Those traders who have been closely following the bitcoin spot and futures prices, and the relationship between the two, will have noticed the little dance that began on 16 February.

The quickstep goes by the name of contango, and it is not a dance at all but the measure of the premium in the price of a futures contract over the underlying asset.

For the first time since November last year the BTCUSD futures price went into contango. Since the 16 February that contango has been pushing higher on the quarterly contract to reach an all-time high, acting as a predictor of the surge of bitcoin above $4,000.

Joe McCann, head of systematic trading for digital asset strategies at San Francisco based Passport Capital, the investment house founded by John Burbank III in 2000, shared his thoughts on the delta of BTC futures/spot with his Twitter followers, and as you can see from the tweets reproduced below, the break in the trend is unmistakeable.

Passport Capital partners include Pantera and Polychain Capital.

The price since November has been in a state of “normal backwardation”, where the spot price is below the price of the futures contract.

The flipping of that position means that the bitcoin futures market thinks the delivery price will be higher than that signalled by the current spot (forwardation), which can be interpreted as a bullish indicator, assuming that the contango holds and open interest positions continue to rise, which they are.

The charts below show the Delta between spot and quarterly futures prices (BTCUSD).

Delta in McCann’s charts jumped from 0.01 on 16th to 106.83 on the 20th.

On 21 February McCann observed:

“

#Bitcoin quarterly futures’ contango continues to rip to new highs. Need a few more days of this to confirm a broader trend change but quite bullish, IMO”.

He was proved right.

Bitcoin 3-month futures vs. spot pricing just barely flipped into contango (tailwinds for bulls) for the first time since November 2018. pic.twitter.com/qtaP9BxpgF

— Joe McCann (@joemccann) February 16, 2019

On 20 February, three days before the latest breakout began, the contango rocketed.

#Bitcoin quarterly futures' contango continues to rip to new highs. Need a few more days of this to confirm a broader trend change but quite bullish, IMO. pic.twitter.com/cm73NohyWm

— Joe McCann (@joemccann) February 21, 2019

Understanding delta

Delta is a measure of the amount that an option price changes in response to the movement of the underlying asset.

A call option, bought when a trader expects the price of an asset to rise and therefore wants to take a long position, will have a delta somewhere within the range 0 to 1.0, and a put option (where a trader expects prices to fall) a ratio of o to -1.0.

-1.0 to 1.0 is sometimes expressed as -100 to 100, depending on conventions used.

A delta reading of 0.5 in a call option means a one point upward movement would return 50% in the option price. It would be, in options lingo, “in the money” (ITM).

McCann is using different expressions in his chart, presumably to take account of the difference between the forward price and the futures price as well as the forward price delta of forwards (phew).

A forward is defined as the change in the value of the forward with respect to an instantaneous change in the price of the underlying asset, all other things being constant. Put another way, carrying costs have to be taken into account, which means the difference between the cost of holding the spot (bitcoin custody) and the cost of holding the derivative (interest on margin).

However, as delta is used for setting hedges on valuations as opposed to worrying about future changes in forward prices, traders in reality are happy to assume forward delta of 1.0 (delta always approaches 1.0 as the contract approaches maturity to match the price of the underlying).

Another way of looking at delta is as the probability that a contract will expire in the money, which means in the case of a call option that is expires above the strike price paid.

