Ripple price formed a solid support base near $0.5400 and recovered against the US Dollar. XRP/USD is now positioned nicely above $0.6000 and it looks set for more gains.

Key Talking Points

- Ripple price bounced back sharply after forming a base at $0.5440 against the US Dollar.

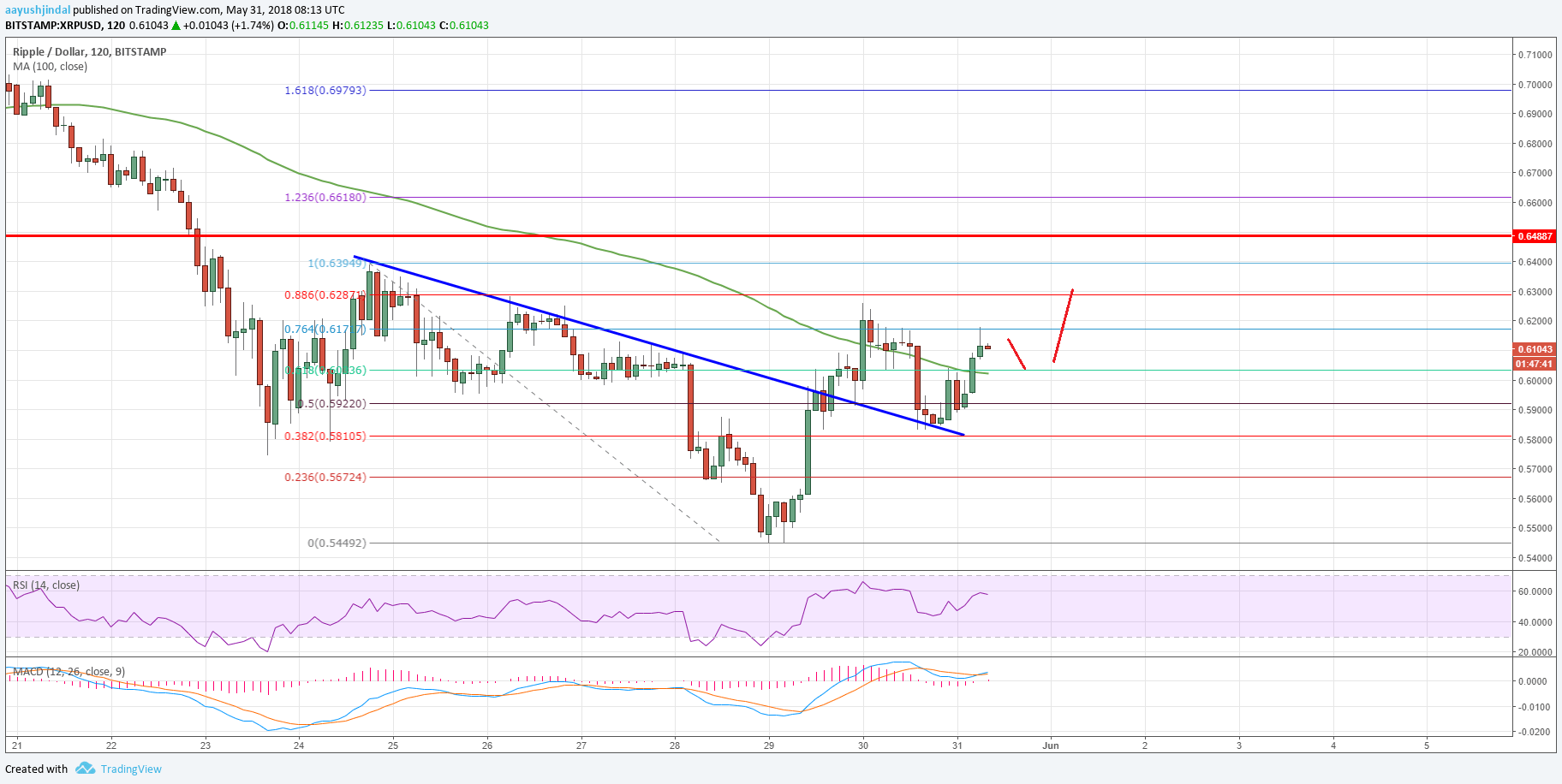

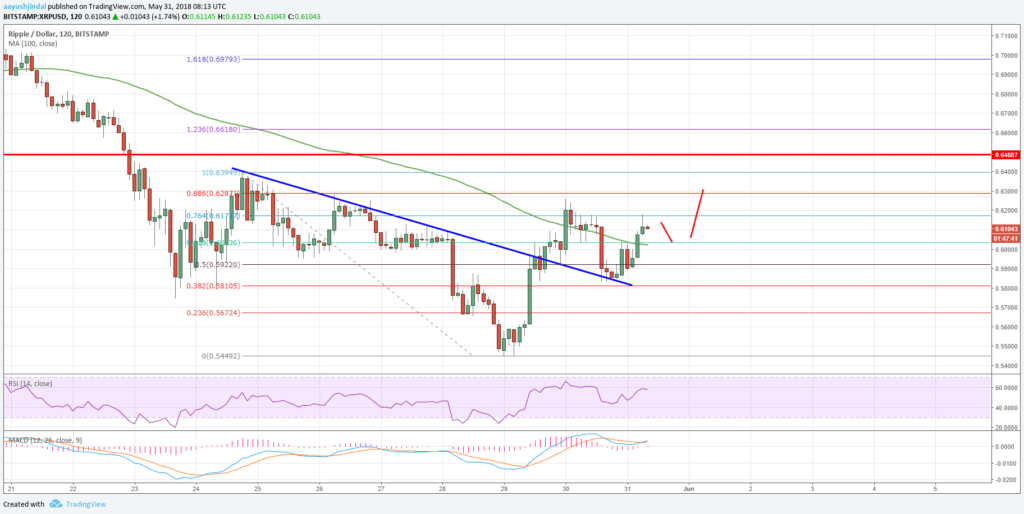

- There was a break above a significant bearish trend line with resistance at $0.5900 on the 2-hours chart of the XRP/USD pair (Data feed via Bitstamp).

- The pair is currently trading above the $0.6000 pivot level, which is a positive sign.

Ripple Price Forecast

After a major decline, Ripple price found support near the $0.5400 and $0.5440 levels against the US Dollar. The XRP/USD pair traded as low as $0.5449 and later it started a nice upside move.

Looking at the chart, there were back to back solid bullish candles above $0.5500, suggesting a change in the trend. The price moved above the $0.5800 resistance to move into a bullish zone.

It also cleared the 50% Fib retracement level of the last decline from the $0.6394 high to $0.5449 low. More importantly, there was a break above a significant bearish trend line with resistance at $0.5900 on the 2-hours chart of the XRP/USD pair.

The pair even settled above the $0.6000 pivot level and the 100 simple moving average (2-hours), opening the door for more gains. At the moment, the price is struggling to clear the 76.4% Fib retracement level of the last decline from the $0.6394 high to $0.5449 low.

Once there is a proper break and close above $0.6200, there could be further gains in XRP/USD towards the $0.6500 level. Above $0.6500, the next major hurdle for buyers is near the $0.6800 level.

On the downside, the $0.6000 level is a decent support. Below this, the previous resistance at $0.5800 will most likely act as a strong support for buyers.

The overall price action is positive as long as the price is above $0.5800. To the topside, ripple buyers could be eyeing a test of the $0.6500 level in the near term.

The market data is provided by TradingView.