is likely to seep into the market.

Further, price action analysis underscores the requirement for traders to be wary – an inability to hold above 50-day moving average for the third time could turn the tables over support of the bears.

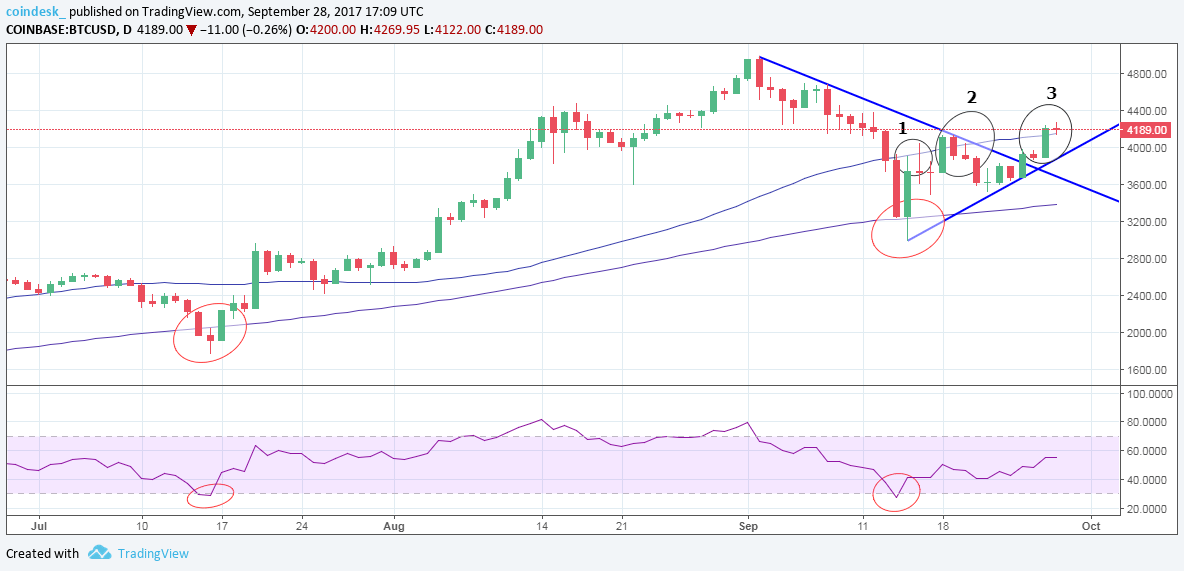

On the charts, bulls are struggling to mimic a successful pattern in July (when a rebound from the 100-day moving average in the wake of an oversold relative strength index was followed by a rally to record high).

Back in July, the rebound from 100-day moving average was followed by a convincing break above the 50-day moving average.

This time, however, it’s a different story. Rather, bulls are having a tough time keeping the cryptocurrency above the 50-day moving average. BTC has already failed twice (on September 16 and September 19) to build upon a break above the indicator.

Prices rose above 50-day moving average yesterdayee, but faced rejection at $4,269 and fell back to $4,140 (the 50-day moving average). A failure to hold above the key moving average for the third time would be bad news for bitcoin.

Bearish scenario

A failure to hold above 50-day moving average followed by a break below the rising trend line support (seen sloping higher to $3,930) would signal the cryptocurrency has topped out. Prices could then drop to $3,382 (100-day moving average levels).

Bullish scenario

Sideways to positive action above the 50-day moving average over the next 48 hours or so would improve the odds of a rally to $4,500-$4,665 (September 7 high).

Read Also: