Neo price gained a lot of traction and moved above $90.00 against the US Dollar. NEO/USD is following a bullish path and it could test $100.00 in the near term.

Key Talking Points

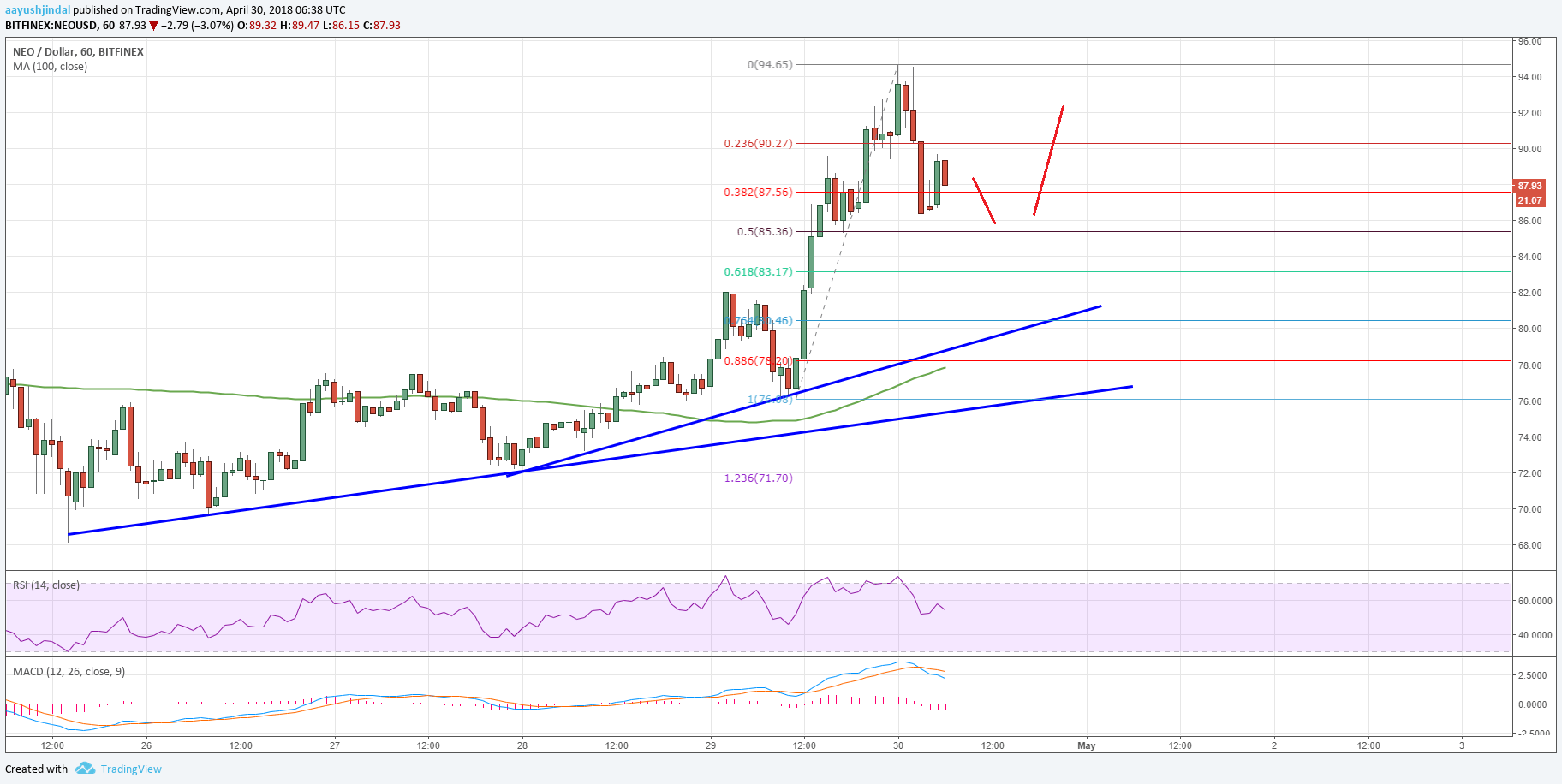

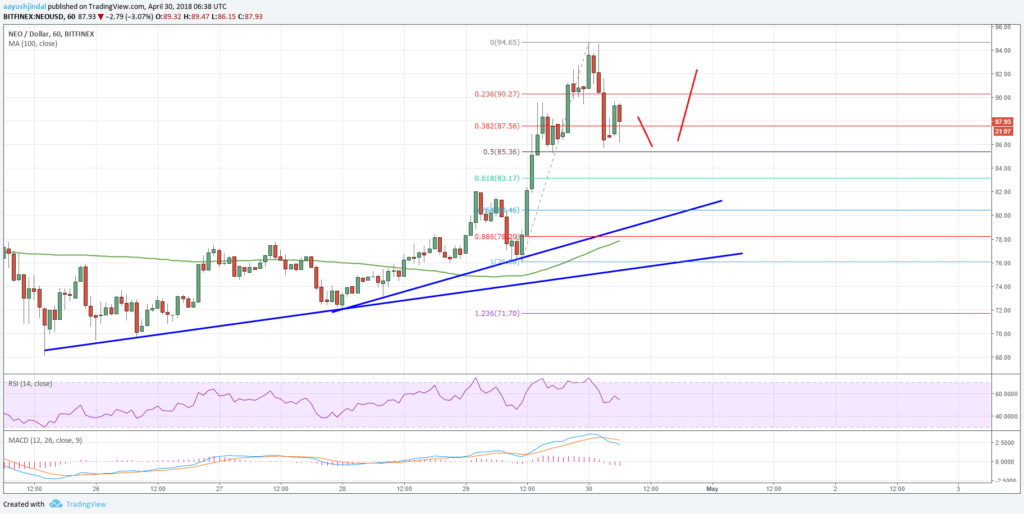

- Neo price made a nice upside move and traded as high as $94.65 against the US Dollar.

- There are two bullish trend lines forming with support at $82.00 and $76.00 on the hourly chart of NEO/USD (data feed by Bitfinex).

- The pair is currently correcting lower, but downsides remain supported near $82.00.

Neo Price Chart Analysis

There was a solid support base formed near $70.00 in Neo price against the US Dollar. The NEO/USD pair started a nice upside move and traded above many resistances such as $80.00 and $85.00.

The chart suggests that the price gained bullish momentum and even broke the $90.00 resistance. It traded close to the $95.00 level and a high was formed near $94.65.

Later, a downside correction was initiated and the price moved below the $90.00 level. There was also a break below the 23.6% Fibonacci retracement level of the last wave from the $76.08 low to $94.65 high.

However, there are many supports waiting on the downside such as $86.00 and $85.00. The 50% Fibonacci retracement level of the last wave from the $76.08 low to $94.65 high near $85.36 is a crucial support near $85.36.

Moreover, there are two bullish trend lines forming with support at $82.00 and $76.00 on the hourly chart of NEO/USD. Therefore, the price remains supported if it declines further towards $82.00.

Any further declines could be limited since the 100 hourly simple moving average is positioned at $78.00. On the flip side, if the price starts to move higher, it may perhaps retest the $94.65 high.

A proper break above the mentioned $94.65 high would open the doors for a test of the $100.00 resistance. The overall bias is positive as long as the price is above $80.00. It is likely to accelerate further towards $100.00 in the near term.

Trade safe traders and do not overtrade!

*The market data is provided by TradingView.