Most of the attention and news has been about Bitcoin in recent weeks. Its doubling in price since the beginning of April has put Bitcoin back in the headlines of mainstream media. Little attention has been given to Ethereum, though, which could also be on track to double in price if a correction does not happen soon.

ETH at 2019 High

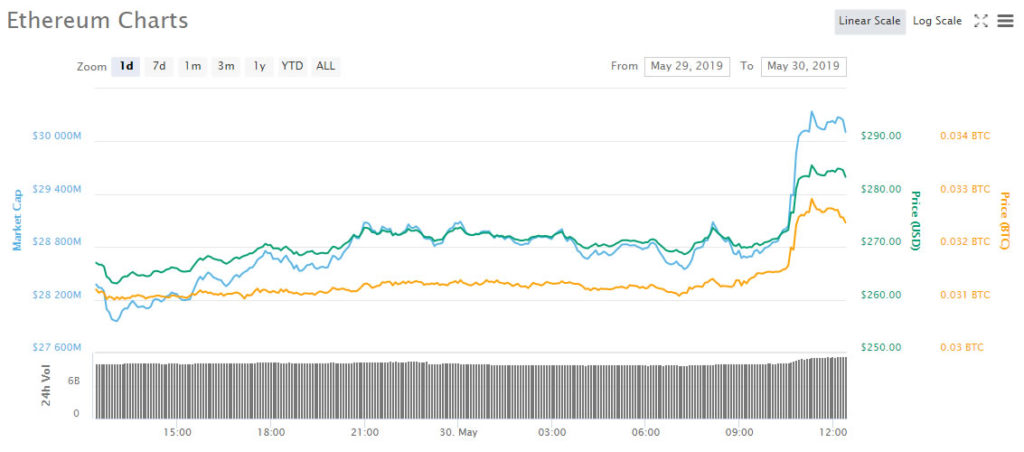

Ethereum has just reached its highest price of 2019 at $285. The 7 percent surge on the day has sent the world’s second largest cryptocurrency to a nine-month high. The last time ETH was over $300 was in early September 2018.

Daily volume has nudged up a little and is still higher than it was during the peak in January last year. The difference now is that retail traders and investors are stockpiling Ethereum rather than companies conducting ICOs. A correction is needed to re-balance the markets but there is a chance it may not come and one analyst predicts a surge to $400 if it doesn’t.

Trader and analyst ‘Credible Crypto’ has taken a look at the charts noticing that things are due to pull back somewhat;

“Bulls beware, it might almost be time to be a bear. I will not short this, but I will take partial profits on a portion of spot ETH longs that I picked up sub $200. If this doesn’t play out, we are headed straight to $350 and then $400.”

According to the chart the fifth leg of the Elliot Wave could take Ethereum to just below $300. After this move things could rapidly fall back to the $200 zone in an almighty correction. Many analysts have already spoken of a 30 percent correction for Bitcoin and this would be Ethereum’s equivalent.

If it doesn’t materialize, ETH prices could push back to $400 in a move mirroring the one in June 2017 when it did exactly that in a couple of days.

Altcoins Up as Bitcoin Dominance Dwindles

Bitcoin market dominance is falling back towards 55 percent. This is still pretty high for the year but some traders, such as Josh Rager, thinks that a fall below 50 percent will herald the beginning of ‘altseason’ which could come as soon as next month.

“% of $BTC dominance continues to slowly move down over the past 3 days. This is good for alts … Nowhere near alt season yet (needs to break below 50% dominance) but good for trade setups,”

Several altcoins are on a roll today, one of them is Bitcoin SV which has been manipulated by fake news out of Chinese social media platforms, driving the herd of Asian traders to jump on it in a frenzy of fomo. As a result it has doubled in price, surging into the top ten and flipping Tether, XLM, ADA, and TRX.