Ampleforth — does that ring a bell? To many crypto enthusiasts, likely not, but this project (yes, it’s seemingly named after the poet in George Orwell’s 1984), which has spawned what it calls a “synthetic commodity”, is quickly propping up shop in the digital asset realm. Unlike other crypto asset projects launched in the past 24 months, Ampleforth intends to entirely differentiate itself from Bitcoin, not copy and try to improve on what the original cryptocurrency did. But this begs the question: what exactly are Ampleforth and its digital asset, Amples?

What Is Ampleforth?

Well, as put by the team behind this project, which includes a series of talented individuals who specialize in computer science and economics and hail from Uber, Google, IDG Capital, Ampleforth is a “digital-asset-protocol for smart commodity-money.” For those who don’t understand what this means exactly, let’s break it down a little bit, citing data and information from Ampleforth’s handy “Red Book”.

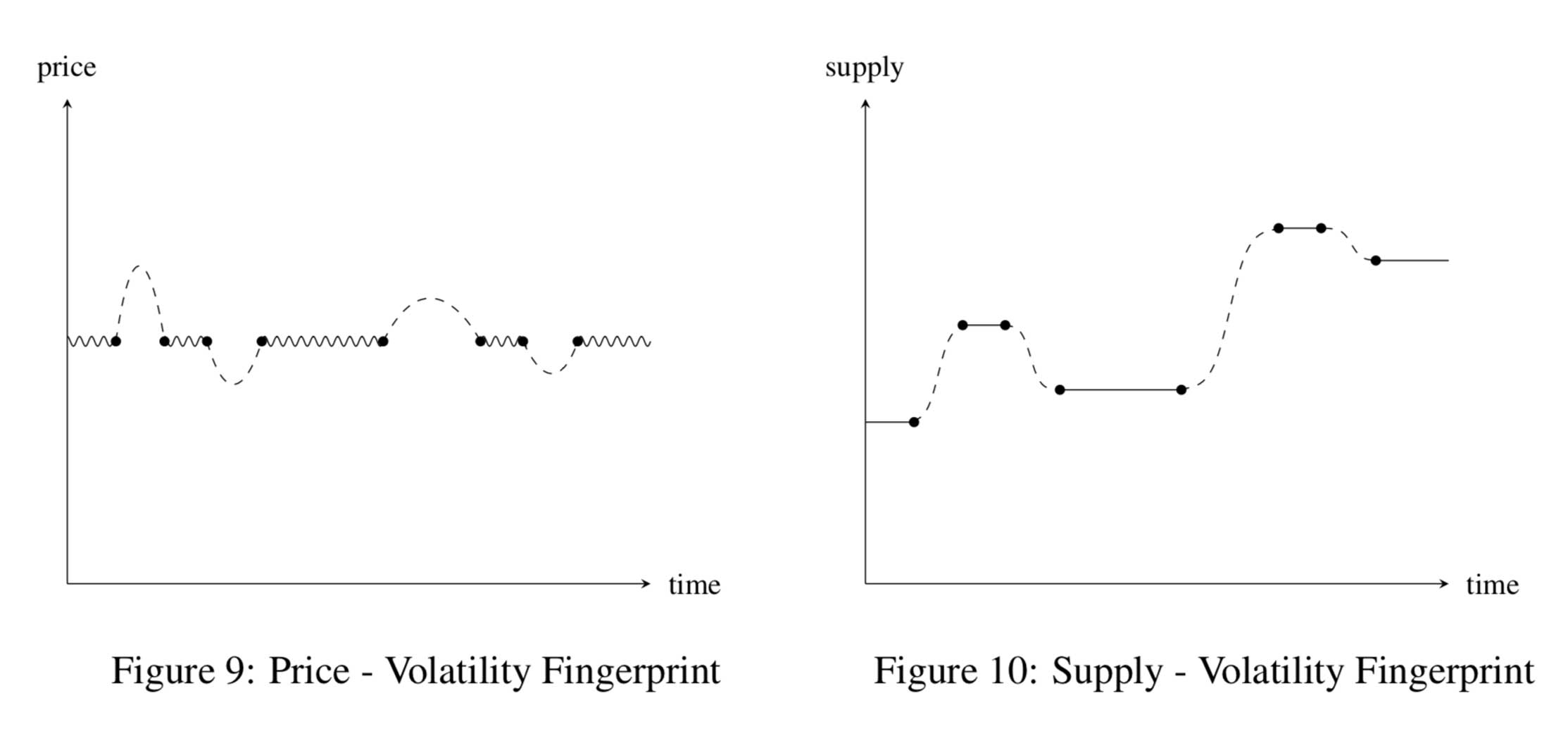

Amples are digital assets created by the Ampleforth protocol, which is a dynamic system that uses price information to determine and alter supply. The project equates this to how “thermal expansion propagates kinetic energy into a material’s volume”. The protocol continually looks for “price-supply equilibrium”, meaning that it alternates between a dynamic (changing) supply, and one that is static for a short period of time. Ampleforth describes this with an example:

If Alice has one Ample worth $1, but demand increases the value of that Ample to $2, the system will ensure that Alice ends up with 2 Amples worth $1 each.

