The star crypto trader on global investment platform eToro isn’t downhearted now that he is no longer a crypto millionaire.

Instead, Jay Smith is feeling the rejuvenating warmth of the crypto spring as it thaws out the trading scene.

Far from being downcast, he holds to the firm conviction that crypto is a long-term game; for him cryptoassets are a bet on what humanity’s future will look like.

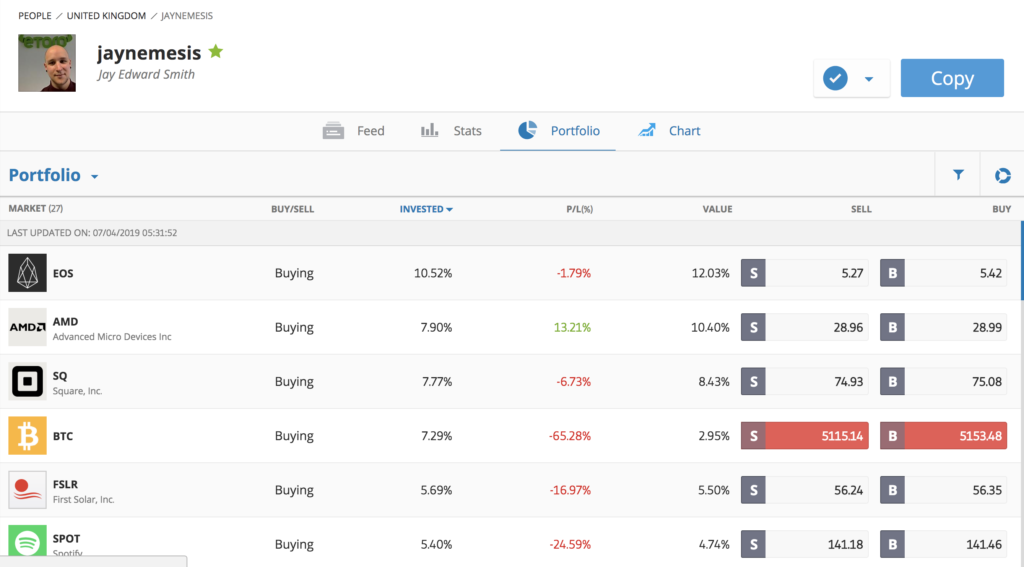

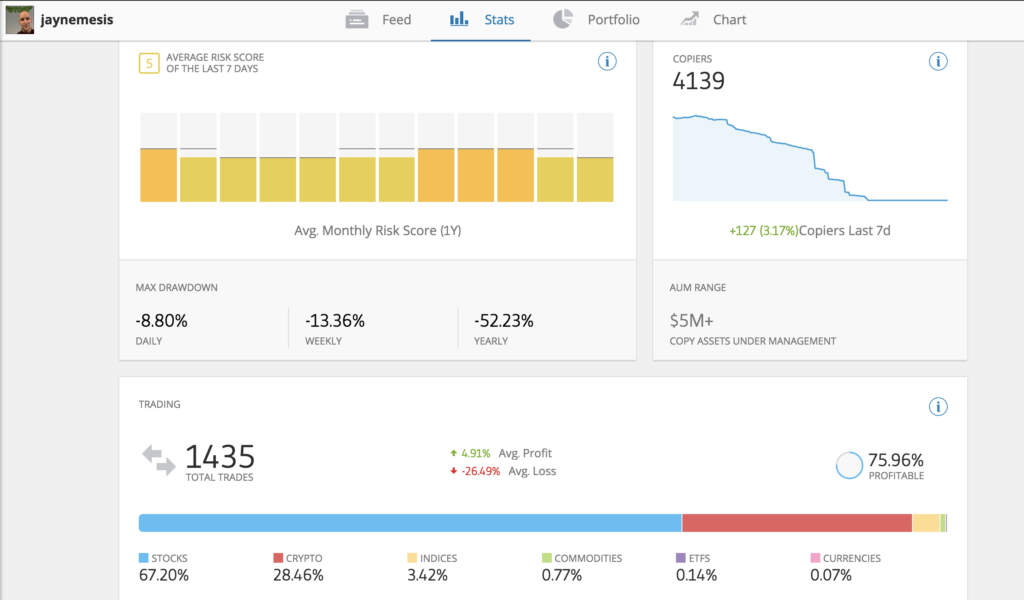

Smith, known by the handle jaynemesis on eToro, has 4,139 copiers on the pioneering social trading platform that enables customers to automatically copy the trades of fellow platform users.

