Fundstrat’s Lee Extremely Bullish on Bitcoin

As news of Facebook’s Libra broke, every mainstream outlet began to cover it and Bitcoin (BTC) in general. So, it comes as no surprise that this morning, CNBC “Futures Now” called on Tom Lee, the head of research at Fundstrat Global Advisors, to talk cryptocurrency in his latest appearance of dozens on the segment.

After discussing how Facebook’s latest venture is complementary to Bitcoin, in that BTC will continue to act as a reserve cryptocurrency, he was asked to give a price target. Staying true to his promise not to give any concrete, time-constrained targets, Lee claimed that Bitcoin could “easily” surpass its previous all-time highs of $20,000, but was hesitant to give an exact date.

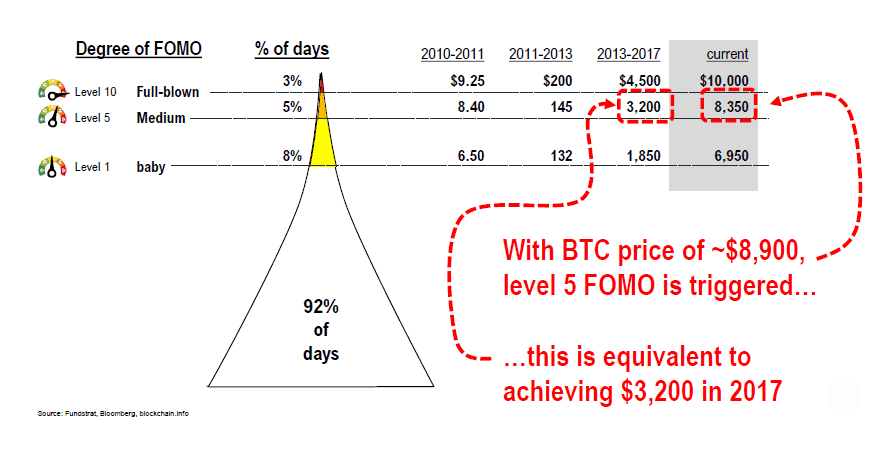

This comes briefly after Lee and his peers at Fundstrat claimed that $10,000 is the level to watch for Bitcoin. They claim that once Bitcoin reaches $10,000, “Level 10” FOMO will grace this market, which last occurred when BTC blipped above $4,500 in late-2017. If history is any guide, the cryptocurrency market will shoot even higher once $10,000 is breached. As the analyst wrote on Twitter earlier this month, “[$10,000] will see FOMO from those who gloated about the 90% crash in BTC… and those who saw Bitcoin dead as forever.”

Per CCN, which reported on this first, the Wall Street analyst stated on a podcast with Binance’s CFO that once $10,000 is breached, there will be a “fast and furious” move to $20,000. And from there, Bitcoin will double in the next five months, reaching $40,000 in a jaw-dropping move.

Catalysts for Further Crypto Run

Lee wasn’t the only bull on this segment. The two other guests to the CNBC show, traditional markets traders Anthony Grisanti and Brian Stutland, were also bullish. Grisanti claimed that as long as BTC doesn’t fall below $9,100, he’s long on the asset until $10,200. Stutland agreed, claiming that he would make a similar trade if he had to. And here’s why.

The CME trader claimed that Bitcoin has and continues to see use as a hedge “against fiat”, which many believe is conducive to the cryptocurrency’s long-term value proposition. This is seemingly true, believe it or not. As reported by Ethereum World News previously, a Hong Kong-based exchange TideBit traded Bitcoin for $9,340 while the asset traded for $9,180 on Coinbase, implying a 2% premium. This small trend, per eToro’s Mati Greenspan, is a sign that Bitcoin is becoming used more and more as a safe haven, validating reports that Hong Kong residents have begun to move their assets out of the region in a bid to mitigate any financial surveillance or government seizure of their wealth.

With the geopolitical and macroeconomic stage continuing to look more tumultuous than ever — with the US-China trade war, proposed capital controls in Italy, expected rate cuts by central banks, and more — some are sure that Bitcoin will only continue to see an increase in capital inflows in the months and years to come.

Photo by André François McKenzie on Unsplash