The trade war is going from bad to worse and contrarian investors will have noticed that that is usually good news for bitcoin.

Currently trading at $8,793, up 2.73% in the past 24 hours according to coinmarketcap, the drop below $8,200 witnessed earlier in the week seems a distant memory.

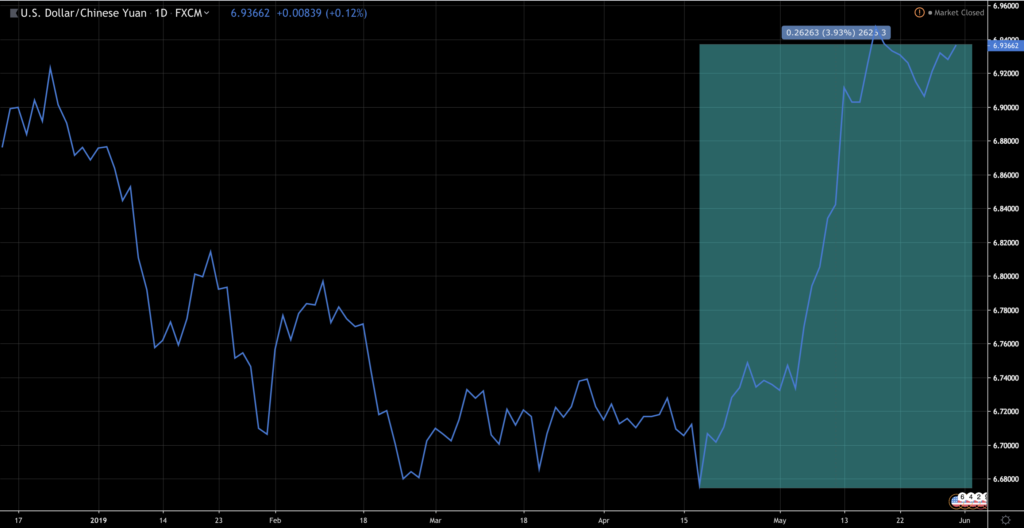

Keeping abreast of the bitcoin market right now, means watching like a hawk the dollar-yuan exchange rate.

That’s an opinion shared by Arthur Hayes, the chief executive of BitMEX exchange – although registered in the Seychelles BitMEX’s operations are based in Hong Kong, so you could say they have their fingers on the pulse.

As the Monday Asia trading session nears, against the backdrop of a deteriorating trade situation and global equity futures flashing red at the time of writing, the price of bitcoin could soon surge above $9,000, for the second time of asking in the past week.

China’s white paper warning to US

China has just released its promised white paper on laying out its stance on the trade dispute it is embroiled in, and squarely blames the US for the breakdown in negotiations, saying the country is “untrustworthy”.

Many governments around the world will probably be in agreement somewhat in the light of the Mexico tariff surprise Trump pulled late last week, that China may have a point. Even if they don’t, the country remains the preeminent workshop of the tech world, so from Asia to Europe tech and other companies are taking a more cautious and pragmatic approach than that shown by the US.

China’s white paper declared that the trade war has not “made America great again”, as the temperature rises between the two erstwhile trading partners.

The white paper’s description of the last round of talks does nothing to engender confidence in any imminent return to the negotiating table. It charges the US with “intimidation and coercion”, of making “exorbitant demands” and making “mandatory requirements concerning China’s sovereign affairs”.

Speaking at a press conference on the white paper China’s vice commerce minister Wang Shouwen said the US was “solely to blame” for the trade talks folding.

Yesterday saw the latest round of tariffs come into force on both sides.

Late last week China said it was drawing up a list of foreign companies it considers to be “unreliable entities”.

China has also been dropping big hints that it might limit supplies of rare earth metals reaching the US. China mines and processes 80% of the world supply of the metals, which are key to making components for electronic equipment in civilian and military spheres.

FedEX and Micron in the eye of the storm

In a further sign of the widening distance between the two countries, Wang said “nothing is agreed until everything is agreed”, breaking off to speak in English as if to stress the lack of progress.

