Pantera Capital, one of the foremost cryptocurrency and blockchain-centric investment firms, recently announced that it has reached its five-year anniversary, issuing a report on the progress it had made in that span of time.

NOW AVAILABLE: Our July #Blockchain Letter, Bitcoin Price Target = $5,000https://t.co/AtAW6lcf1y

— Pantera Capital (@PanteraCapital) July 27, 2018

Humble Origins: The 2013 $5k Bitcoin Call

Shortly after the grand opening of Pantera, Dan Morehead, the firm’s fervent leader and CEO, released an email to his investors, highlighting the first price prediction they made for the foremost, and most successful digital asset. In the email, titled “Bitcoin Forecast V” on August 21, 2013, Morehead wrote:

I was discussing bitcoin with an investor yesterday and he replied somewhat dismissively “It’s just like buying gold”. No, it’s like buying gold in 1000 B.C. 99% of the financial wealth has yet to address bitcoin. When they do, bitcoin is either going to be worth zero or $5,000 /BTC.

The Pantera CEO went on to talk about how there is a “north of 50% chance” that the world will adopt a cryptography-based payment system, replacing the high fees charged by traditional institutions. Dan also noted that if a cryptocurrency, whether it may be Bitcoin or not, can succeed, it will become the first global currency since gold and the first borderless payment system.

It is important to note that at the time this email was released, Bitcoin was a mere $104, with a $1.4 billion market capitalization. While it wasn’t clear what time frame the CEO was allotting to the prediction, looking back, we can clearly see that Bitcoin had surpassed his original price prediction.

However, despite going above and beyond the $5,000 mark, the “July Blockchain Letter” noted that this logic remains true to this day.

Pantera’s Lifetime Return = 10,000%

According to the aforementioned report, the fund now has a return of just around 10,135.15% net of fees and expenses, a gargantuan feat that goes without saying.

The success of the firm can be attributed to a variety of investments made into an array of crypto firms and projects, including Augur, Brave, ShapeShift, 0x, Circle, Earn, Xapo and Ripple. It was also noted that the investment fund has a close relationship with Augur, as Joey Krug, the Co-Chief Investment Officer at Pantera, co-founded Augur just four years ago.

Pantera plans to continue investing in innovative new startups through the firm’s third venture round, which is set to occur within the upcoming months after a series of lunches held all across the world.

Bitcoin To Hit 21k By The End of 2018, And $67.5k By The End of 2019

To the minds of many, a highlight of the report was the firm’s Bitcoin price prediction, which forecasted Bitcoin hitting $21,000 by the start of 2019, and seeing a further three-fold gain to reach $67,500 by December 2019. While this may not be the most outlandish prediction, it still stands above and beyond the current expectations of many industry leaders.

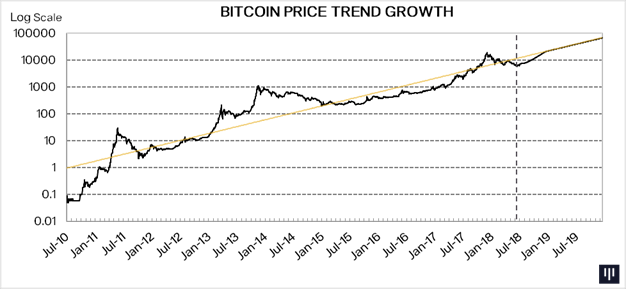

Releasing a statement alongside the chart seen above, the firm wrote:

This chart plots bitcoin’s price history since July 2010 in log scale to show its very consistent exponential growth. The gold line is the trend line during this period. Projecting price through the end of 2019 using this historical trend line as a guide would put the price of bitcoin at around $21,000 by the end of 2018, and $67,500 at the end of 2019. Seems eminently reasonable to me. Those are our current bitcoin price forecasts.