Latest Bitcoin News

By dropping 8,540.4082 BTC, the number of Bitcoin open short positions at BitFinex is down 26 percent at the time of press in the last two days. This decline hint of capital flight and as a major player in the space, a downtime that would see the exchange move their servers from Amazon Web Service to servers under their control is proving to be a windfall for traders who had to contend with sharp drops in 2018. In a Medium post, the exchange said the migration will take up-to seven hours:

“BitFinex and ETHFinex trading platforms will be down for up to seven hours. Account holders will not be able to access their wallets, and all features across both platforms will be offline for the duration of the upgrade.”

Read: BitFinex and ETHFinex To Go Offline on 7th January for a Complete Data Migration to New Servers

While this drop could be a precautionary step by investors and traders who don’t want to inconvenience and unable to cash out assuming there is a technical glitch preventing free withdrawal after the migration, the number of long positions is increasing, up 5193.5740 BTCs or 18 percent in the last two days at the time of press.

“Whilst the migration is scheduled to take place on January 7th, placing our traders’ best interests at the forefront, this date will be contingent on market conditions. If the market is deemed too volatile on January 7th, the migration will be postponed to a day of more typical movements to protect our traders”

Obviously, the drop in BTC shorts would logically be accompanied by a drop in long positions ahead of the schedule. However, that is not the case. Needless to say, it is likely that increasing BTC longs point to increasing demand. Despite the withdrawal of liquidity during maintenance, traders stand to profit if they hodl after transferring their BTC stash to wallets whose private keys they have control of.

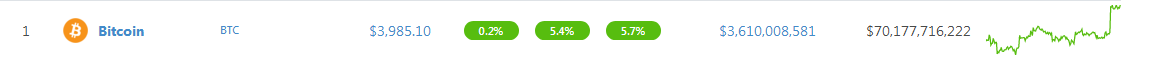

Bitcoin (BTC) Price Analysis

At the time of press, BTC is firm and trading above $4,000. It is up 5.4 percent against the USD in the last day and seems to be breaking off consolidation in lower time frames triggering lower time frame long positions. Still, conservative traders ought to take a neutral position until after there are sharp, high-volume gains above $4,500 solidifying our previous stance while opening doors for $5,800 and $6,000.

Trend and Candlestick Formation: Bearish, Ranging and Breaking Out

Market participants are positive and with Bakkt roll out on the cards, BTC can easily print $6,000 or higher. Nevertheless, candlesticks point to a different ball game.

From a top down approach, it is clear that sellers are in control. However, take note that this could be a normal retracement in a trend dominated by bears.

When we paste a Fibonacci retracement tool between Nov-Dec 2018 high low we realize that BTC liquidation is at the $4,500—or the 38.2 percent retracement level. More often than not and has history show, asset prices tend to resume dominant trend from this level.

Therefore, it is of prime importance that bulls—if they are indeed in control, closes above $4,500. Ideally, this should be at the back of above average volumes reasserting their presence and nullifying bears of mid-Nov 2018. If not and prices drop today, BTC may see $3,500 or lower by end of the month.

Volumes: Low, bullish

The ecstatic sells of Nov 20 marked the end of high volume bars. As we can see from the charts, trading volumes are tight and with it trading ranges are low and accumulating.

Ideally and as reiterated in previous trade plans, $4,100 and $4,500 are important trade levels. If bulls are in control then breakouts should be accompanied by high volumes above those of Nov 20—117k versus 37k.

At current volumes averaging 17k, it’s a long short but nothing can be discounted considering how the space is volatile.

Conclusion

Based on the above, our BTC/USD trade plan assuming bulls are in control and close above $4,500 today is as follows:

Buy; $4,500, spot

Stop: $4,100, $3,800

Target: $5,800, $6,000

All charts courtesy of Trading View—BitFinex

This is not investment advice. Do your own Research.