Before a deal could be struck the US would have to “work towards cancelling them [tariffs]” said Wang, and there’s no indication that’s going to happen any time soon.

A deal looks even further away now that US express delivery firm FedEx is being investigated regarding whether it “violated the legitimate rights and interests of its Chinese clients” according to the Global Times, one of the most stridently nationalist of the official media.

FedEx, according to CNBC, has admitted to rerouting mail being sent from Japan to China to the US, making the parcel delivery firm a prime candidate for early inclusion on China’s list.

It’s not the only US firm in trouble either.

US chipmaker Micron has found itself the subject of an investigation by the Chinese anti-trust regulators. That follows complaints the Texas-based company made about intellectual property theft by a Chinese competitor.

For its part, the US, via the Pentagon has just accused China of practicing “predatory economics”.

Watch Trump’s Twitter feeds and the USD/Yuan rate for next crypto market moves

In addition to Trump’s twitter feed, crypto investors need to keep a watching brief on the yuan dollar exchange rate.

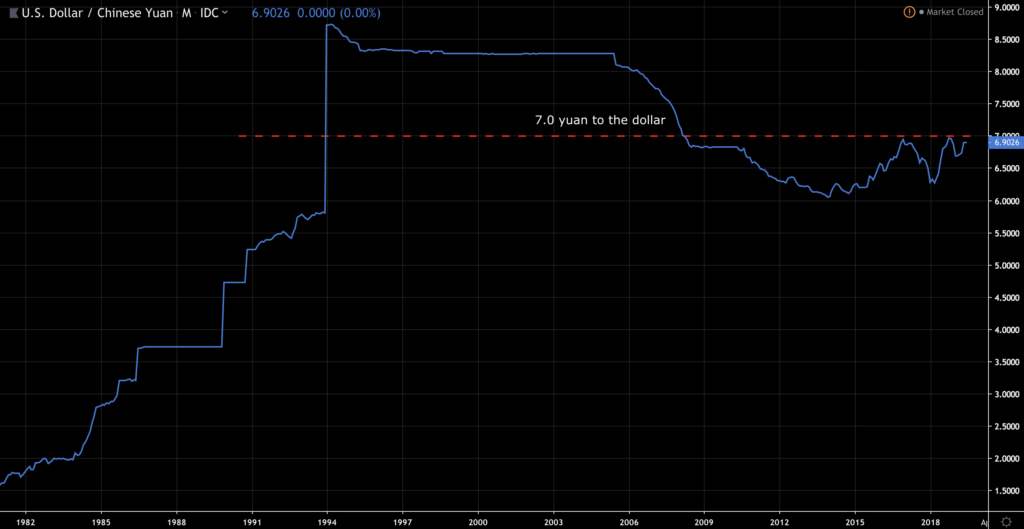

They key level is 7.00. If the yuan rises above that, it will be the first time it has done so since 2008, and we all know what happened in that momentous year.

The last time China let the currency depreciate (2014-2015) it triggered capital flight as yuan-denominated assets fell in value.

But the value of the currency is not even necessarily the main driver of outflows. Ultimately, asset-rich individuals in China are looking to diversify their holdings to mitigate risk while at the same time scouring the world for higher returns in a low interest-rate world. The USD/CYN rate in this view may merely be the irritant.

Nevertheless, allowing the yuan to depreciate to make exports cheaper risks opening the floodgates of capital flight as far as the government is concerned. But logic and what is rational may find themselves put to one side as the trade war heats up and the temptation to inflict damage on the trading adversary impairs more considered judgement.

The Trump administration would likely label China a currency manipulator if it was seen to be deliberately weakening its currency, further exacerbating the trade conflict by adding a currency war to the mix.

The Chinese government is convinced capital controls is the answer to capital flight, real and imagined, no matter how ineffective. In the decade to 2017 outflows of capital from China are estimated at $3.8 trillion.

