Latest Bitcoin Cash News

35 days after Bitcoin Cash hard fork, Roger Ver’s Bitcoin.com is ready to unveil “one of the world’s first” smart contract oracle for the Bitcoin Cash network. BCH has grand plans of taking over commerce by being a better and faster alternative. Therefore, by introducing smart contracts, they might just be veering off and even shelving Satoshi Nakamoto’s original plan. Already, a beta version is in place.

Read: CoinBase Sent 5% Of All Bitcoin (BTC), More In $5 Billion “Crypto Migration”

Enabling this are implementation done in the last two hard forks. After Nov 15, the Bitcoin.com team said its scripting language has made it easier for businesses to code smart contracts. Besides, because of DSV and 32 MB blocks, BCH smart contracts are secure, encouraging participation as oracle solve millions of different use cases ranging from solutions in “prediction markets and decision-based transactions”.

Also Read: Brad Garlinghouse: If Ripple Shuts Down, XRP Will Continue to Trade

Meanwhile, the French National Assembly has rejected several cryptocurrency tax proposals that would have seen traders and investors remit less in taxes. The government also disagreed with suggestions of raising tax exemption level from €305 to either €3,000 or €5,000 saying this increment is “excessive” and the €305 level as favorable.

Bitcoin Cash (BCH/USD) Price Analysis

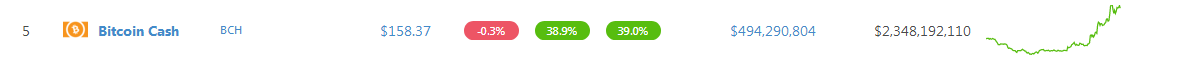

The crypto space is now thawing and spearheading this crypto renaissance is BCH. Not only is the coin expanding and up roughly 40 percent in the last day and week, it is the top performer at the time of press. Still, it is perched at fifth and yet to replace EOS at fourth position because like BCH, EOS is also surging. At this rate, we expect BCH to test $200 by the end of the year providing the impetus for further gains toward $400 in Q1 2019.

Candlestick Formation and Trend: Bullish, Breakout (Larger picture still bearish)

Bulls are back months after BCH literally fell off from $4,400 early this year. So, while the community is positive, the troubles of Nov 15 hard fork may freeze price expansion. Seeing that BCH is at new highs, traders might have an opportunity to unload at whatever highs causing prices to tumble. That’s just one angle.

On the reverse side, this correction could turn to be the beginning of something large. From a conservative point of view, it will be important if BCH price print above $200 by the end of the year. That will not only reassure the market but the double bar bull reversal pattern by end of Dec 2018 shall technically shore prices attracting capital.

Volumes: Bullish

No doubt, buyers are in control as visible from the chart. Trade ranges are wide and average volumes backing this expansion excess daily average. Of note in the last 10 days or so are Dec 1, 0300HRs bear volumes—20k against 8k and Dec 19, 1900HRs bull bar 50k versus 20k.

As visible, the break above $116—an important resistance now support level was at the back of above average volumes nullifying the bear breakout pattern of Dec 6 meaning this bull breakout has support from market participants. It is not in any way a fake breakout or a bull trap.

Conclusion

In line with the above, our BCH/USD trade plan will be as follows:

Buy: $116, $150

Stop: $100, $116

Target: $200

All Charts Courtesy of Trading View

This is not Investment Advice. Do your Own Research.