Ether volatility was no wonder for the cryptocurrency market, as this is a perfectly explicable reaction to the news. As cryptocurrency market is very new and is just starting to get really strong, traders will need time to analyze the information and understand how to take it.

Then news on Facebook banning any ads that promote cryptocurrencies and ICO caused a selloff throughout the whole crypto market. This is because Facebook target audience is really huge, and many potential clients and leads for ICO’s and cryptocurrencies came from this social media. Facebook officials stated in the comments that the decision was based on many cases of scam and advertising methods that were not always transparent.

Another piece of negative news came from South Korea, where the authorities imposed mandatory verification on all local traders that use a bank account. The government is thus trying to raise transparency of cryptocurrency trading and avoid money laundering and other fraudulent activities to the maximum extent possible. Most likely, such verification measures is just the first step towards further regulatory tightening. Once the authorities get access to the traders’ bank accounts related to cryptocurrency trading, any suspicious transaction may lead to complete suspension until the circumstances are clarified.

According to some sources, same tightening is going to occur in all other locations where cryptocurrency trading is allowed. This does not mean the cryptocurrency market is kaput; instead, just like any other market, it is moving on to the text level.

Unlike Bitcoin and other digital currencies, Ether did not fall too much in the light of the news mentioned above, as it is still supported by Weiss rating. Ether got B mark, which is ‘good’, and is better than Bitcoin, while no existing cryptocurrency got A.

