Litecoin price is slowly moving higher and is currently trading above $180 against the US Dollar. LTC/USD has to move above $210 and 100 hourly SMA to gain momentum.

Key Talking Points

- Litecoin price made a decent recovery so far and is currently trading above the $180 resistance (Data feed of Kraken) against the US Dollar.

- There was a break above a crucial bearish trend line with resistance at $190 on the hourly chart of LTC/USD pair.

- The pair is currently trading around the $200 resistance and the 100 hourly simple moving average.

Litecoin Price Forecast

It seems like there is a slow and steady bullish bias forming above $150 in litecoin price against the US dollar. The LTC/USD pair is currently placed nicely above the $180 pivot level and is eyeing more gains above the $200 level.

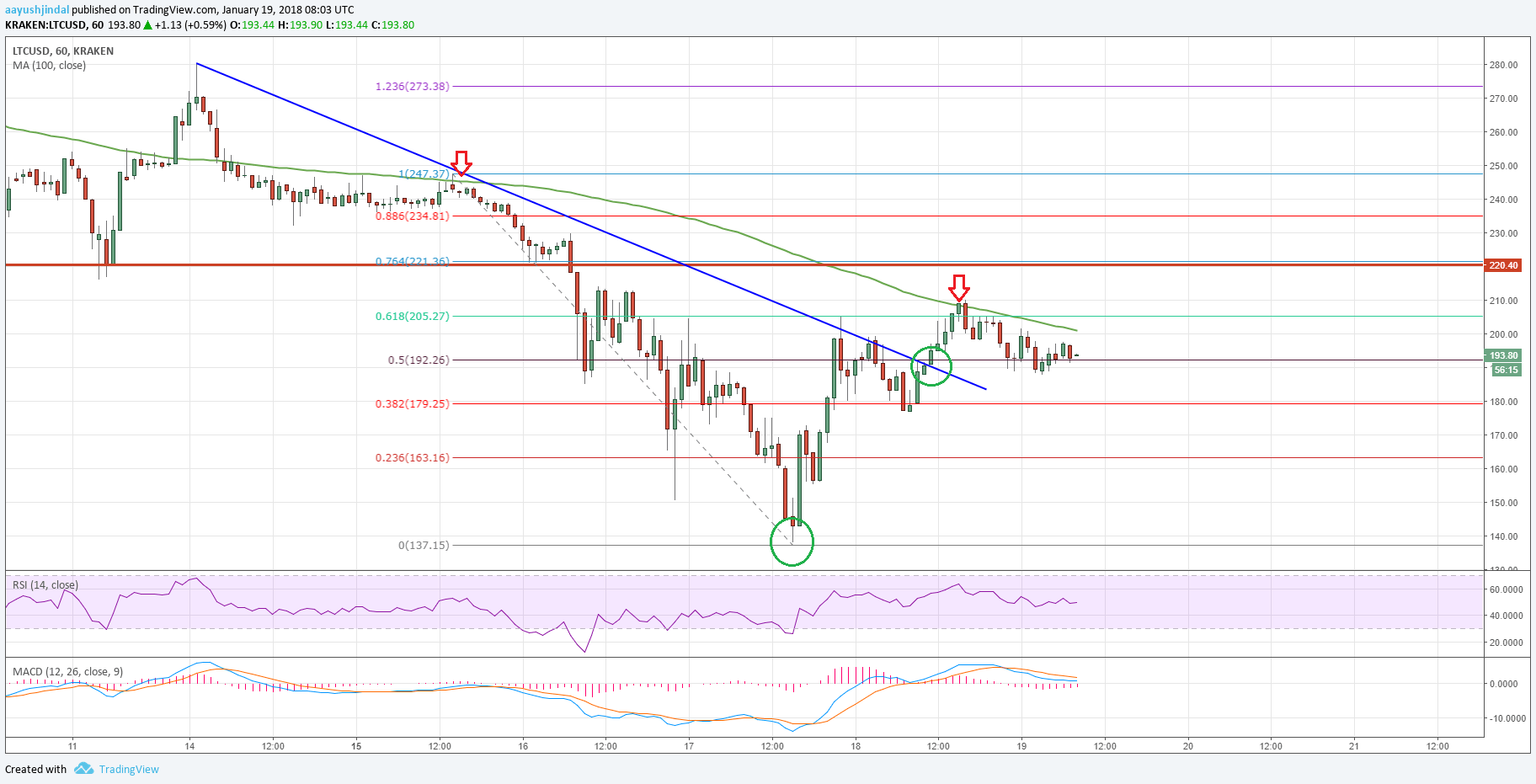

The bias is positive considering the fact that the price is above the 50% Fib retracement level of the last major decline from the $250 swing high to $140 swing low.

During the upside move, there was a break above a crucial bearish trend line with resistance at $190 on the hourly chart of LTC/USD pair. The pair is now attempting a close above the $200-210 resistance.

The stated $200-210 resistance is near the 100 hourly simple moving average. That’s why, an upside break above $210 won’t be easy. The stated level is also close to the 61.8% Fib retracement level of the last major decline from the $250 swing high to $140 swing low.

Should LTC buyers succeed in pushing the price above the $210 level and the 100 hourly SMA, there could be more gains toward $250.

On the downside, an initial support is around the $180 pivot. If buyers struggle to break the 100 hourly SMA, there is a chance of litecoin price breaking $180 for $150.

The overall short-term bias is bullish as long as the price is above $180. However, LTC/USD has to move above $200 and $210 as soon as possible to avoid bearish pressure.

Trade safe traders and do not overtrade!