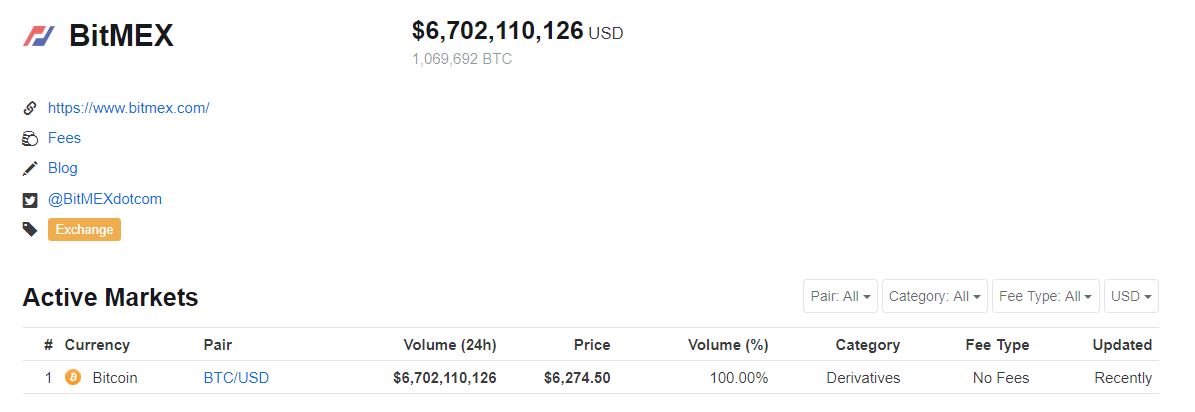

For the second time in two weeks, BitMEX has hit a daily turnover of 1 Million Bitcoin (BTC). This milestone was reached on the 8th of August 2018 and during a period of uncertainty in the crypto markets due to a declining BTC value. The exact 24 hour trading volume was 1,027,214.62 Bitcoin and the last time the exchanges surpassed 1 Million was on the 25th of July this year. A screenshot of the volume recently reached milestone can be found below:

BitMEX CEO and Co-founder Arthur Hayes is quoted as saying the following with regards to the 1 Million BTC milestone:

Once again meeting our own record of 1 million bitcoin traded within 24 hours is a major milestone for the crypto-coin market and testament to the strong community BitMEX is growing. In continuously engaging with, and truly listening to, the needs our customers, we’ve recognized an overwhelming demand for innovative financial products that give the crypto market greater versatility. It’s thanks to our discerning community that we have launched our two innovative, new products: the ETHUSD perpetual swap product and UPs and DOWNs.

In the case of the ETHUSD perpetual swap, the exchange was encouraged to offer the product after the success BitMex’s XBTUSD swap product. Customers can now trade ETHUSD price at leverage, while avoiding issues with settlement and large amounts of basis inherent to typical futures products. Within one week of launching, this product is now one of the most liquid instruments globally to trade the Ethereum / USD pair.

With regards to the UPs and DOWNs, BitMEX users can take advantage of call and put options. UPs, or Upside Profit Contracts, work similarly to traditional stock call options by giving token holders the right to purchase crypto-coins on BitMEX at a specified price for a predetermined period of time. DOWNs, or Downside Profit Contracts, act like traditional put options, letting token holders sell a crypto-coin on the platform at a specified price.

Mr. Hayes would go on to add the following with regards to the 2 new products:

The ETHUSD perpetual swap and UPs and Downs represent new and exciting territory for BitMEX and an unprecedented opportunity for the crypto community to experiment with more sophisticated financial instruments on an easy-to-use and highly secure trading application…With futures, swaps, and now options available on BitMEX, we are making great strides toward offering a wealth of derivative products designed for the crypto-coin industry.

In conclusion, BitMEX (Bitcoin Mercantile Exchange) has proved once again that it is one of the most liquid and exciting crypto trading platforms in the crypto-verse. The exchange was founded in 2014 and as a result of harnessing the financial derivatives experience of its staff. The exchange’s mission is to professionalize the trading of bitcoin and other cryptocurrency derivatives. By offering a fast, safe, and liquid way to hedge crypto vs. fiat currency risk, BitMEX hopes to spur bitcoin and general cryptocurrency adoption by consumers and merchants.