Today all Chinese citizens are limited to a maximum conversion of yuan to $50,000. However, even that figure may be too high for the liking of some officials.

Just last week Yu Yongding, a one-time adviser at the People’s Bank of China, was barred from transferring $20,000 out of the country to relatives residing abroad, the South China Morning Post reported.

If a former adviser to the central bank is having trouble moving such relatively small amounts of capital that is well within current rules, then it does suggest that a tightening of foreign exchange policy and capital controls is taking place.

Bitcoin still in demand despite talk of eliminating mining

There has been scant mention of bitcoin for some time in the Chinese media most closely aligned with the ruling party, except in the coverage of clampdowns on miners and cases of crypto-related fraud.

A woman was jailed for four months, the Global Times reported on 23 May, for stealing 17,277 Kw/h of electricity to mine bitcoin.

China’s powerful economic planning ministry has designated crypto mining as an industry to be “eliminated”.

The Beijing News reported a day earlier on one hundred individuals who had been defrauded of 7,000 bitcoin in the over-the-counter market, the only type of bitcoin trading that’s still allowed in the country.

Nevertheless, Wei Xiao from the Bank of China Law Association explicitly stated that owning bitcoin is legal in China, even if exchanges and initial coin offerings are banned.

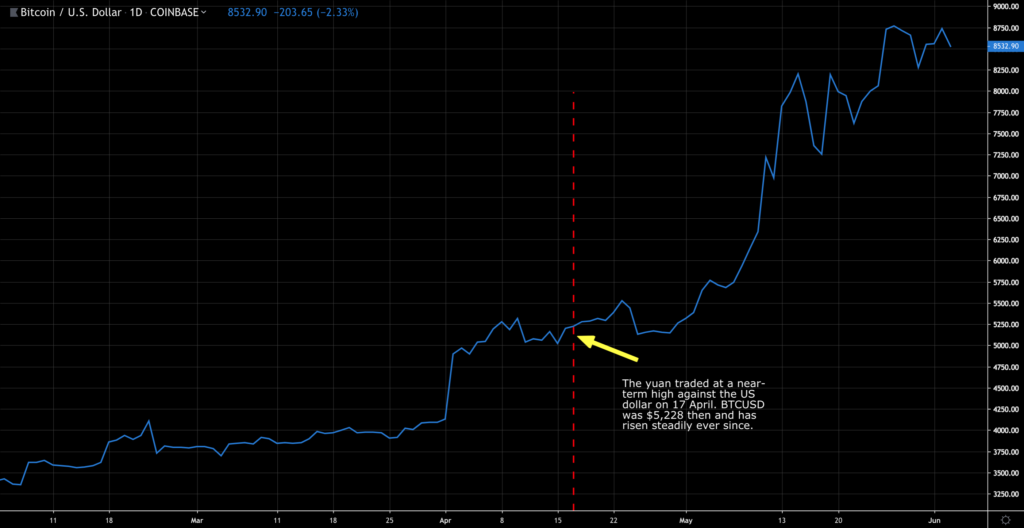

Since the 17 April the yuan has fallen against the dollar by almost 4%, a big move by the standards of the foreign exchange market major trading pairs.

On that date bitcoin was priced at $5,228 and has risen in value ever since.

Certainly, the network fundamentals and industry developments are enough to explain the recent uptrend for the word’s best-performing asset this year, but for near-term accelerant there’s no need to look much further than China.

Haven asset? Growing numbers think bitcoin is, and that’s what matters

Also, bear in mind the other side of the equation, namely the growing unease among market participants in the US.

The US is the largest crypto market by some distance and it is where the anxiety about the impact of loose monetary policy on the fiat currency is at its highest.

Chances that China will play the US Treasuries card are low as it would be undermining the value of its $1 trillion hoard of US debt.

Bitcoin is not a haven asset on a par with US government or German debt or gold for that matter, but lots of people think it is – and for others, such as Chinese investors, it is an attractive store of value on offer, either as capital flight conduit or a hedge in itself.