Many crypto enthusiast and traders were aware that there might be massive volatility as we headed into the Holiday Season of 2018. Many had expected a Santa Claus rally or a false breakout as many traders were cashing out to spend time with family. By December 24th, Bitcoin (BTC) was trading at $4,200 and up $1,000 since its recent low of $3,200 on the 15th of December.

However, the excitement before Christmas got exhausted a few hours later with the King of Crypto dropping to $3,600 by the 28th of December: a drop of 14.2% from the earlier mentioned $4,200.

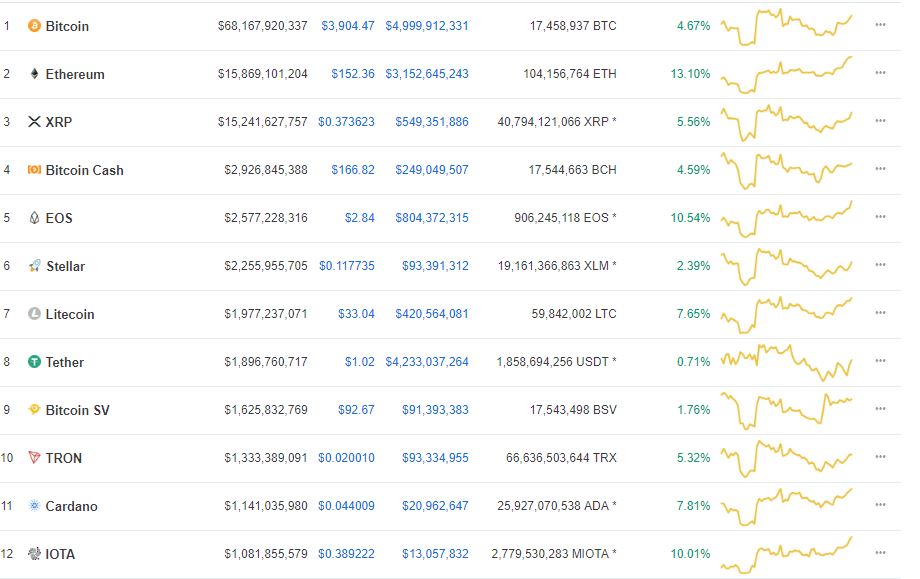

All Green Today, the 2nd of January

As we entered the New Year, Bitcoin was trading at $3,700. The same BTC is now valued at $3,900 and up 4.70% in the last 24 hours. Further looking at the top 10 cryptocurrencies according to Coinmarketcap.com, we find that Ethereum (ETH) has reclaimed the number 2 spot from XRP as the Constantinople hard fork approaches. The upgrades on the Ethereum network are meant to be initiated on the 16th of January, thus providing ETH with the necessary momentum to gain considerably in the past few days. A screenshot of the top cryptocurrencies in the green can be found below.

The January Effect Explanation

In traditional stock markets, the January effect is defined as…

[A] seasonal increase in stock prices during the month of January. Analysts generally attribute this rally to an increase in buying, which follows the drop in price that typically happens in December when investors, engaging in tax-loss harvesting to offset realized capital gains, prompt a sell-off.

Another possible explanation is that investors use year-end cash bonuses to purchase investments the following month.

Given the entry of crypto investing by Wall Street institutions such as Hedge Funds and regular crypto exchanges wooing institutional investors, it is safe to assume that the January effect could have crossed over to the crypto markets.

New Capital Might Have Also Found its Way Into Crypto

This then brings us to the second reason why the markets are in the green. The just concluded year of 2018 saw many major cryptocurrencies decline by 80% to 93% from their All Time High (ATH) values. These digital assets are still currently massively discounted when using ATHs as reference points. Such discounts are not easily missed by Hedge Fund managers who would be quick to transfer funds from banks – as soon as they reopened today, January 2nd – to start their crypto investment strategies for 2019.

Conclusion

Summing it up, January 2nd has provided a pleasant day in the crypto markets as many of the digital assets have experienced considerable gains in the last 24 hours. This then brings us to observe that such a ‘rally’ could be as a result of The January Effect in the crypto markets. Also to note, is that many digital assets are massively discounted when compared to their All Time High values of late 2017 and early 2018. As a result, new capital could have entered the crypto markets from Hedge Funds wishing to capitalize on these opportunities.

What are your thoughts on the gains being experienced by Bitcoin and other cryptos today, the 2nd of January? Please let us know in the comment section below.

Disclaimer: This article is not meant to give financial advice. Any additional opinion herein is purely the author’s and does not represent the opinion of Ethereum World News or any of its other writers. Please carry out your own research before investing in any of the numerous cryptocurrencies available. Thank you.