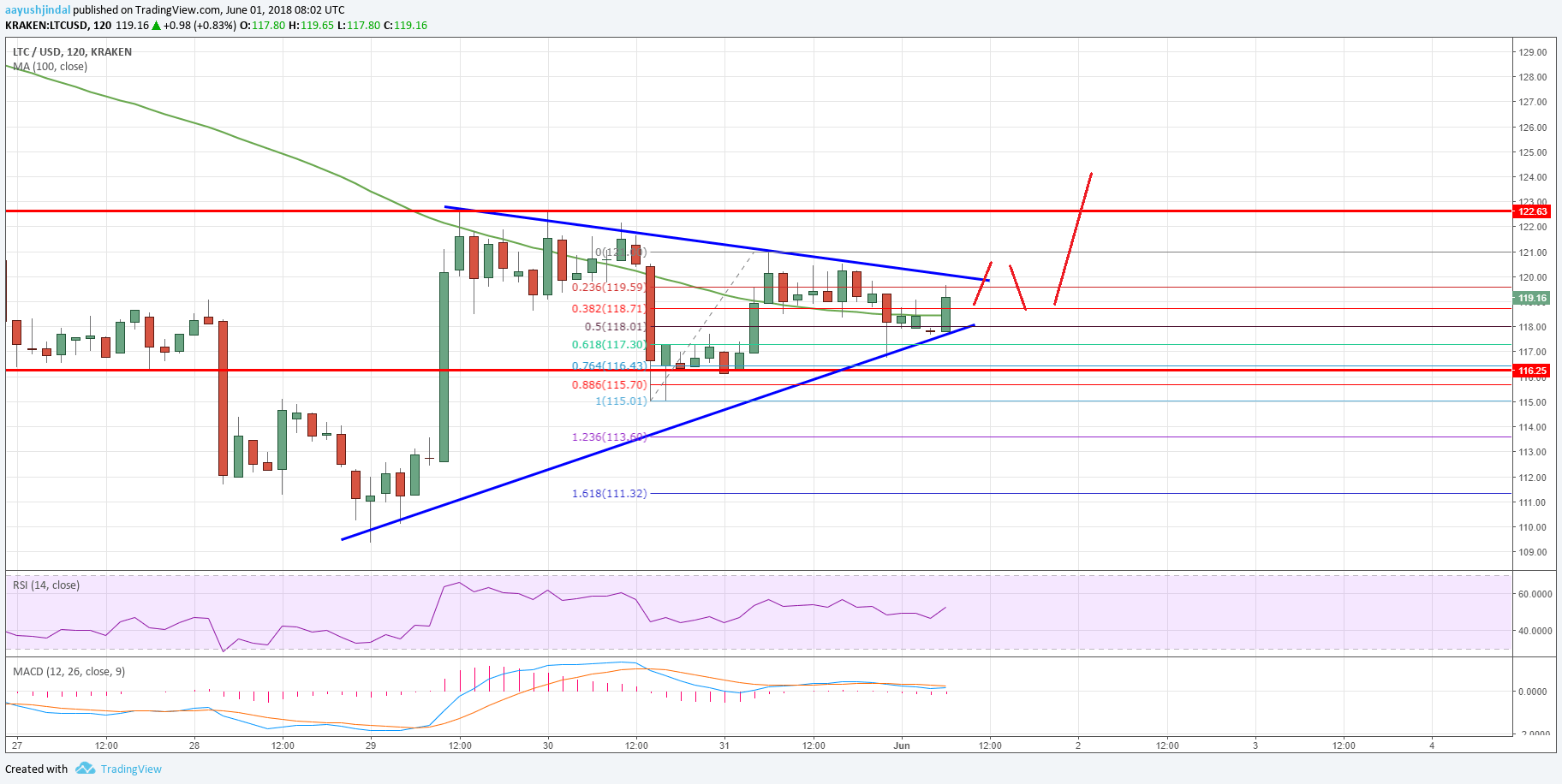

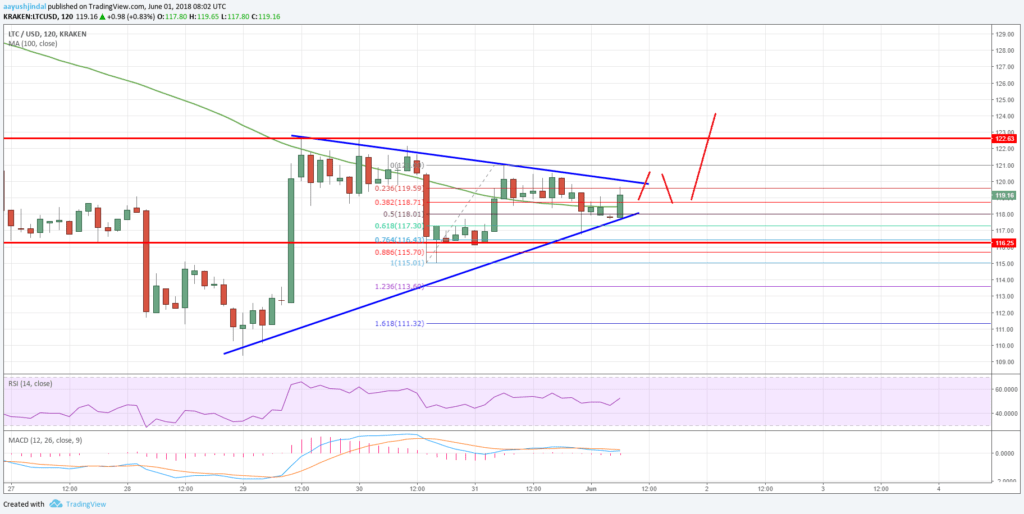

Litecoin price is trading with a positive bias above $115 against the US Dollar. LTC/USD is currently approaching a short-term break either above $122 or below $116.

Key Talking Points

- Litecoin price remained above the $115 and $116 support levels with a bullish angle (Data feed of Kraken) against the US Dollar.

- There is a short-term contracting triangle forming with support at $117.50 on the hourly chart of the LTC/USD pair.

- The pair is likely to make the next move either above $122 or below $116 in the near term.

Litecoin Price Forecast

During the past three sessions, there were mostly ranging moves above $115 in litecoin price against the US dollar. The LTC/USD pair consolidated and it seems like the pair is preparing for the next break.

Looking at the chart, the price recently failed to move above the $121.50 and $122.00 resistance levels. A high was formed at $121.10 and the price corrected below the 50% Fib retracement level of the last wave from the $115.01 low to $121.10 high.

However, the downside move was limited by the $117.00 level. Moreover, the 61.8% Fib retracement level of the last wave from the $115.01 low to $121.10 high also prevented the decline.

At the moment, there is a short-term contracting triangle forming with support at $117.50 on the hourly chart of the LTC/USD pair. The pair might soon make the next move either above $121 and $122 or below $117 and $116.

If there is an upside break above the channel, the next resistance sits at $122.50-60. Above this, the price could even break the $125.00 level to register further gains.

On the flip side, if the pair breaks the channel support at $117.50, there could be a retest of the $115 support area. The price must stay above the $115 support to avoid a downside break towards the $110 level in the near term.

Overall, the next break either above $121 or below $117 could decide the near term bias for litecoin.

The market data is provided by TradingView.