With all the doom and gloom being published about Bitcoin at the moment it is often hard to overlook how it has been designed. When prices plummet, hashrate and mining difficulty follow suit as the blockchain operates exactly as it has been designed.

The mainstream merchants of doom are almost rubbing their grubby hands together with glee as Bitcoin falls to new yearly lows and drops over 80% from its all-time high. Stories of mining farms closing down due to non-profitability have added fuel to the fire. Even established finance websites such as Marketwatch are running headlines of despair and crypto worthlessness.

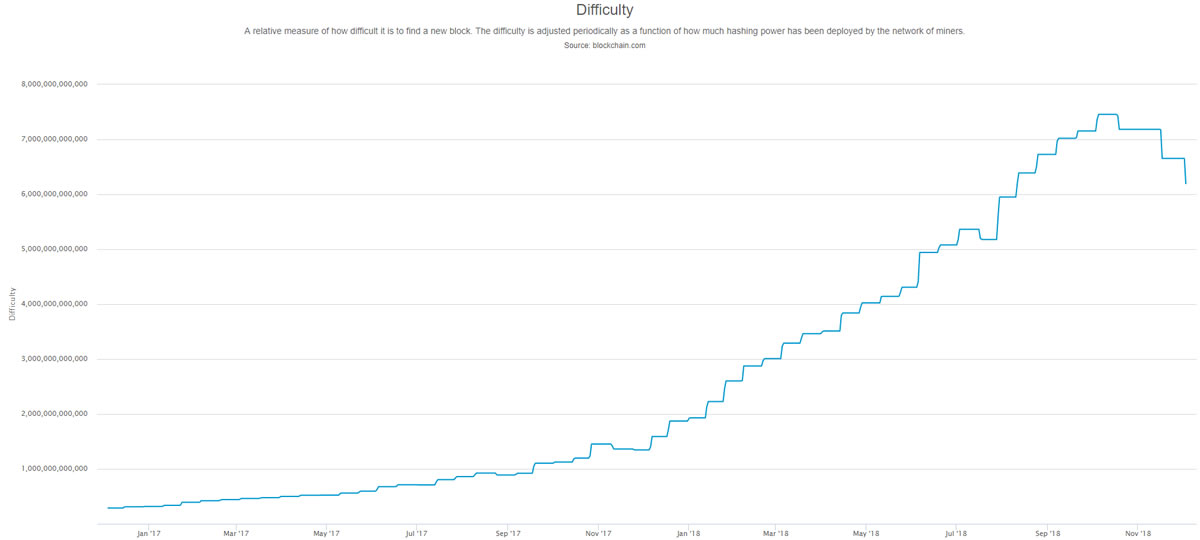

According to that opinion piece, Bitcoin is getting close to the point where it becomes worthless claiming that a fall in price to below the cost to mine will render the digital currency redundant. However, with the falling price comes a decline in difficulty as highlighted by charts on Blockchain.info.

The 15% fall in difficulty shows the ease at which miners can find a new block. Hashrate, which has fallen by the same amount, shows the amount of computing power required to make the calculations.

At the time of writing the hashrate has fallen to just below 32 million TH/s.

As powerful mining machines such as Bitmain’s Antminer S9 shut down due to power consumption costs there is less computing power in the mining pool which will reduce the difficulty.

Some observers have noted that this has been the biggest fall in Bitcoin history.

#Bitcoin just had its second largest drop in mining difficulty in history: -15.1%. This is the current ranking:

2011-nov-01: -18.0%

2018-dec-03: -15.1%

2011-oct-16: -13.1%

2012-dec-27: -11.6%

2011-mar-26: -9,5%

2013-jan-26: -8.6%

2011-dec-01: -8.5%

2012-may-25: -9.2%— Fernando Ulrich (@fernandoulrich) December 3, 2018

This fall has come a year after the biggest rise in Bitcoin history so things are ironing themselves out in the ecosystem and the blockchain is behaving as it was designed to. The fall makes it more profitable to mine Bitcoin than some of the other cryptocurrencies. This may open the doors to new miners and reduce the power of the conglomerates such as Bitmain.

As previously reported by ETW Bitcoin miners are now switching to alternatives such as BCH or BSV. The recent ‘hash war’ between the rival groups and attempts to entice BTC miners over to their camp no doubt had some influence over the recent market rout which dropped prices by almost 40%.

Things will eventually balance themselves out in the Bitcoin network, it will find a bottom, probably stay there for quite a while then, according to many industry observers, rally again sometime around the middle of next year.