Aggregating the funds his copiers have allocated to his trades means his assets under management amounts to more than £5 million ($6.5 million).

eToro rolled out its social trading platform in the US last month.

I interviewed Smith a few years ago on email after noticing he was the most successful crypto trader on eToro. That was before he became one of the best known crypto traders in the UK.

This week he featured on BBC World Service’s Business Daily programme.

The World Service is perhaps Brexit Britain’s last lonely vestige of soft power on the global stage; still a popular station with influencers in the English-speaking world and beyond.

Presenter Manuela Saragosa was, in the light of the bounce back by bitcoin and the general crypto market, looking for answers to the question “does the case for investing in them make any more sense?”

First, the tiresome critic

In the critics’ corner was David Gerard, author of Attack of the 50 Foot Blockchain. We won’t dwell long on his comments because they don’t add much to the sum of human knowledge in their repetition of the well-worn “no use case” line and the bubble thesis.

Here’s a flavour.

“The trouble with bitcoin is it is an asset that doesn’t do anything. It has no use case, except for being tradeable and payment system.”

“The only thing you can do with cryptos is buy them sell them or hold them.”

“You buy it on the basis that you predict that other people will want to buy it from you at some point. This is a recipe for bubbles.”

Sigh.

He elaborates further with the “greater fool” premise.

“One, someone notices that an asset is going up. Two, other people talk about the asset going up. Three, the mass media gets in on it and then people start buying specifically on the assumption they can all be sold to a greater fool.”

“And the fourth stage is the bubble pops. All bubbles pop eventually.”

How many times he expects the bitcoin bubble to burst Gerard does not tell us.

From the New York Times to The Economist and Motley Fool, we’ve had much the same from the rest of the mainstream media and assorted “expert” critics.

From £5 to a £1 million

Far more interesting were the comments from Smith in which he highlights the new-found resilience of the market built up through previous bear markets.

He also points to a future tokenised world in which he sees stockmarkets disrupted by the decentralisation of crypto and the key barrier to adoption being a solution to the problem of delivering ease of use.

So how much was Smith worth at the height of the bear market?

“When it peaked at the end of 2017 over a million [pounds] ($1.3 million).”

Smith explained how he made his first bitcoin investment in 2012, when it was trading at £25 ($32), buying 0.1 bitcoin to begin with.

So how did he get through the Mt.Gox implosion of 2013, when it dropped 90% in an hour?

“It was pretty scary. If it dropped that quickly in an hour, what’s going to happen in the next 10 minutes?”

“At the time people thought this was it. In the worst case scenario it’s just a couple of thousand pounds, it was not the end of the world for me.”

“For the people who bought further up of course it was a lot more scary… if you had bought at $800 or $900 and it drops down to $200 that’s pretty scary.”

Inexperienced crypto buying near the top

And, as this is crypto, it all unfolded in the open on reddit and the bitcointalk forum.

“In the Reddit community for bitcoin at the time, the top posts on that were all just suicide hotlines for different countries.”

And if we need a reminder of the dynamic that is perhaps beginning to unfold now, he described how the last bull market took hold, and the inexperienced, less knowledgeable buyers it attracted.

“The problem is that when the price is going up really rapidly, it starts to hit new highs, it’s picked up by the mainstream media, which means that the people [who] perhaps haven’t done as much research as I have for example, hear about it, invest in it and then watch their investment plummet by a huge amount – 80%, 90% – within a few days.”

The pain for swathes of retail investors was very real, although the extent to which people invested what they couldn’t afford to lose may have been overstated.

“And so those people are left in a position where they’re potentially too scared to sell or if they’ve invested more than they can afford to lose or worse it they have used leverage, credit debt or remortgaged their house, which I know a lot of people have done from reading those threads, they’re left in a position where they are pretty desperate,” says Smith.

Trading is now “the day job” but only 28% in crypto

Smith is now a full-on professional investor.

“I describe it as my life at the moment,” he told the BBC.

“This is the day job. Every day I wake up, I look at crypto I look at stock as well. I invest in a lot of different stocks, mainly in the tech sector, a lot of them actually involved in cryptocurrency and blockchain in some way. So yeah, I spend most of my day researching and part of my day trading.”

