Crypto Volatility Slows, Market Posts Slight Loss

On Monday, October 8th, the crypto market surprisingly saw some semblance of price action, with nearly every single crypto asset posting 1.5 percent gains (or more) at one point in the day. Bitcoin, for example, moved from $6,550 to $6,650, with some claiming that a breakout past the $6,800 resistance level was imminent. Some optimists even claimed that Monday’s move was the spark that would’ve catalyzed crypto’s next parabolic run-up.

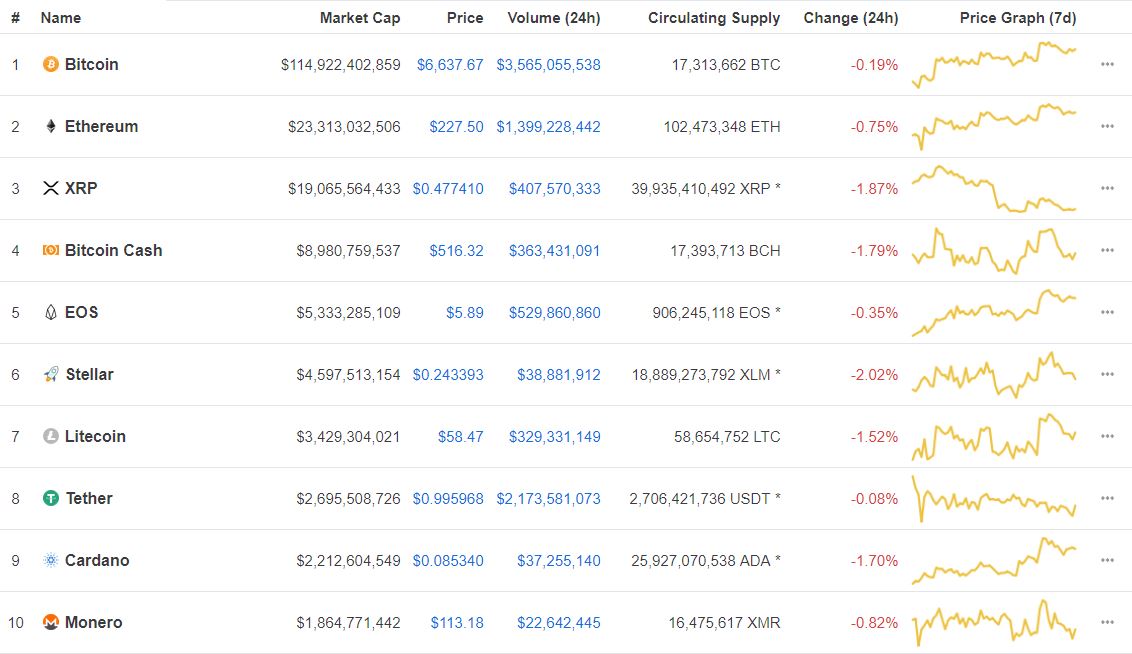

But, in classic bear market fashion, the market slowed as the sun rose again, with crypto assets reversing direction. Although Bitcoin is down only 0.27 percent at the time of writing, altcoins have taken a bit more of a beating, as digital assets such as Ethereum (ETH), Ripple’s XRP, Bitcoin Cash (BCH), Tron (TRX), have seen two percent pullbacks in the past 24 hours.

While a two percent move in a $200 billion market isn’t something to joke about, this move only corroborates the fact that volatility in this budding market has all but dried up, as reported by Ethereum World News previously.

Despite the calls that the slowing volatility, decreasing volumes, and growing support for this nascent industry indicates that a bottom is in, prominent analyst Rob Sluymer claims that investors should be patient before further allocating capital to cryptocurrencies.

Per a MarketWatch report, Sluymer, technical strategist and analyst at Fundstrat Global Advisors, claimed that the evidence that a bottom or market reversal has occurred isn’t easily apparent, adding that traders should wait for a clear signal before increasing exposure.

More specifically, Rob, who has appeared on CNBC Fast Money on multiple occasions, explained that a strong move about the “September real and relative highs, [which] remain as the key resistance/reversal levels will need to be exceeded to signal the early stages of a trend reversal.” Although the New York-based technician didn’t indicate any clear price levels, it is likely that Sluymer is referring to the aforementioned $6,800 level, which Bitcoin failed to legitimately surpass in the entire month of September.

Crypto Could Implode, Researchers Say

This bearish sentiment isn’t just confined to Fundstrat, however, as Juniper Research recently claimed that the cryptosphere could see its market implode in the near future. As reported by Bloomberg originally, citing statistics compiled and processed by Juniper, the Bitcoin network has seen daily transaction numbers fall from 360,000 at the peak of 2017’s bull market to 230,000 in September of this year.

Although 230,000 transactions still indicate that crypto, specifically Bitcoin, continues to see a fair amount of activity, the value contained in those transactions have fallen from $3.7 billion to $670 million, which can be attributed to falling prices and a slow down in the trading activities of ‘whales’. From a holistic perspective, the situation doesn’t look much better, with transaction values plummeting from 75 percent in Q2 of 2018 in comparison to Q1.

A Juniper report on the current state of the crypto market, titled The Future of Cryptocurrency: Bitcoin & Altcoin Trends & Challenges 2018-2023, also added that this decline in the value of crypto transactions are only set to continue. The researchers who authored the report claimed that a 37 percent quarter-on-quarter drop is more than likely, which isn’t a good sign for any aspiring global technology.

But then again, it isn’t all doom and gloom, as an array of industry leaders, Bitcoin bulls, and commentators recently took to news outlets and social media to tout their price predictions for Bitcoin’s end of year value. Tim Draper, a world-renowned venture capitalist, recently maintained his $250,000 BTC price prediction, indicating that the crypto asset largely dubbed “digital gold” could breach the price level in four years time.

In a survey, Fundstrat found that institutions are still considerably bullish on Bitcoin, with 54% of an institutional respondent group stating that BTC has likely hit its 2018 bottom, with 57% of the same surveyees claiming that the crypto asset will surpass $15,000 by the end of 2019.

Photo by Andre Francois on Unsplash