Latest Tron News

Recent events confirm that Bitcoin is king and it has a magnifying effect on altcoin prices. A simple 12 percent dip on BTC was enough to double losses in TRX causing prices to dip below important support levels.

Now unless otherwise, Tron need CoinBase more than ever. The California based cryptocurrency exchange is gradually shifting its stance, increasing the number of coins after receiving $300 million in a Series E funding led by Tiger Global Management, with participation from Y Combinator Continuity, Wellington Management, Andreessen Horowitz, Polychain and others valuing the exchange at more than $8 billion.

We're pleased to announce our latest funding round, led by Tiger Global Management. We plan to accelerate our global expansion and investments in the utility phase of crypto—always working to create a more open financial system for the world. Read more: https://t.co/JzGlMGLjaC

— Coinbase (@coinbase) October 30, 2018

Though their COO, Asiff Hirji, said they “didn’t need the funds” their campaign to drive mass adoption of cryptocurrencies demand funds for development of the necessary technical infrastructure smoothening transactions between fiat and crypto more so when they increase their coin support.

ZRX is now live at https://t.co/bCG11KveHS and in the Coinbase iOS and Android apps. Coinbase customers can log in now to buy, sell, send, receive, or store ZRX. https://t.co/kzDisSZrFu

— Coinbase (@coinbase) October 16, 2018

Though they have listed BAT and ZRX from the five coins under exploration, investors across the board expect CoinBase to offer support for TRX and XRP. After all, Tron meets the exchange’s listing framework because it is liquid, decentralized and with a working platform. In fact, as reported by Ethereum World News, the platform did launch a DEX on TronScan.

did everyone see the DEX tab on Tronscan!!!!! @WLFOFMYST @thacryptomaniac @curtiskitchen

— FetzLink1KEOY (@thefetztizzle) November 8, 2018

Besides, there has been no reports of regulatory hitches that would cause friction with regulators anywhere in the world.

TRX/USD Price Analysis

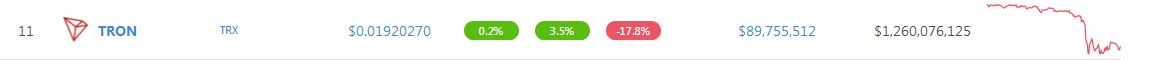

After a tough week that saw TRX/USD glide 18 percent on a week over week basis, prices are now stable and up three percent in the last day. However, the recovery isn’t a pass for higher highs as we expect further meltdown now that TRX/USD is trading below important support levels.

Trend: Bearish

Apart from the consolidation and higher highs registered from August through to Sep, TRX/USD is bearish. That has been the trend in the last 10 solid months and bears show no signs of slowing down.

Volumes: Bearish and Increasing

In a bearish market, several candlesticks are conspicuous: The bear breakout bar of June 24 which registered 9.6 million in daily volumes, Sep 5 bar rejecting highs above 3 cents with volumes at 29 million surpassing averages of 19 million, Nov 11 bar rejecting breaks above 3 cents for the second time in two months with 44 million against 25 million on average and Nov 14 bar breaking below the bear flag and confirming sells at 43 million against averages of 9 million. Notice that for every rejection of 3 cents volume increases culminating in Nov 14 break below the three-month bear flag.

Candlestick Formation: Bear Breakout, Bear Flag

The higher highs from August with caps at 3 cents did complete a bear flag. All this did print inside a bear break out pattern set in motion by June 24 break below 4 cents. From our previous TRX/USD trade plans, we had reiterated the importance of bulls closing above 3 cents or Sep highs.

That was the only way for bulls to assert their influence. However, losses from Nov 4 did build the much-needed momentum for Nov 14 break below the bear flag.

Conclusion

Overly, the crypto market is grappling with deep losses and TRX/USD is no exception. After bears broke below 2 cents with high trading volumes, it did nullify our previous bullish stance setting in motion aggressive sellers aiming at 1.5 cents. On the other hand, conservative traders should wait for clean breaks below 1.5 cents main support before selling on pull backs with first targets at Jan 25 lows.

All Charts Courtesy of Trading View

This is not Investment Advice. Do your own Research