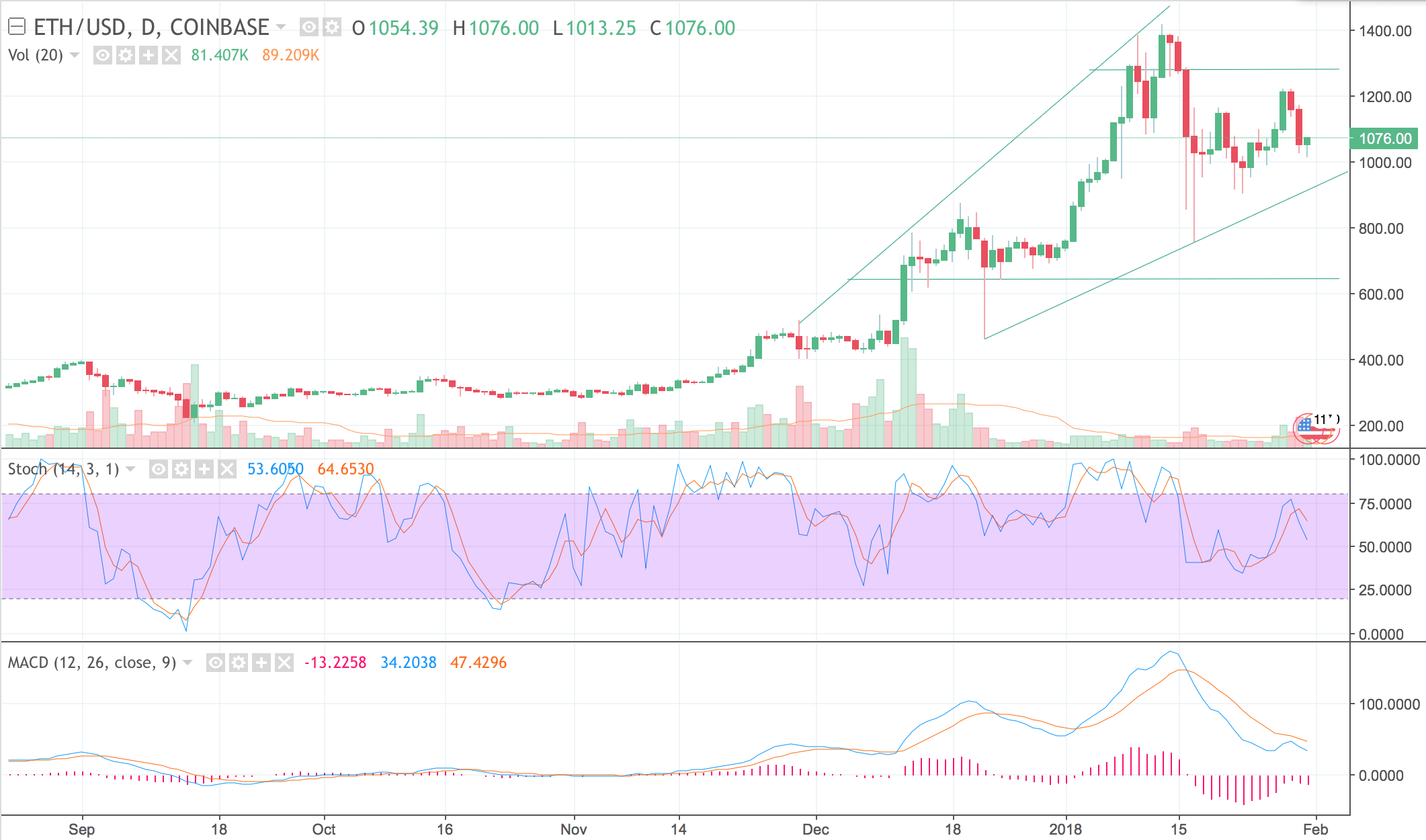

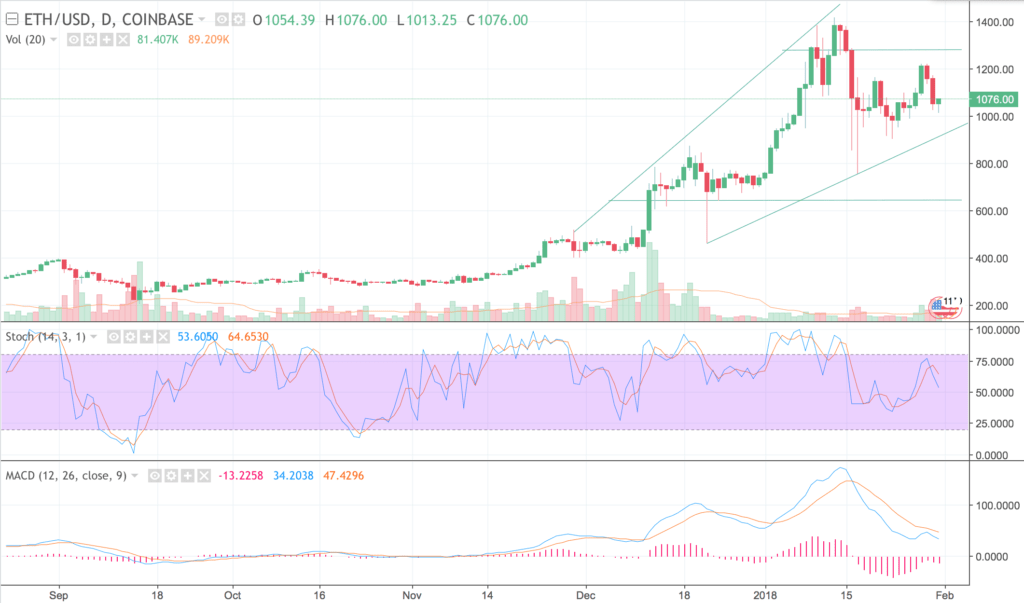

Technically, the long term ascending channel in Ether is still there. The support is at $620-$680, while the resistance is at $1,280. Such a big range can be explained by high volatility. There is also an intermediate support between $770 and $800, that, if hit, would signal that the sellers might be serious. Speaking short term, the selloff is stopping around $1,070 or $1,080, which allows us to assume that Ether is going to trade above $1,200 once the latest news are priced into the market.

Author: Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any forecasts contained herein are based on the authors’ particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.