This purportedly “applies countercyclical pressures” to the Ampleforth ecosystem, and promotes the creation of a stable price of units of a good, Amples. To ensure the system doesn’t over or under correct, the supply increase or decrease is spread out over 30 days, giving the economy a chance to react. This leads to another question, can you trade Amples for economic profit?

Well, according to the Red Book, you can. It is important to note, however, that trading Amples is not meant to be an activity based off its price, but rather, the movements (or expected movements) of the supply of the asset. As the Red Book explains: “Traders using supply in addition to price as a proxy for gains and losses will be distinctly advantaged.”

Traders have the chance to make some delta (gains) during three (two, really) scenarios: expansion, contraction, (and equilibrium). During expansions, traders that are quick on the draw (fast) can quickly sell their Amples when each is worth more than the target price, but before the supply corrects. The same is said with contractions, but inverse. This dynamic system can create a market like what is seen below. So in that sense, it isn’t a stablecoin as some expected.

What Makes Amples Different Than Bitcoin?

Most notably, Amples, unlike the current leading cryptocurrency, has an entirely different supply schedule while still touting similar values to BTC. As explained earlier, the amount of Amples in circulation and available to investors and traders are changing most of the time, meaning that it isn’t fixed like Bitcoin’s set issuance system and 21 million coin cap. This gives the asset more of a medium of exchange and unit of account value proposition, rather than Bitcoin’s value proposition as the store of value of the Internet and of the future. As explained:

Like Bitcoin, Amples also evolve in utility alongside risk and reward. However, in their final state, Amples evolve into a fair and politically-independent commodity-money that can be used as an alternative to central-bank-money, rather than a digital-silver or digital-gold.

And unlike every other altcoin in circulation, save for stablecoins, Amples’ value and supply isn’t entirely dependent on demand and supply in the Bitcoin ecosystem.

Big-Name Backers

Ampleforth’s innovative premise and technology have allowed it to secure endorsements and partnerships with key players in the crypto asset and ledger technology industry. According to CrunchBase, the company has ten investors, many of which are well-known to Bitcoin fanatics, like me or you. These investors include Pantera Capital, one of the key cryptocurrency financiers whose portfolio includes Bakkt, Abra, Brave, Circle, ErisX, Ripple, among others; Brian Armstrong, a Bitcoin pioneer that heads Coinbase; and FBG Capital. It is unclear how much the aforementioned investors allocated to Ampleforth, but such monetary endorsement is reassuring.

In terms of company advisors, the roster is quite notable.

- Joey Krug, a long-time cryptocurrency diehard who is an executive at Pantera Capital and co-founded the Ethereum-based Augur.

- Paul Veradittakit, also of Pantera. Paul has also worked at crypto-friendly incubator Boost VC and is currently advising Icon, Origin, and Blockfolio.

- Sam Lessin, a Facebook vice president turned startup founder.

- Noah Jessop, an MIT graduate that founded crypto mining startup Honey Miner.

- Manuel Rincon Cruz of the Hoover Institute and a graduate of Stanford University.

And Niall Ferguson, who needs a bit of a paragraph for himself. Earlier this year, in February, the British historian that has composed an array of books about international history and finance, revealed that he joined the advisory board of Ampleforth. He had previously suggested that cryptocurrencies will be the medium of money and finance of the future, adding that a financial crisis might fuel adoption of this new innovation.

On the matter of Ampleforth itself, Ferguson said in a statement that he likes the idea of “reinventing money”. He adds, however, that Bitcoin is incapable of satisfying this reinvention, leading him to look at Amples, which he likes because Ampleforth’s mission is to “reinvent money in a way that protects individual freedom and to create a payments system that treats everyone equally.” This ties in with his personal ideologies, as defined in his (arguably) magnum opus, “The Ascent of Money”.

With a strong staff and advisory board behind it, maybe Ampleforth has a chance to accomplish great things in this embroynic space. We will have to wait and see.