Cryptocurrencies are here to stay, and many adopters dream of a society in which they replace traditional centralized financial systems. For Bitbond, an online German lending platform founded by Radoslav Albrecht, that future seems to be getting closer and closer as they have been able to function successfully and normally by using bitcoin for international payments rather than requiring the services of omnipresent SWIFT.

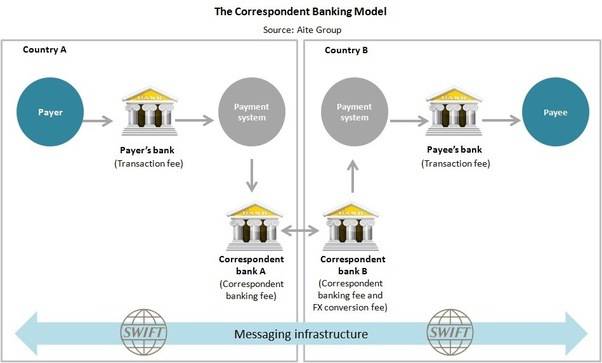

SWIFT stands for the Society for Worldwide Interbank Financial Telecommunications. It is a messaging platform used by financial institutions to transmit information regarding monetary transactions and operations using a standard coding system.

The robustness of the system combined with constant updates has made it possible for SWIFT to consolidate itself as the number one choice for interbank payment processing. However, for bureaucratic reasons inherent in the banking system, some transactions may take hours or even days to be completed.

To solve this problem, Bitbond uses cryptocurrencies to avoid the long waiting times that would exist through traditional systems. Similarly, the high fees that have to be paid due to a large number of intermediaries that may be involved in a SWIFT transaction could be overcome by the small – or nil – fees that are charged when using cryptocurrency.

In an interview for Reuters TV, Albrecht mentioned the apparent advantages for a bank of using blockchain over traditional systems such as SWIFT:

Traditional money transfers are relatively costly due to currency exchange fees and can take up to a few days… With Bitbond, payments work independently of where customers are. Via internet it is very, very quick and the fees are low.

Blockchain: A Powerful Tool for Traditional Banks

In order to circumvent the problems associated with the fluctuation in the value of cryptos, the clients hold the loans in digital tokens like Bitcoin only for seconds or minutes until they are exchanged back into the currency of their country avoiding the crypto’s exchange rates, having the confidence that the amount in FIAT will be the same even though the means of transfer have a fluctuating value.

The service has grown over time, managing a portfolio of over $1 million per month in loans for a clientele of mostly small business owners and freelance workers.

Bitcoin has been growing in popularity in the country. Right now, Germany has the most substantial number of Bitcoin nodes in the world (1939) after the United States (2538). This fact allows envisioning a near future in which the adoption of cryptocurrencies becomes a reality. And it is more likely that this future will be fulfilled in Germany than in any other country on the European continent.

The use of Blockchain technologies has already proven to be a valuable tool for banking. Ripple’s solutions have earned it specific strategic alliances such as SAMA and SANTANDER. But SWIFT does not want to be left behind in the race for technological innovation and is developing its own blockchain which in its preliminary results behaves “extremely well.” On an official Press Release early on March, Damien Vanderveken, Head of Research and Development, shared his optimism towards blockchain technologies:

The PoC went extremely well, proving the fantastic progress that has been made with DLT and the Hyperledger Fabric 1.0 in particular

edit: even though Reuters (primary source) published that Bitbond was officially licensed as a bank in 2016, the information was not accurate.