Latest EOS News

After an extended crypto winter that saw different projects wrecked and developers calling it quit, it appears that the path towards stability is cooperation. Tron has been pretty successful in that and now Wanchain, an Ethereum fork which is creating solutions for cross chain interoperability allowing seamless value transfer between heterogeneous blockchains, will this year support EOS—the fourth most capitalized coin and a project ranked as “Superb” by CMC’s new partner, a blockchain analytic firm, Flipside.

Read:Citi Once Had Plans To Launch A (Centralized) Crypto Asset, But Failed To Execute

Already, Wanchain incorporated Loopring—a layer-2 protocol which allows third parties to build non-custodial DEX meaning token or coin exchange can be done in a peer to peer manner without the need of an third party while all order management is done off-chain—on their platform. Here’s what Jack Lu, Wanchain’s Founder and CEO had to say:

“Wanchain’s interoperability platform is an excellent complement to Loopring’s protocol and will set the stage for a more advanced DEX ecosystem with the ability to offer cross-chain trading pairs and increased liquidity. “

Also Read:Could Bitcoin (BTC) Follow Gold’s Long-Term Chart?

All in all, 2019 could be an interesting year for DEXs thanks to continued pummeling of centralized exchanges and increased oversight (and demands) from protective regulators. Aside from Wanchain—Loopring initiative, Binance is testing their version. However, should liquidity be overcame then we may as well see a migration towards secure DEXs thereby drawing additional demand to EOS—ranked as the best platform by China’s CCID.

EOS/USD Price Analysis

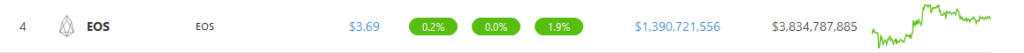

At the time of press, EOS performance is stellar and prices are up 1.9 percent in the last week with EOS changing hands at around $3.6 apiece. Even so, we should note that this could as well be a deserved correction and as price action dictates, a period of extended losses or gains should be followed by a correction. From the charts, it is clear that EOS is correcting and our resistance as laid out in the chart has been marked by a humongous bear bar.

Trend and Candlestick Formation: Short-term bullish and breakout pattern

From a top-down approach, sellers are technically in charge and EOS is trending within a bear breakout pattern thanks to mid-Nov 2018 sell-off. Nonetheless, in the short-term and in a classic bear breakout pattern, the current pullback could as well be the second stage—the retest phase (targets at $4—which has been retested) before a trend resumption phase begins.

Therefore, while we are bullish and anchoring our analysis on the bullish breakout bar of Feb 18, we should also realize that the failure of bulls to muster enough momentum and satisfactorily close above $4, reversing losses of Feb 24 is bearish for EOS.

If EOS fail to close above $4.5 complete with above average volumes exceeding 18 million in days ahead and instead drop below $3, we shall have solid reasons to exit this trade as bears of Feb 24 flow back. If not and prices rally, then bulls of Feb 18 would be present and in that case, first targets will be at $6.

Volumes: Bearish

Our EOS/USD price analysis is based on Feb 18, 24 and yesterday’s average at 14 million, 18 million and 3 million according to streams from BitFinex. Since we are bullish, we expect prices to edge higher and, in that case, EOS must print above $4.5.

As a result of this position, accompanying volumes must exceed 18 million as price action confirms bulls of Feb 18. Conversely, losses below $3 must be complete with equally high volumes exceeding 18 million and recent averages confirming liquidation of Feb 24.

All charts courtesy of Trading View—BitFinex

This is not investment Advice. Do your Research.