Smith is currently 67.2% invested in stocks and only 28.4% in crypto, which feels overweight stocks and underweight crypto if the turn in sentiment continues to push crypto higher.

His top crypto holdings are EOS (10%), BTC (7.2%) and Dash (5.1%).

A Green in a sea of libertarianism

So, what about the mindset of crypto investors? Would you describe yourself as a libertarian, asks Saragosa?

His reply might surprise some.

“I am the complete opposite. I am a card-carrying member of the Green Party. I am like the black sheep of the cryptocurrency community. It’s quite interesting really. I have quite a lot of arguments with other people about that.”

“But the wider community tends to see bitcoin as a good way to escape the state and try and take back control of your money and get away from the banks and everything . And that’s why bitcoin started if you read the original white paper.”

For Smith, crypto is about much more than just payments.

His example of how it could make avoiding tax harder might not go down very well with John McAfee and many others in the crypto community.

“It’s got potential to do all sorts of really cool things. You could automate tax in theory. Automate tax for the whole world. Nobody needs to file anything. Everything is taken care of. Nobody can avoid the tax.”

He continued: “To me that seems like a pretty cool world to be moving into. But the cool thing about bitcoin is it is open source.”

The possibilities are endless.

“So anyone who wants to do that can copy and paste the code and start their own cryptocurrency that is focused on what they want to do. And that’s what people have been doing.

“So you’re seeing all of these different experiments playout in people’s different visions of the future.”

Bitcoin adoption will be a 10-year game

Where are we now in terms of value and adoption?

Smith homes in on the poor usability and lack of understanding among the wider population. He’s looking 10 years ahead before serious traction happens for bitcoin, although as he points out, he’s said that before.

“Realistically, cryptocurrency is incredibly difficult to use at the moment. Using exchanges, finding places to actually spend it , installing the software on your computer or on your wallet, the big confusion about what mining even is and how to do that and if that’s required, do you have to run a node…

“I’m probably speaking another language to most of your listeners at the moment. It’s not an easy thing to use, so I think realistically it’s got a very, very long time before we start to see real mass adoption. You know, 10 years or something I was one of the people 10 years ago that was saying that it would be in 10 years’ time.

So how to fix this? The key to speeding adoption is building user-friendly tools, says Smith.

“User interface. Its accessibility, it’s information, understanding of how it works, even regulation to some extent.”

Tax confusion and how millennials invest differently

And then there’s regulation in the sense of tax regimes.

He provides the example of how the UK tax authorities treat buying goods and services with bitcoin as a taxable event.

“Tax regulation is different in every single country. No one knows how to control it tax wise. If I buy a t-shirt, under UK tax law, using bitcoin then I have to pay capital gains tax on the bitcoin when I buy the t-shirt, which is quite confusing.”

But if ordinary people can’t get their head around it being just code, how does adoption move forward, does crypto really have a future, the BBC presenter presses?

“If you look at how different generations have invested, the baby boomers – stocks was their thing, before that government bonds was the big thing.

“I think if you look at millennials they are looking more and more to things like cryptocurrencies.

“And actually, just generally there is a trend to investing in products that they use and care about – Tesla, Facebook, Netflix. The FAANG stocks are the big stocks because retail investors love them as they use the products every day and they believe in it and want to own part of it.”

The brave new world of tokenisation

Although he wisely avoids the word “tokenisation” presumably for fear of obfuscating matters for his audience with jargon, he nevertheless explains how it would work with equities – and beyond – in a clear and accessible way.

“I see a future where stockmarkets get replaced by cryptocurrencies because it is more efficient. If I can transfer you my shares in Facebook right now without having to go through any exchange, or anything like that – just from my phone to your phone instantly for free – that’s a pretty compelling argument to move toward cryptocurrencies.

Smith sees strength growing out of the trials and tribulations in the wild swings of crypto markets. The market is maturing as resilience grows.

“The people who have gone through it, we’ve learnt the resilience, we’ve learnt that understanding the application of the technology is what’s important and not to throw loads of money into this thing because it is ultimately still an experiment.”

Smith thinks people will have to learn through their own mistakes.

“Unfortunately, I still do think that an awful lot of people maybe listening to this show are potentially going to go and invest without that kind of knowledge and they will have to learn for themselves.”

Listen to the full show here (registration required).