- Fundstrat’s Tom Lee says that he expects bitcoin to be the best performing asset class through the end of this year.

- Bitcoin has already more than tripled in value this year.

- Lee expects growing institutional investor demand from the launch of bitcoin derivatives will help drive the digital currency’s price higher.

Bitcoin if everything works as smooth as it did, it could do better than stocks and bonds the rest of the year, based on what the first major Wall Street strategist to issue a report on the digital currency.

“I think bitcoin is an underowned asset with potential for huge institutional sponsorship coming,” Fundstrat co-founder Tom Lee said.”

“It has a lot of characteristics that are very similar to gold that I think will make it ultimately attractive as an alternate currency,” he said. “It’s a good store of value.”

Gold or bitcoin? Bitcoin?

“Yes.”

Would you rather own bitcoin versus a basket of U.S. stocks?

“Between now and year end it’s easily bitcoin.”

Will bitcoin be the best performing asset?

“Yes.”

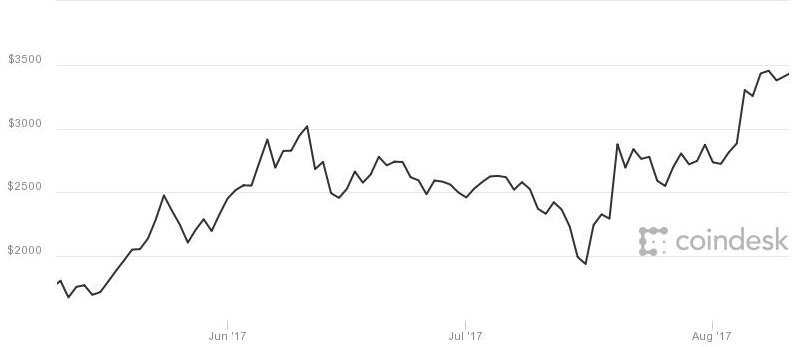

Bitcoin climbed past and over to record highs this week above $3,500, which is more than three times in value for the year even with the hard fork split in the currency last week into bitcoin and bitcoin cash, an alternative version supported by a minority of developers.

Bitcoin traded 1.5 percent higher near $3,428 Thursday morning, according to CoinDesk. Bitcoin cash steadied after wild swings in its first week, trading near $303, according to CoinMarketCap.

Another digital currency, ethereum, rose 1 percent to just under $300, according to CoinDesk.

Bitcoin price Development in the Last Three Months

Lee published a report in early July outlining the potential for bitcoin to rise above $20,000 and potentially reach $55,000 by 2022. Formerly the top stock strategist at JPMorgan and a perennial favorite of big institutional investors, Lee was also one of the few on Wall Street to predict that a Donald Trump win in last year’s election would cause stocks to rally, not fall like most had seen.

Lees Other Reasons for the belief in the Future Surge for the Dominating Cryptocurrency:

“Institutions have to directly buy the coin today through a broker, but both the CBOE and the CFTC have opened up options futures trading, so I think it’s going to grow in holdings,” he stated.

In the last month, the Chicago Board Options Exchange said it plans to offer bitcoin futures by early next year, while the U.S. Commodity Futures Trading Commission approved a digital currency trading firm called LedgerX to clear derivatives.

Market strategists have noted there are few highly attractive investment opportunities with U.S. stocks at all-time highs and bonds steady as the Federal Reserve remains on a gradual pace of monetary policy tightening and gold in a trading range.

The median S&P 500 target of strategists surveyed by CNBC is 2,475, just a point above where the stock index closed Wednesday. Lee happens to be the most bearish among those strategists with a year-end target of 2,275, or 8 percent below Wednesday’s close.

Read Also:

-

Ethereum Price Climbs Monthly High And Recovers Close To 50% In 2 Weeks

- Cryptocurrency Price Daily Analysis 9 August: Ethereum, Bitcoin, Ethereum Classic, Litecoin Ripple Price Prediction

Original Author: Evelyn Cheng

– For more Cryptocurrency market related Updates and News Follow us on our Facebook and Twitter pages.