Latest Cardano News

Aside from developing this peer-reviewed smart contracting platform, Cardano is all about the community. Participants are “amazingly diverse and vibrant”. We saw Charles Hoskinson and Ken Kodama open letter and how they needed the community to rally behind their effort to rid the chairman of the Cardano Foundation whom they accuse of incompetence and attempts to coalesce power.

Part of Cardano’s guiding principles include “the growth of the community and its needs”. Now, as they work towards Voltaire, they are also diligent taking every step with caution and even including third parties to hold IOHK accountable assuming there are flaws that end up hurting users.

Read: 2 Reasons Cardano (ADA) Could Be Listed on CoinBase Before Stellar (XLM)

Patience, diligence and commitment to quality are the hallmarks of Cardano and this is rightfully so especially when we recognize that a financial operating system and a multi-layered protocol is being built. It demands exceptional attention to detail to every line of code and this monumental task is heaped on IOHK which aside from guiding this project also has other activities to deal with.

Check out my month progress update on Cardano! Some great progress as always this month!https://t.co/qhJ6OiTdDf

— Sebastien Guillemot (@SebastienGllmt) December 6, 2018

As a result of this and the realization that Cardano isn’t lacking in engineering resources but the fact that they are researching and at the same time building the protocol which is difficult. Because of this postponement of Project Shelly’s Q1 deadline is almost inevitable.

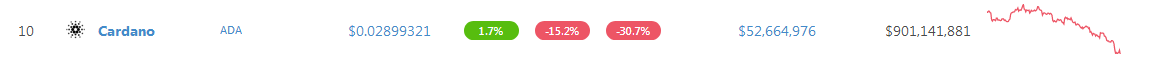

ADA/USD Price Analysis

At spot prices, ADA is down 15 percent and 30 percent in the last day and week but still hanging on at 10th. At this rate, prices are not only trending at new 2018 lows but are confirming the bear breakout pattern of early August. We expect this draw down to continue as long as BTC prices dump and deadlines extended.

Trend: Bearish

Everything else constant, ADA has been on a free fall after breaching the 6 cents previous main support and now resistance. Unless otherwise, this trend should continue and ADA could slip below 1 cent before year’s close.

Volumes: Bearish, increasing

Of interest in our analysis are Nov 28 bull bar—218 million versus 140 million and Nov 4—131 million versus 127 million, Nov 5—144 million versus 123 million and Nov 6—165 million versus 127 million. Notice that, the trend is clear, the last three bars have increasing volumes but the deviation from average is not that wide.

In the meantime, Nov 28 high trade volumes didn’t stop sellers from marching forward, reversing earlier gains. At spot rates, ADA/USD is trading below Nov 2018 lows accompanied by high trade volumes. This is bearish and we expect prices to trend lower unless of course there are surges above 3.3 cents erasing these losses.

Candlestick Formation: Bear Breakout

Following drops of Nov 19, ADA sellers drove prices below important support level completing the bear breakout pattern set rolling in early August. The drop has been near perpendicular and as long as prices trend below 1.5 cents, bears are in control.

Conclusion

11 months later and sellers are not slowing down partly because of BTC price declines. We expect losses to continue and as ADA/USD trade below 3.3 cents, the bear breakout pattern of Nov 19 is valid and sellers are in control. Floors are not yet visible and we shall recommend buying once proper bull reversal signals print perhaps driving prices above Nov 2018 lows and even 4.5 cents.

All charts courtesy of trading view

This is not Investment Advice. Do your own Research.