Latest Tron News

What we can authoritatively say is that, Bitcoin—despite its scalability issues and centralization—is king. Therefore, as a market leader, when it coughs, altcoins do get a cold. We have seen this happen on numerous occasions.

Read: Samsung Galaxy S10 Leaked Images Reveal New Crypto Wallet

The situation was crystal at the deep of last year’s meltdown more so during the injurious hash rate war. Moving on, there are challengers and Justin sun, the ambitious founder and marketing genius of Tron has never been shy to proclaim his intentions of seeing TRX being the second most valuable coin. Although we cannot dismiss these statements as vaporware, he won’t budge.

Meanwhile, he continues to shill his Tron and TRX, we expect immediate demand and even flap to sixth in the near future. Our optimism stems from BitTorrent and their plans to airdrop BTT tokens for all TRX owners. Ethereum world News reported that the six-year air drop at 0.11 BTT per TRX will be via 14 liquid exchanges including Binance.

Also Read: Tron Surmounts Milestones Following niTRON, TRX Outperforming BTC, XRP

BTT token sale commence later this month and funding will be via Binance Launchpad. As expected, investors would only participate in crowd funding by exchanging their BTC or ETH or any other altcoin for Binance Coin or TRX.

TRX/USD Price Analysis

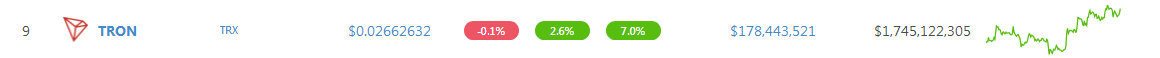

At the time of press, TRX is one of the top performers. It is up 7.0 percent in the last week and trading within a clear breakout pattern after clearing the 2.5 cents barrier. Since all of our trading conditions are live, chances are TRX prices will continue to soar ahead of the BTT token sale. Afterwards, depending on reception, demand will taper but not before TRX blast above 4 cents solidifying bulls’ resolve of kick-starting attempts of recouping 2018 losses.

Trend and Candlestick Pattern: Bullish, Breakout Pattern

In the short-term, bulls have an upper hand as prices continue to edge higher, above main supports at 2.5 cents. At the back of this bullish projection is the simple fact that TRX bulls did drive prices above 2.5 cents at the back of decent volumes. Subsequent retest didn’t spark a sell off. On Jan 14, bulls reemerged to confirm the bull breakouts of Jan 7-8. Therefore, unless otherwise there are steep losses invalidating the double bar bull reversal pattern of Jan 13-14, every dip should be a buying opportunity with first targets as aforementioned.

Volumes: Increasing

Even though volumes of Jan 14 stand out at 50 million versus 20 million averages, TRX demand has been on rise on the last few days. Note that between Jan 18—7 million and Jan 22—18 million, momentum has been building up. We can attribute this to upcoming BTT token sale and if that is the case, expected demand would no doubt propel prices towards 4 cents or higher validating our overall trade plan.

All charts courtesy of Trading View—BitFinex

This is not Investment Advice. Do you Research.