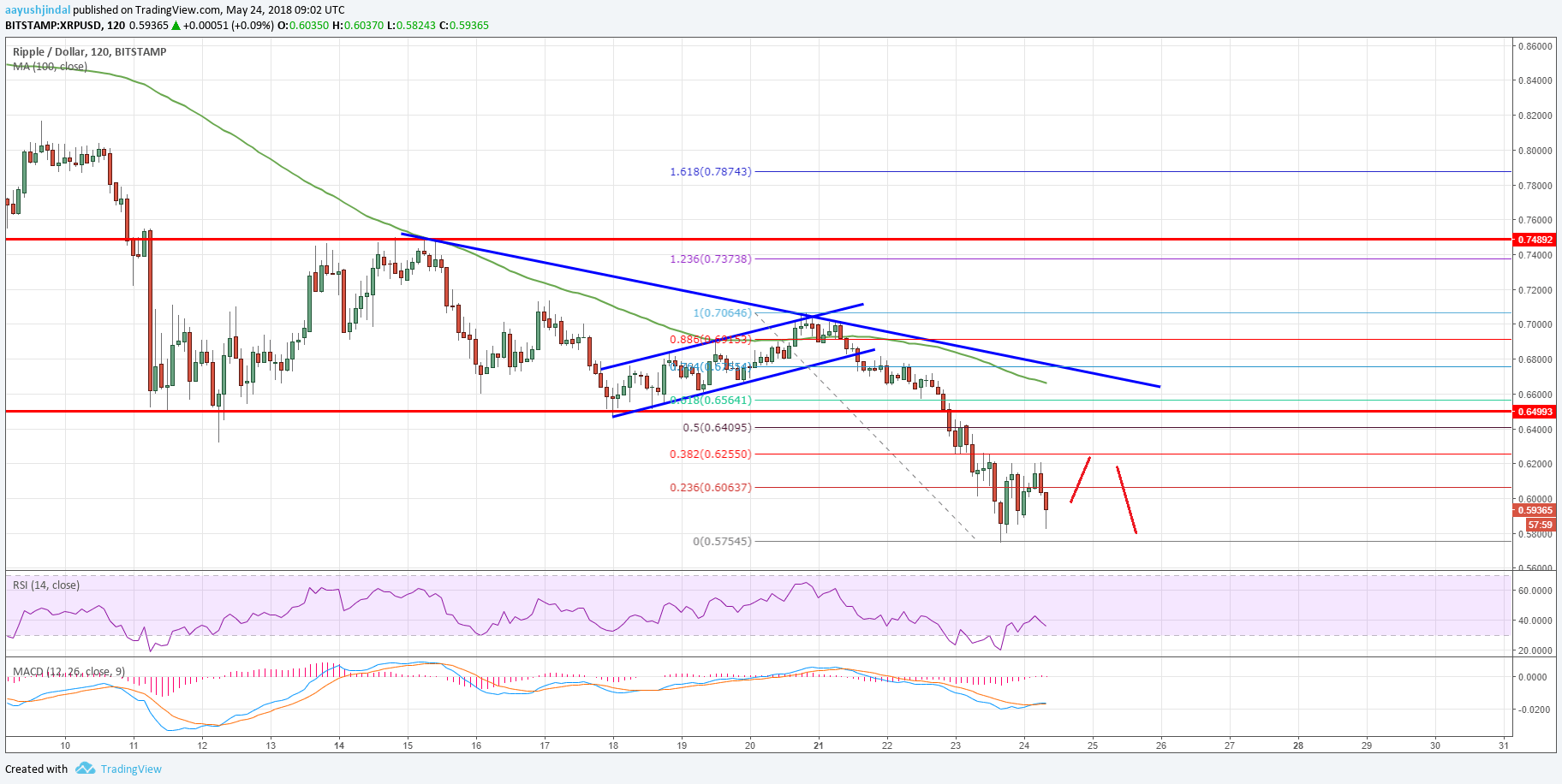

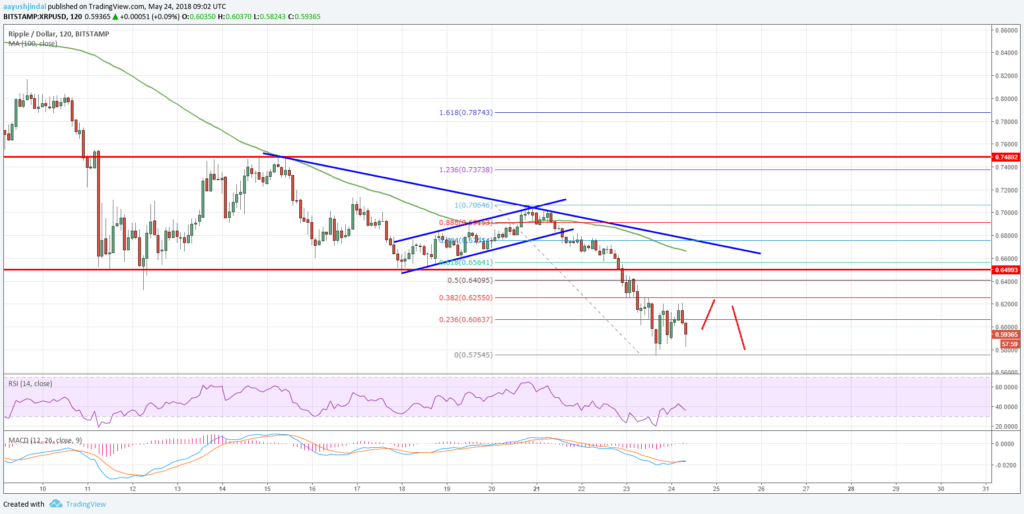

Ripple price broke a major range support at $0.6550 and declined against the US Dollar. XRP/USD is now positioned well below $0.6000 with a lot of bearish signs.

Key Talking Points

- Ripple price has moved into a bearish zone with a break and close below $0.6550 against the US Dollar.

- There is a crucial bearish trend line formed with resistance at $0.6620 on the 2-hours chart of the XRP/USD pair (Data feed via Bitstamp).

- The pair is likely to decline further and it could break the $0.5500 support in the short term.

Ripple Price Forecast

There was a fresh start of a downside move in Ripple price after it failed to move above $0.7000 against the US Dollar. The XRP/USD pair declined and broke a few important support levels, including $0.6800.

Looking at the chart, there was a break below an ascending channel with support at $0.6850 on the 2-hours chart. More importantly, the price broke a major range support at $0.6550, which cleared the path for sellers to take control.

The price traded below $0.6000 and is currently trading well below the 100 simple moving average (2-hours). It traded as low as $0.5754 and is currently trading in a range. It moved a few points higher, but buyers struggled just below the 38.2% Fib retracement level of the last decline from the $0.7064 high to $0.5754 low.

However, the most important resistance is at $0.6500, which was a support earlier. Moreover, the 50% Fib retracement level of the last decline from the $0.7064 high to $0.5754 low is at $0.6400 to prevent upsides.

Additionally, there is a crucial bearish trend line formed with resistance at $0.6620 on the 2-hours chart of the XRP/USD pair. Therefore, if the price corrects higher towards $0.6400 and $0.6500, it is likely to face a lot of selling interest.

On the downside, a break below the $0.5700 level will most likely push ripple back towards the $0.5500 level. Below this, the price may perhaps test $0.5200.

The market data is provided by TradingView.