Any seasoned crypto trader will inform you that trading on a Sunday is riskier than swimming in an ocean known to be infested with sharks. The last Coinrail hack wiped off a cool $47 Billion from the crypto markets in a matter of 48 hours and beginning on a Sunday. The same can be said about today for the markets have witnessed a further decline of $19 Billion in a span of 6 or so hours.

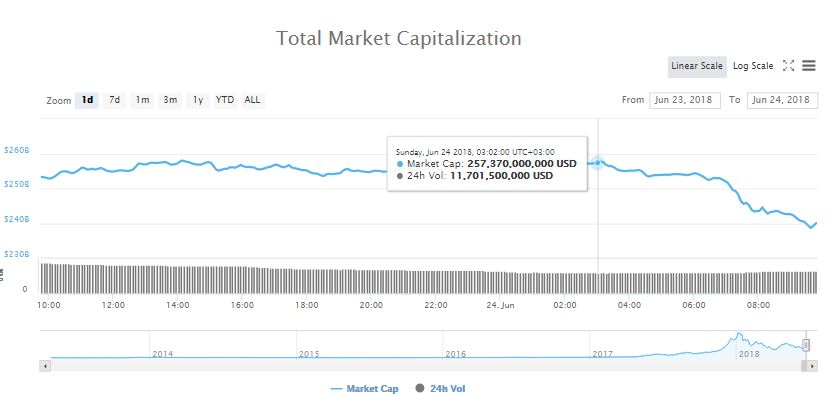

Early Sunday morning found the total market capitalization at $257 Billion. This figure would drop to recent lows of $238 Billion in the aforementioned time period. This is a drop of 7.4%. The market cap has since stabilized at current levels of $241 Billion.

Bitcoin (BTC) has also suffered a similar fate. Early Sunday found the King of Crypto trading at comfortable levels of around $6,150. BTC would soon drop to $5,860 in a time period close to 6 hours. This was a decline of 4.7%.

Lower levels were experienced in several exchanges with Binance seeing BTC valued at $5,777.

All other cryptocurrencies were also not spared by the decline in values this morning. Ethereum (ETH) is currently trading at $445 and down 4.53% in the last 24 hours. Ripple is also down 5% and currently trading at $0.46. Bitcoin Cash (BCH) has also experienced a decline of 8% and is currently trading at $691 at the moment of writing this.

Back in late May, veteran digital asset analyst, Willy Woo, had predicted that Bitcoin would test $5,500 to $5,700 levels before there would be any signs of recovery in the crypto markets. In his analysis, Mr. Woo was quoted as saying:

I think we are gonna go to $5500-5700 next, I can’t see $7000 holding. Most likely we’ll balance a bit, then we’ll slide through. Long timeframes here, looking into June for rough timing of this to play out at a best guess.

He outlined four reasons why this was the case.

- The NVT signal is still too high for BTC. The market needs more blockchain transactional activity to justify the current price or the price to drop to reconcile the difference. The said transactional activity is highly unlikely in a bear market. Therefore, there will be further decline in BTC

- The volatility is still too high

- The standard NVT is high and more time will be needed to bring it down

- A Volume profile cliff below $6,800

Standard NVT Ratio is simply the Network Valuation divided by the Transaction Value flowing through the blockchain and then smoothed using a moving average. NVT Signal then applies the moving average to only the transaction value. The signal is the work of Willy Woo and Dimitry Kalichki.

In conclusion, Mr. Woo was correct in predicting the current levels of BTC that we are experiencing. However, the feel and mood in the crypto-markets is that we are not out of the woods yet and that a $2,500 level of Bitcoin is highly probable.