Crypto Dog Wouldn’t Be Shocked If Bitcoin Plummeted To $1,800

Over the past two months, Bitcoin (BTC) has surprisingly held its own, failing to break under the $3,000 level on a number of occasions. This has led many traders to claim that $3,000, a key technical and psychological price point, will be the level at which BTC bottoms in the current market cycle.

And while this theory has undoubtedly gained traction, especially by those expecting that cryptocurrencies will begin to push higher in the coming weeks, some are wary that lower lows are inbound. Morgan Creek Digital Assets head Anthony Pompliano, for example, has remarked on a number of podcasts, tweets, and publications that Bitcoin could fall under the auspicious $3,000 level.

Most recently, a well-known crypto trader with the moniker, “The Crypto Dog,” claims that he/she wouldn’t be surprised if cryptocurrencies fall another ~50% from current levels. In fact, in a tweet that got the crypto community buzzing, Crypto Dog noted that a $1,800 BTC and $50 Ethereum (ETH) isn’t out of the realm of possibility.

$1800 $BTC and $50 $ETH wouldn't surprise me.

I don't know for any certainty we'll see those prices, nor do I mind if we reach them or not.

If you're in $BTC for the long haul, DCA. If you're learning to trade, just survive. Keep your risk low, gains will be easier someday.

— The Crypto Dog📈 (@TheCryptoDog) February 5, 2019

He even drew attention to those calling for Bitcoin to fall to $1,200, which was the peak of the 2013 bull market and the zone that catalyzed 2017’s parabolic rally. While he did note that BTC reaching the aforementioned level, which would be a ~65% drop from current levels, is a near-impossibility, he maintained that $1,800 isn’t as bizarre as it may seem from the surface.

Backing this call, the analyst went on to cite one of his quips from late-December, in which he stated that as the cryptocurrency ecosystem is presumably nearing the end of its downturn, it may range trade between an absolute low and high of $1,800 and $6,200 respectively for a “substantial period of time.”

This recent comment, which can only be described as foreboding, comes after Murad Mahmudov used an array of fundamental, social, and technical/historical measures to accentuate how the flagship cryptocurrency could likely reach a floor of $1,700 in the coming months.

Optimism Still Remains

And while $1,800, $1,700, or whatever a ‘worst comes to worst’ scenario would look like, would evidently be dismal for a majority of this space’s common Joes and Jills, many of which are retail investors with other financial obligations than ‘HODLing’ BTC, whether it goes to the ‘moon’ or otherwise, Crypto Dog was still decidedly optimistic.

He remarked that if his followers are truly in BTC for the long haul, now’s the perfect time to dollar-cost-average in, while ensuring that risk is kept to a minimum. In his December tweet storm, the trader even remarked that the halvening slated to occur in May 2020, along with the arrival of Bakkt, Fidelity, the potential VanEck & SolidX Bitcoin ETF, along with other institutional products will be drivers for “further bullish momentum” in the years to come.

8/ I look to mid 2019 and the 2020 halvening as a fundamental catalyst for further bullish momentum. (not to mention BAKKT, Fidelity, VanEck, etc,)

Happy holidays everyone!

— The Crypto Dog? (@TheCryptoDog) December 20, 2018

Crypto Dog isn’t the only trader to be enamored with the halvening & Wall Street narrative. Per previous reports from Ethereum World News, Jeff Berwick, better known as the Dollar Vigilante, told BlockTV that he expects for 2019 to beckon in the arrival of institutionally-sourced greenbacks, which will “change the game completely.” He remarked that as institutional capital becomes a common sight in coming months, cryptocurrency prices en bloc will “explode,” as there are presumed trillions waiting on the sidelines.

On the block reward side of the equation, “200M_trader,” a trader that turned $200 million in profits trading Ethereum in 2017, told CCN that the issuance reduction, which should decrease daily selling pressure from Bitcoin miners, should catalyze some semblance of market growth. He remarked that as we near the auspicious halving, the closer this industry will be to defrosting. In fact, the trader seemed so adamant that the event would be a bullish happenstance that he advised readers to “count down the remaining days [to the] halving.”