Futures volumes surging on CME

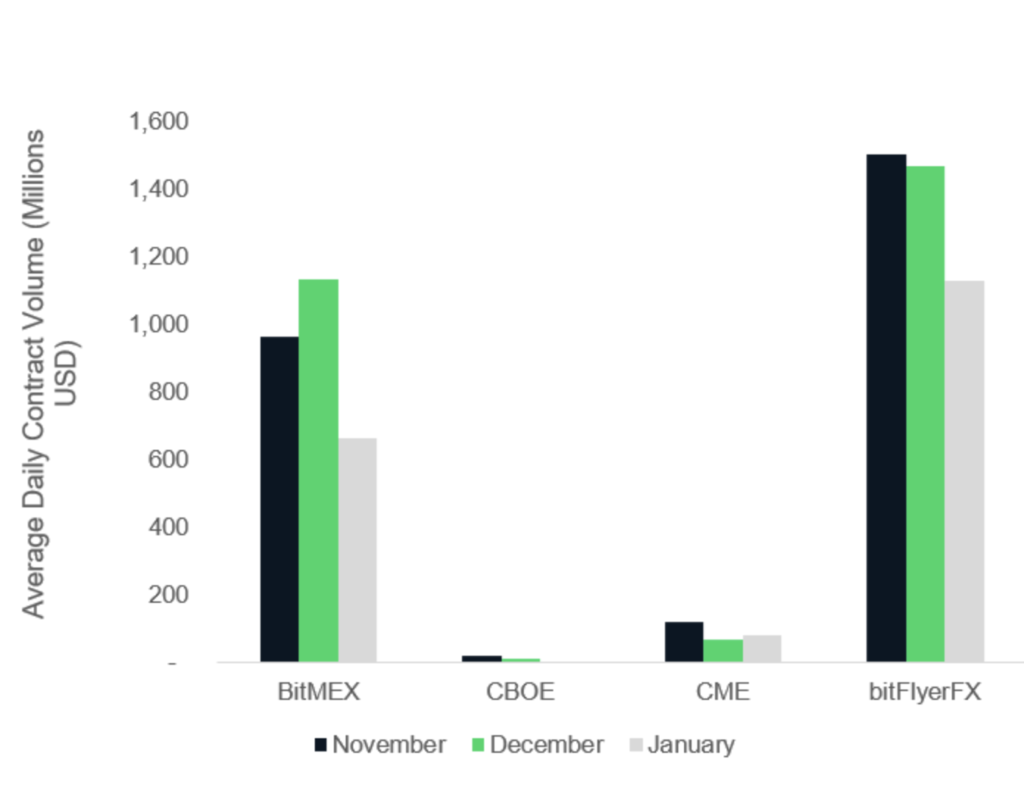

The CBOE contract represents one bitcoin while in the much larger CME market a contract represents 5 BTC. The regulated BTC futures market is a mere fraction of the amounts traded on the likes of Seychelles-based BitMEX and Japan’s BitFlyer.

On 19 February the CME saw a record level of bitcoin volumes, with 18,338 traded, according to a note the Chicago derivatives exchange sent to clients.

“Yesterday [Feb 19] set a new record with 18,338 contracts traded. This is equivalent to 91,690 bitcoin or $360 million.”

Crypto hedge funds need some love

Passport Capital describes itself as a thematic investment firm and went long on blockchain in 2017. That was also the year when it closed its flagship Passport Global Fund. It then pivoted to digital assets by setting up a crypto hedge fund. Along with it crypto hedge fund peers, the returns have been horrendous with the bear market taking its toll.

(Source: Hedge Fund Research)

McCann and his colleagues will have seen previous false dawns teasing the end of the bear market in crypto. They will be hopeful that smashing through resistance at $4,000 means overcoming looming major resistance at $4,250 on the one-day chart will also prove to be a piece of cake.

But if there is a pullback, then bulls will need to see $4,000 holding by the end of the coming week.

As EthereumWorld News reports today, other market participants see the regulated futures market as a vector for shorting, which will prevent the price seeing another parabolic bull run, which some might see as a healthy outlook.

Javad Afshar, the founder of BlockchainBTM, said: “This 2017 phenomena happened because there was no instrument for the speculators to short the market. Now that we have the future markets for bitcoin, speculators can short the market whenever it gets out of hand.”

Higher yearly lows, declining volatility

Stepping back from the daily and hourly candles, James McDowall, co-founder of polybird.io, a tokenised asset exchange, reminds market participants that the bigger picture remains bullish, given the higher yearly lows and the declining volatility. The point about the lows has been made incessantly this year by hopeful bulls.

Volatility has indeed declined, but went up again marginally last year.

Nevertheless, it would be a reasonable assessment to conclude that the market is maturing in terms of improving market depth and the profile of buyers is broadening as retail exits (although that might be changing soon) and institutions enter, albeit still tentatively.

https://twitter.com/CryptoXpertUK/status/1099514769323819008