The crypto markets did two spectacular things this week. Firstly, Bitcoin (BTC) and the total crypto market capitalization improved tremendously on Saturday. Secondly, both BTC and the total market capitalization held their gains through Sunday and into today, Monday.

Starting with Bitcoin, Friday found the King of Crypto trading at $5,800 levels. There was a feel of uneasiness in the crypto markets for not too many traders were sure what the weekend had in store for them. The question was if Bitcoin would fall further during the weekend, or embrace the new month of July with new confident levels. What happened is the latter case. BTC peaked to approximately $6,400 on Saturday morning. This was a jump in value of 10.3% in less than a day.

Bitcoin has since maintained those values and is currently trading at $6,371 and only down 0.21% in the last 24 hours. This can in turn be interpreted that the month of July will be less volatile than her counterpart, June.

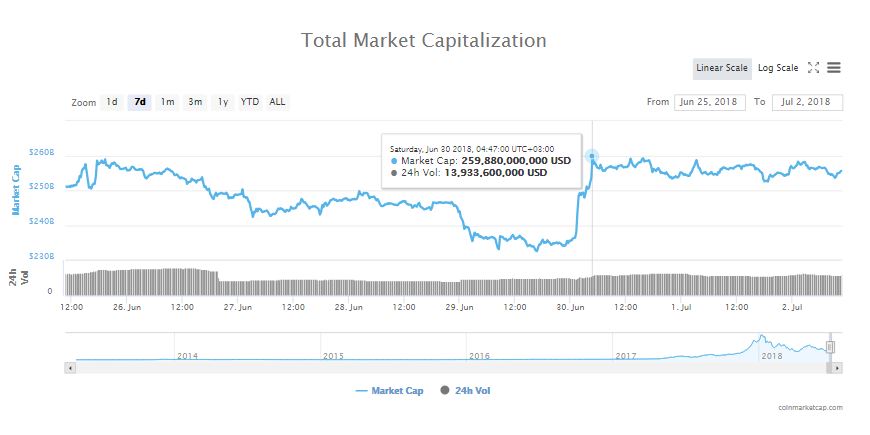

Observing the total crypto market capitalization, we find that a similar spike was seen on Saturday. The total market capitalization was at a new low of $232 Billion on Friday only to gain by 11.9% to $259.8 Billion.

With respect to Bitcoin, the current resistance levels of between $6,400 and $6,500 are what many traders are expecting the coin to break through as we head into the week. The converse is that in the worst case scenario, BTC will drop to familiar levels of $6,100 to $6,200.

One of the theories that has been put forth explaining the spike in the value of BTC on Saturday, is the expiration of Bitcoin Futures on Friday. These investment products are scheduled to expire every last Friday of every month. This means that traders and investors were reluctant to buy in given such information. Another theory would be that the demand for Bitcoin had been artificially reduced to meet the Bitcoin Futures that were expiring last Friday.

Of course all this is speculation but anything is possible in the crypto markets.