Latest Bitcoin News

Coinciding with BTC market pull back is morale boosting news that the US state of Ohio will begin accepting tax payments in Bitcoin. Spearheading this drive is the State Treasurer, Josh Mandel, who term the move efficient, secure, transparent and cheap especially for merchants and businesses that in days to come will settle 23 different tax obligations using Bitcoin.

Though the state won’t hold any Bitcoin, it will be a short in the arm for BitPay, the crypto payment processor who recently reported that the slid in Bitcoin prices has seen their transaction volumes drop down by 80 percent after peaking in Dec 2017.

Payments will be done via OhioCrypto.com, a platform that Josh said is an effort by the Ohio State Government to leverage cutting edge technology while providing businesses with options improving the way citizens interact with the government. Note this: the site is not a portal for individual tax payers but just a means to improve efficiency and boost revenue collection.

Also Read: Hong Kong Crypto Trader: China Crackdown On Bitcoin Is Overstated

Initially there were fears that the dropping Bitcoin prices could initiate some sort of a death spiral for miners affecting Bitcoin network through drops in hash rate and difficulty. However, this has been put to rest with the Golden Goose project where a South Korean blockchain start up, Commons Foundation, confirmed that the government of Paraguay shall supply electricity for the project touted to be one of the largest crypto mining center and global exchange. That’s on top of the 50,000m2 of land set aside for setting data miner centers and related infrastructure.

Interested Read: ShapeShift CEO Bullish On Bitcoin (BTC): Bears In Euphoria

BTC/USD Price Analysis

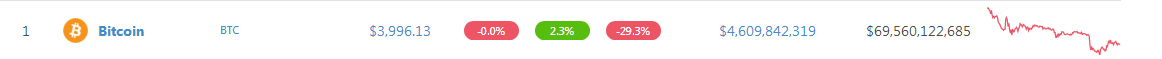

At spot prices, BTC/ is roughly up $300 from the $3650 lows it tested on Nov 26. That’s a three percent rise in the last 24 hours and even with that there is a lot of convincing to be made—if traders are to fade current trend—now that we have a whole bear bar supported by high trade volumes closing below our previous support now resistance at $5,800.

Trend: Bearish

Thing is the drop of BTC/USD prices has been near perpendicular since the Bitcoin Cash hash war began on Nov 14. Since then it has been clear that the path of least resistance has been southwards. And with every low, BTC losses keep expanding. At spot price, BTC is down roughly $1,500 from Nov 14 highs.

Volumes: Increasing Bearish

Bears are in charge and making their presence are the high-volume bars of Nov 14—when prices broke below the psychological $6,000 mark with 69k versus 14k, Nov 20 bar when prices hit and broke below our first bear targets of $4,500 with 117k versus average of 37k and the trend continuation bar of Nov 24 which pushed prices below $4,000 with high volumes—51k versus 43k average. All in all, the last leg of this rapid loss has seen low market participation relative to Nov 14 and 20 bars meaning momentum is waning out. As a result, we expect BTC/USD prices to rebound off $4,000 and perhaps retest our minor resistance at $4,500—700 zone before trend resumes towards $3,000.

Candlestick Formation: Bear Breakout

What we have in the daily chart is a classic bear break out pattern below a descending wedge following events of Nov 14. So far, there has been a confirmation and as long as prices fail to recover above $6,000, then BTC/USD is technically bearish. Every pullback should be a shorting opportunity with first targets at $3,000.

Conclusion

As it is BTC/USD is technically bearish and as mentioned above, every recovery is another sell opportunity more so if there is no momentum to drive prices above $4,700—our minor resistance level. Should this happen in the course of the week then odds are bulls would race towards $5,000 and $5,500. On the reverse side, sharp drops below Nov 25 lows at $3,700 could fuel further loses towards the psychological $3,000 bear target level.

All charts courtesy of Trading View

This is not Investment Advice. Do your own Research