A massive move during trading in Asia this morning saw Bitcoin finally pullback from the $8,000 zone and drag the entire crypto market down with it once again.

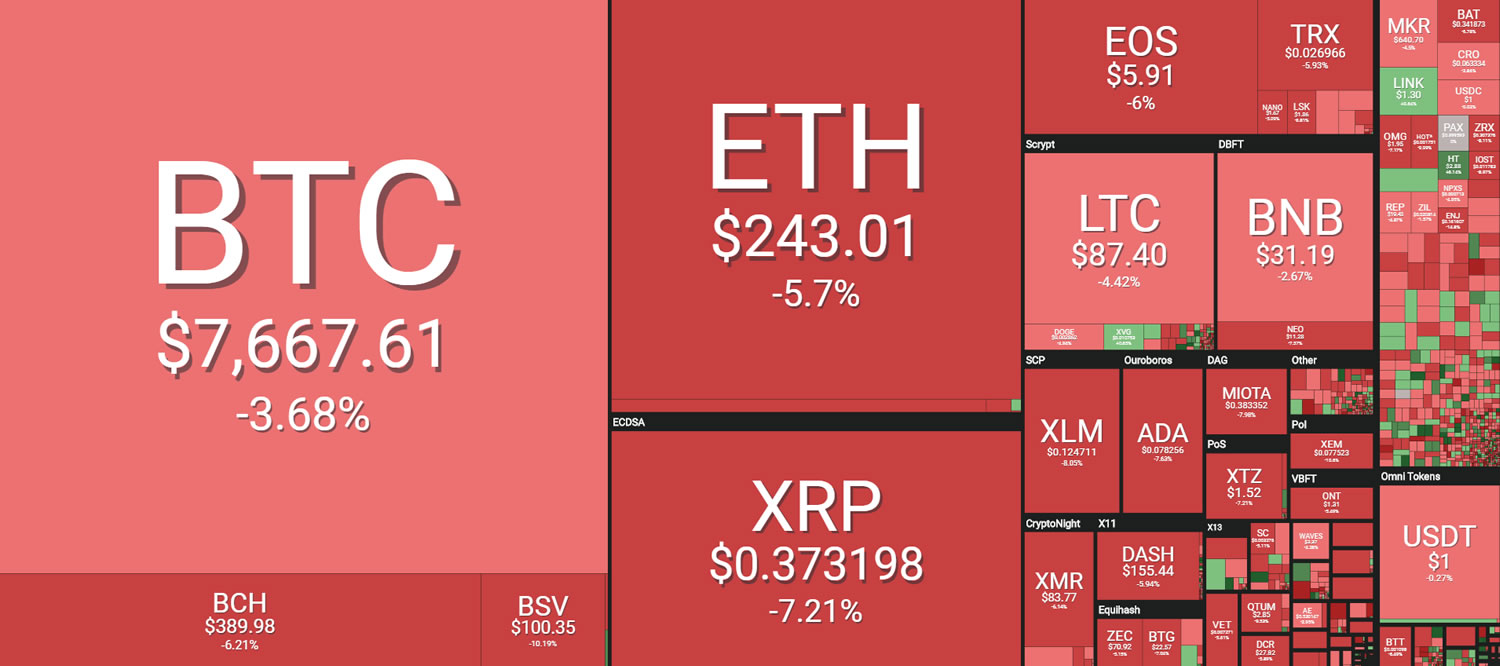

Dropping over $12 billion, total crypto market capitalization has been crushed by almost 5% as it fell from $250 billion to $238 billion over the past 12 hours. The altcoins are bleeding at the moment shedding gains from a couple of weeks of upwards momentum.

Bitcoin Drops 4%

Bitcoin has played the digital pied piper once again as it failed to break resistance over $8,000 for the third time in less than two weeks. It started to slide from a high of $7,965 a few hours ago, dropping 4.2% to a low of $7,625 according to Coinmarketcap.com. On some exchanges BTC fell as low as $7,500.

The move follows the formation of a double top with the neckline just over $7,000. The first significant level of resistance for Bitcoin is $7,400, a fall through that could see it drop to $6,800 and then things may turn south very quickly. The $6,400 price has been mentioned many times over the past month or so as it was 2018’s most frequently traded price, hence a huge support level.

Trader, Josh Rager, is not worried and maintains that the current formation is neither bullish or bearish.

“$BTC still in this condensing formation and held by horizontal supports. Not a lot has changed which shows that you don’t have to stare at charts all day – waiting for that next massive candle. The Formation is neither bullish nor bearish. It’s there to show price is condensing & a volatile move will likely follow …”

Altcoin Avalanche

The same could not be said for the altcoins which are all getting smashed at the moment. Ethereum has lost over 5% as it falls back to $240, and XRP has fared even worse with a 6.3% dive back to $0.375. Bitcoin Cash has dumped 6% causing it to fall back below $400, and EOS has dropped below $6 with a similar loss.

Stellar and Cardano are getting hit hard with 8% declines, and BSV after surging yesterday has dumped 11% back to $100. There is no escape at the moment as the profit taking exodus accelerates. Markets are still up though compared to a couple of months ago and the correction is natural process. When the digital dust finally settles more accumulation is likely to take place in preparation for the next leg up in the already established bull market.