It’s around that time of the year and as government workers resume after one of the longest shut-down in US history, the IRS will soon be ready to knock on your doors. Like everywhere else, filing for taxes is a mandatory and crypto traders, investors and holders must comply. Everything else constant, filling will be hectic for crypto day traders. These are individuals who actively trade—and it doesn’t matter the pair. Both crypto-to-crypto and crypto-fiat or vice versa are deductible events and the US government expect taxes from these properties whenever you buy or sell. Luckily and as reported by Ethereum World News, CoinBase did integrate with Turbo Tax to simplify filling.

Turbo Tax Simplification

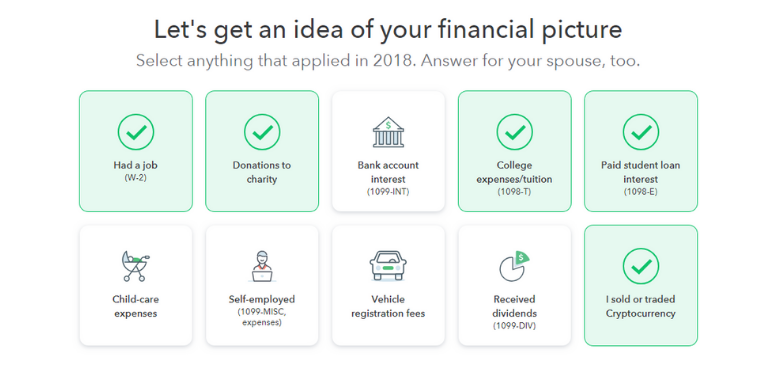

But, here’s some good news for those who transact at alternative on-ramps—fiat to crypto or crypto to crypto. Turbo Tax now has a “I sold or Traded Cryptocurrency” option. No doubt, this will be a massive boost for traders seeking to cut down the tedious process of counter-checking and filling taxes online. Aside from this new option, note that users won’t be charged a cent and all they have to do is create an account.

Furthermore, the site provides and easy way to track trades. The only problem is that Turbo Tax can only accept 100 trades and they have been reducing this from 1,000 to 500 and now 100 trades which is quite disappointing especially for active traders. However, users can get around this by filtering their CSV files to exclude zero gains.

Before you move on and download your CSV, take a few minutes and note this:

- Make sure you fill and submit Form 8949 on time.

- Crypto-to-crypto and crypto-to-fiat (or vice versa) trading is a taxable event

- Spending your crypto, like buying stuff online, is a taxable event.

- Gifting someone in crypto is a non-taxable event—but must have supporting documents.

- Making crypto donations to IRS certified charities is not a taxable event.

And

Hiding your assets—let’s buy Monero guys—is tax evasion and a federal offense. CoinBase was forced to give away traders that had transacted more than 20k. There is no hiding.