Latest Ripple News

The just concluded Impact Fintech 2018 was yet another platform for Ripple officials to reiterate the vision-mission statement of their company: that of providing simple, cheap and yet effective cross-border settlement solutions. To execute this objective, the company has rolled out xVia, xRapid and xCurrent. The latter received an update but against expectations, uptake has been slow with a handful of banks updating but failing to adopt xRapid—the solution that leverage XRP as an on-demand liquidity tool. By incorporating XRP in their transactions, banks can free up funds which could otherwise be used in providing liquidity.

Read: Winklevoss Twins Unfazed Amid Crypto Winter, Launches Gemini Mobile

During the conference, Ross D’Arcy, the Sales Director of Ripple said the company is actively using their options to solve real user cases and are not in a Proof of Concept (POC) stage or in science experiment. He went ahead and said centralized banks are not institutions to be trusted as they are opaque in their operations and full of restrictions that needs to be fulfilled before a transaction is settled.

On the other hand, with Ripple funds can be sent instantaneously without the need of holding the destination fiat currency. With each and every bank that plugs in to the network, Ripple business model of collaboration is achieved and their goal of creating this internet of value is slowly becoming a reality.

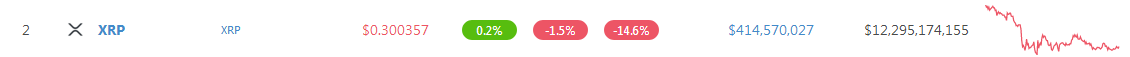

XRP/USD Price Analysis

With each and every implementation and partnership, Ripple fundamentals appear positive. However, we need more banks to utilize xRapid in their operations. This will no doubt help lift prices from current levels. XRP is down 1.5 percent at the time of press but stable in lower time frames. While bears are in control, sellers are yet to press lower and reverse Sep 2018 gains—and this is bullish.

Trend: Bearish, Ranging

Aside from series of higher highs of trend defining Sep, XRP/USD has been trending lower in the last two months. This has seen XRP drop 90 percent from Sep highs and from the last two weeks, there is risk of further declines more so if prices fail to expand above 40 cents—our resistance line previous support.

Volumes: Bullish

Comparisons can’t be made between volumes of the last few weeks and those of Sep. There is a great disparity meaning market activity is tapering as investors, traders and participants feel the sting. Nonetheless, a standout in the last few days is Dec 8, 2300HRs bull bar—23 million versus 9 million average. Notice that price action of the last three days is still within its high low. Its 4 cents trade range shall define our trade triggers and since we are net bullish, we expect gains above 33 cents. This shall ignite buyers aiming at 40 cents and higher by the end of the year.

Candlestick Formation: Bear Breakout, Re-test phase

Losses of Dec 6 means XRP/USD is trading within a bear breakout pattern. For bulls to reign then there must be gains above 33 cents. Otherwise, rejection of higher highs past 33 cents—our minor liquidation line, could see prices tumble back in a retest phase below 29 cents. This in turn could trigger another wave of sells driving XRP prices to 25 cents or lower.

Conclusion

Overly, we retain a bullish overview because bears are yet to reverse Sep surges. As such, our XRP/USD price analysis will be as follows:

Buy: 33 cents

Stop: 31 cents

First Target: 40 cents

All charts courtesy of Trading View.

This is not Investment Advice. Do you own Research.