For Tom Lee, Fundstrat’s CEO and financial strategist, the bitcoin will close the year at a price of nearly 25k despite its recent performance.

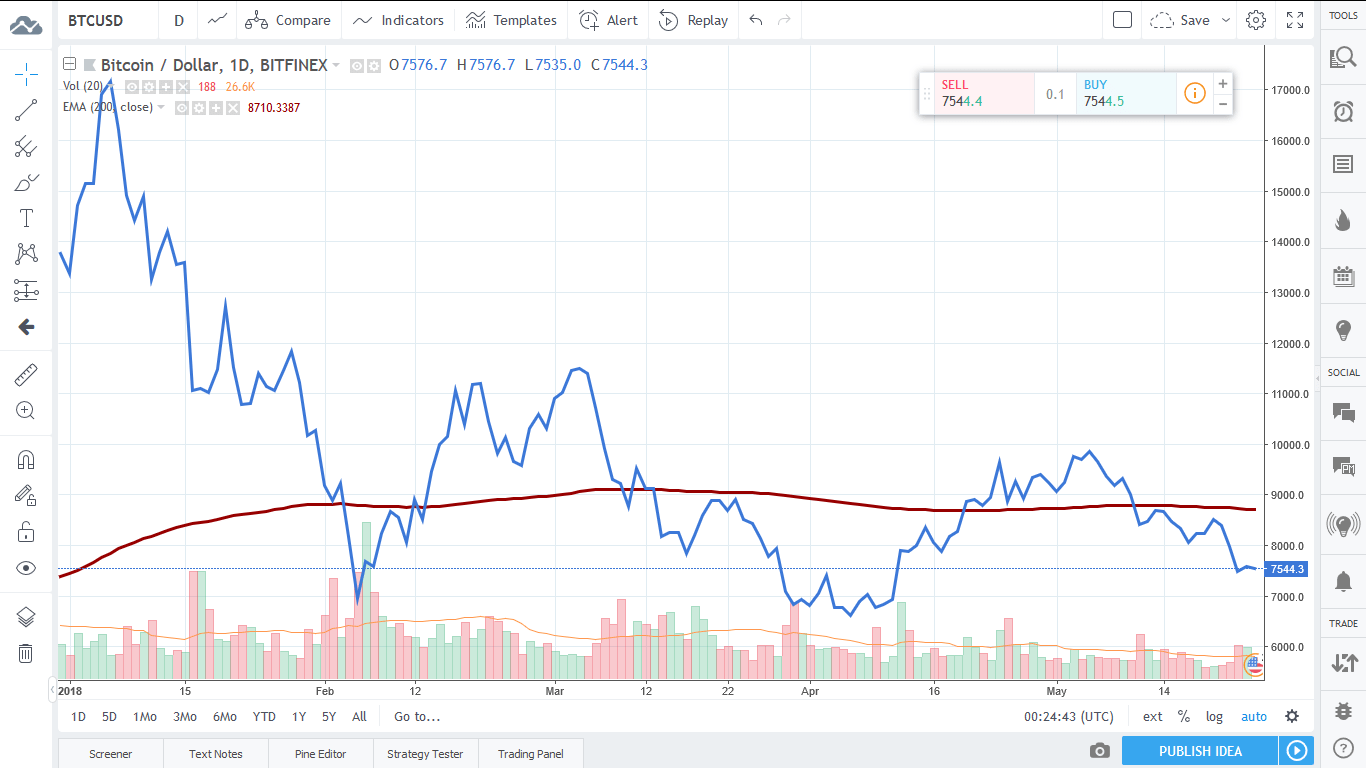

The Bitcoin during 2018 has had one of the strongest falls in its history, going from 20k to just over 7.5k as of May 24, 2018.

However, this behavior is perfectly normal according to Tom Lee, who considers it as “typical crypto volatility.”

For Tom Lee, what’s really important is to keep a certain amount of Bitcoins for a whole year so as not to lose a growing streak that lasts for an average of 10 days (not in a row for) a whole year:

Historically, 10 days comprise all the performance in any single year of Bitcoin’s price. If you just took out those 10 days, Bitcoin’s down 25 percent a year. So as miserable as it feels holding Bitcoin at $8,000, the move from $8,000 to $25,000 will happen in a handful of days.

Tom Lee is known for focusing his studies on bitcoin behavior. This year he presented an indicator specifically designed for this crypto: The Bitcoin Misery Index

Regulations: Tom Lee’s Predictions’ Main Enemy

Previously, one of Lee’s predictions failed: His optimistic view of a bullish rally on crypto prices after the NY Consensus 2018 was not met. A later explanation for CNBC noted that a daunting regulatory landscape would have prevented a wave of massive investment needed to boost prices.

Also, the volatility of the cryptocurrencies could be due to a kind of competition in which the potential applications promoted by the bullish face the fears of the regulatory barriers promoted by the bearish.

In an interview for CNBC, Tom Lee based his optimism on three fundamental pillars:

- Bitcoin Mining Costs: Bitcoin could never be worth less than its production costs as this would make the miners migrate to other, more profitable crypto. This shortage would lead to an increase in its value to a point of increasing equilibrium in the long term as its adoption also increases.

- The large number of institutional investors who have not yet fully ventured into the world of cryptomoney for fear of the arbitrary position of governments on regulatory issues.

- The overall behavior of bitcoin has been bullish. However, the high levels of growth have occurred in periods of approximately 10 days per year. Subtracting those 10 days, the bitcoin would lose 25% annually.

Previously, Fundstrat submitted a report predicting a price of approximately $20,000 to $64,000 by the end of 2019.

CRYPTO: Our quant/data scientist @fundstratQuant publishing #bitcoin mining white paper. Crypto mining economics lead/explain $BTC price—suggests $39,000 per bitcoin by YE19. key takeaways below… pic.twitter.com/f5ZQ4py3jS

— Thomas Lee (@fundstrat) May 10, 2018