Litecoin price started an upside move from the $92 support against the US Dollar. LTC/USD is still below the $100 barrier and it lacks momentum for more gains.

Key Talking Points

- Litecoin price climbed higher recently and tested the $100 resistance level (Data feed of Kraken) against the US Dollar.

- Yesterday’s highlighted important bearish trend line was breached with resistance at $95 on the hourly chart of the LTC/USD pair.

- The pair is currently correcting lower and is finding it hard to break the $100 barrier.

Litecoin Price Forecast

Yesterday, there was a solid support base formed around the $92 level in litecoin price against the US dollar. The LTC/USD pair started an upside move and traded above the $95 resistance level.

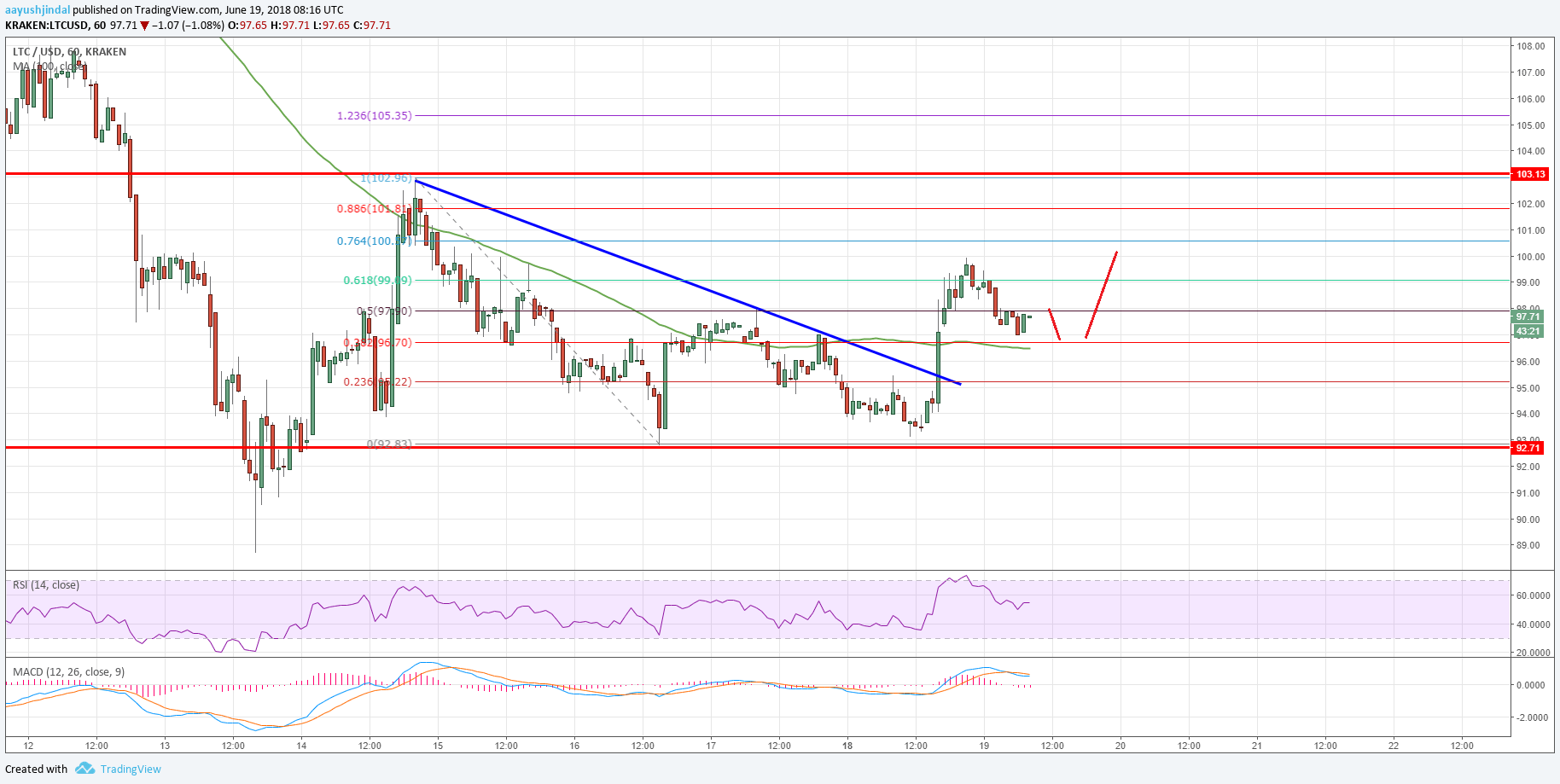

Looking at the chart, the price succeeded in clearing the 23.6% Fib retracement level of the last decline from the $102.96 high to $92.83 low. Later, yesterday’s highlighted important bearish trend line was breached with resistance at $95 on the hourly chart of the LTC/USD pair.

The pair even moved above the $98 resistance level, but the upside move was prevented by the $100 barrier. The price failed to stay above the $100 level, resulting in a downside move.

Moreover, there was a failure just above the 61.8% Fib retracement level of the last decline from the $102.96 high to $92.83 low. At the moment, the price is correcting lower and is trading near the $97.50 level.

It seems like it could make another attempt to move past the $100 resistance. Should litecoin buyers gain momentum, there is a chance of more gains above $100. Above this, the next resistance is around the $104 level.

On the flip side, if the price slides from the current levels, then the $95 support and the 100 hourly simple moving average may perhaps hold declines. Below $95, the price may revisit the $92 support area.

Overall, LTC price is trading with a positive tone, but a break above $100 is needed to overcome selling pressure.

The market data is provided by TradingView.