It has come to the conclusion of many crypto-traders that sometimes technical analysis does not work when dealing with the crypto markets. All the technical stuff gets thrown out the window because the market sometimes operates on news and FUD. It is with the latter situation that we are still suffering from the gut wrenching blow that was the delay of the Bitcoin (BTC) ETF.

Before the announcement was made, the total crypto market capitalization stood at $255 Billion. We are now at $191 Billion at the moment of writing this: a drop of 25% in a week. BTC was also at $7,100 before the SEC announcement. It has since touched $5,990 a few minutes ago: a drop of 15.6%. Ethereum (ETH) has been hit the hardest by falling from $410 to a new low of $259 in just the same time frame: a drop of 37%.

With all the turmoil, one is left to wonder what is next?

Technical analysis aside and tackling the situation head on, a market recovery is hinged on three possible events.

Firstly, the SEC rules in favor of a Bitcoin (BTC) ETF on the 30th of September. This will reignite faith in the crypto-markets as well as setting us up for another bull run into the holiday season that starts in November. However, the SEC might take the current volatility of the crypto-markets to further extend on making a ruling on the ETF. Remember the SEC is tasked with protecting the welfare of investors in America. They might get skeptical about a volatile crypto market.

Secondly, the crypto traders might just find it within themselves to immediately continue trading without the idea of the SEC at the back of their minds. The inventor of Bitcoin, Satoshi Nakamoto, never intended for the fate of Bitcoin to lie in the hands of the financial institutions it was created to avoid. Therefore, we, the people, have a majority say as to what the future of the crypto markets will be. We can decide to let Wallstreet determine that for us with ETFs and companies like Bakkt, or we can go on with business as usual like we did before all the hype of Institutional investors.

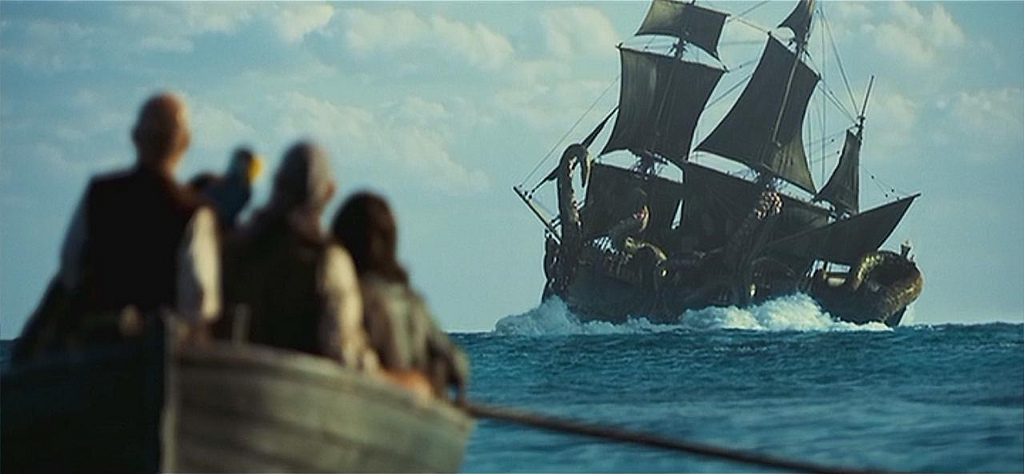

Thirdly, and the option many might not want to hear, is that we let the current market decline to phase out in a natural manner and with time. One can compare the current turmoil to a storm in the high seas. Only the strongest of sailors have been there before and know how to battle the waves with a smile on their faces as the rest of the crew hide below deck or abandon ship completely. It takes a more or less brave sailor to tackle storms with a smile. But that is indeed what many of us need to do heading forward. We love this crypto-verse too much to let it wither under our feet. Five years down the line, we will be laughing at how back in 2018, we almost gave up on our Bitcoin and Alt-coin positions.

[Photo, sinking of the Black Pearl from the Pirates of the Caribbean. Source, flickr.com]