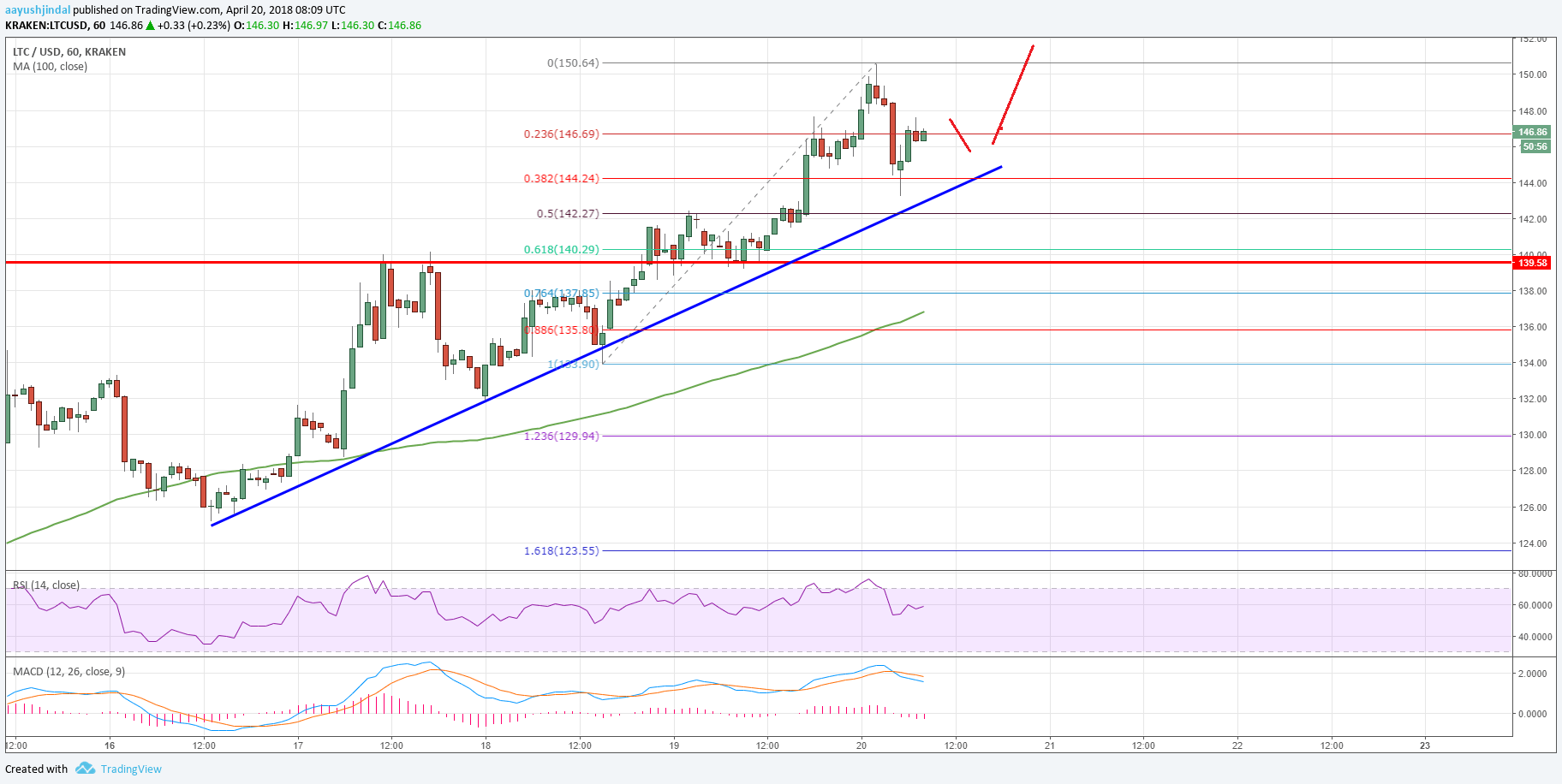

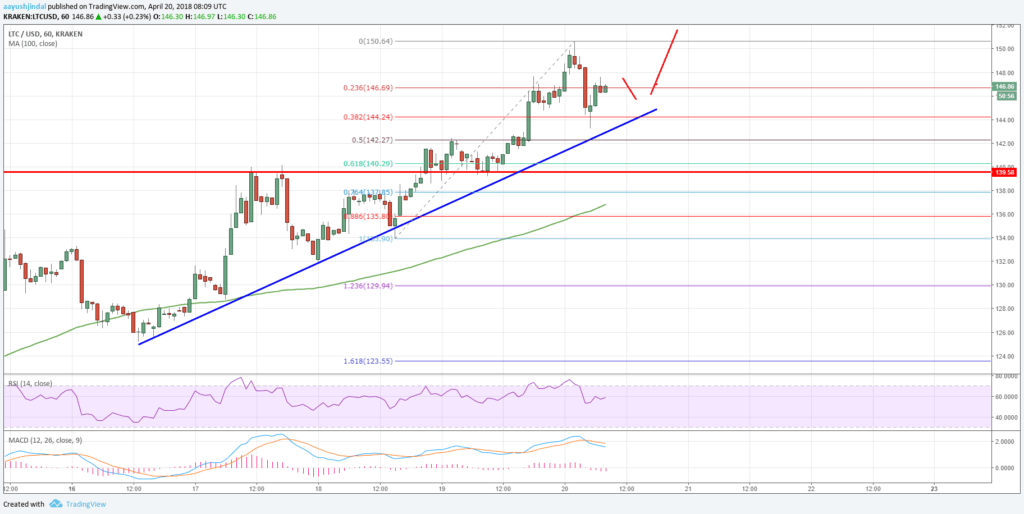

Litecoin price gained traction and tested the $150 resistance against the US Dollar. LTC/USD remains in a solid uptrend and it could trade past $150.

Key Talking Points

- Litecoin price made a nice upside move and traded to a new monthly high at $150.64 (Data feed of Kraken) against the US Dollar.

- This week’s highlighted crucial bullish trend line with support at $145 is still in place on the hourly chart of the LTC/USD pair.

- The pair is currently correcting lower, but it remains supported on the downside near $140-145.

Litecoin Price Forecast

Yesterday, we discussed about more gains above $140 in litecoin price against the US dollar. The LTC/USD pair remained in a bullish zone and broke the $140 and $145 resistance level.

It tested the $150 resistance level and formed a new monthly high at $150.64. Later, there was a downside correction and the price traded below the 23.6% Fib retracement level of the last wave from the $133.90 low to $150.64 high.

However, the decline was protected by the $144-145 support zone. More importantly, this highlighted crucial bullish trend line with support at $145 is still in place on the hourly chart of the LTC/USD pair.

The pair tested the 38.2% Fib retracement level of the last wave from the $133.90 low to $150.64 high. The $144-145 support area played well, and as a result, the price resumed its upside.

At the moment, the price is trading near the $147 level, with an immediate resistance near the $150 level. Once there is a successful hourly close above the stated $150 resistance, LTC price will most likely accelerate higher towards the $155 level.

Above the mentioned $155 level, the $158-160 zone is likely to act as a sell area in the near term. On the flip side, the $145 support region is a very crucial for the current uptrend.

If there is a downside break and close below the $145 and $144 support levels, the price could test the $140 pivot level.

Trade safe traders and do not overtrade!

*The market data is provided by TradingView.