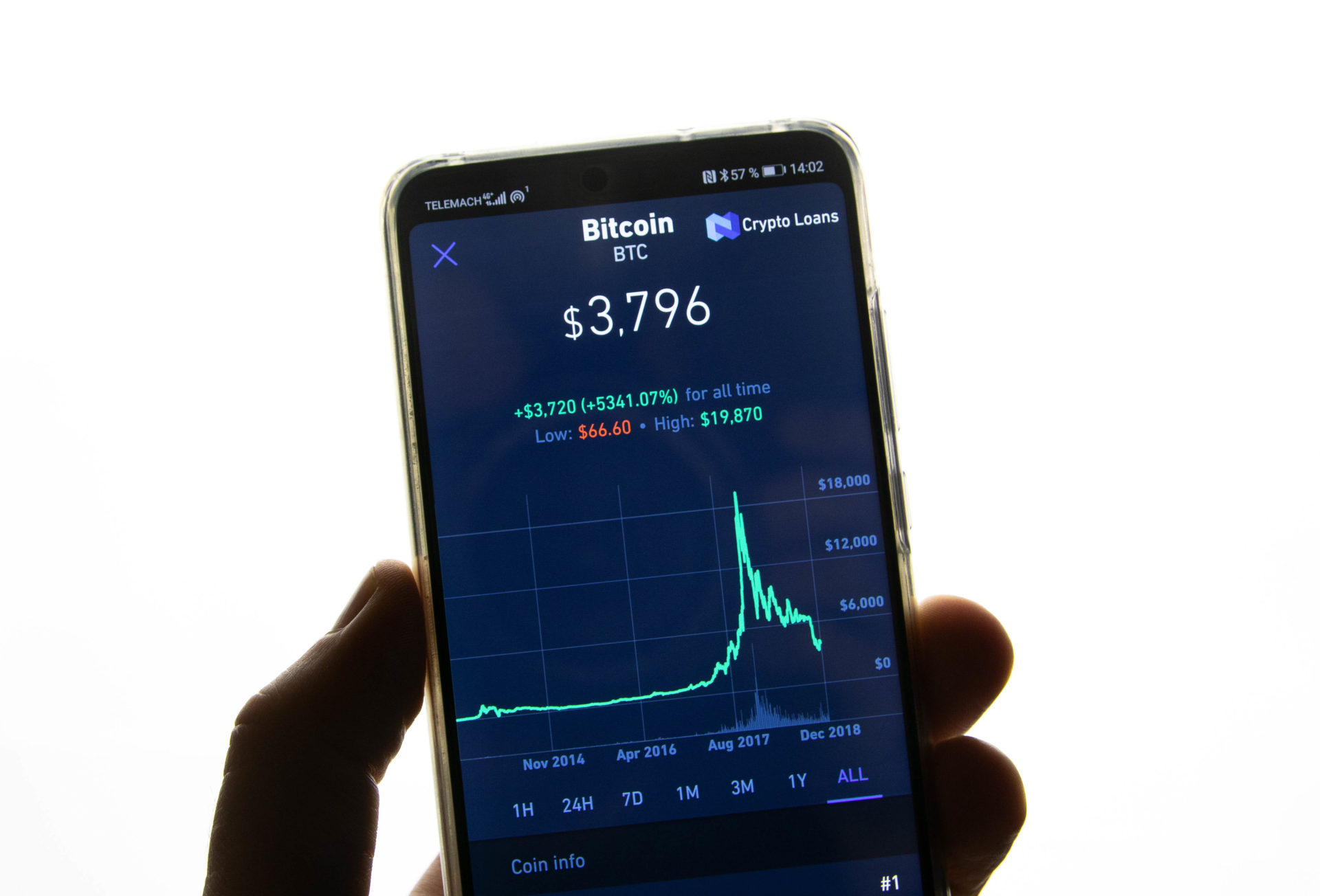

Title Image Courtesy of Ethan Hoover on Unsplash