Cryptocurrency exchange platform behemoth, Coinbase, has acquired Keystone Capital – a financial services firm based in California. This move is the latest in a series of rapid expansion activities by the San Francisco-based Coinbase. The company announced the acquisition deal in a blog post on June 6. By this latest move, Coinbase is in line to become a regulated broker-dealer platform.

Coinbase Broker-Dealer License Aspirations

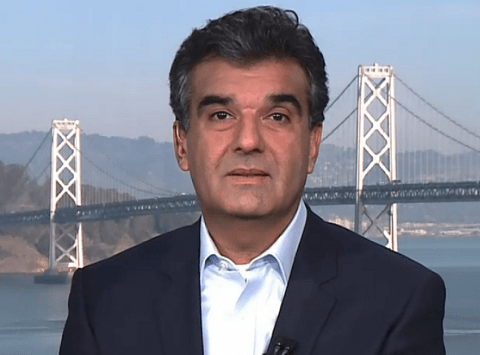

Announcing the Keystone Capital acquisition, Asiff Hirji, the President and COO of Coinbase said it was an important move in the platform’s aspiration to become a regulated broker-dealing. Commenting on the deal, Hirji said:

We’re announcing that Coinbase is on track to operate a regulated broker-dealer, pending approval by federal authorities. If approved, Coinbase will soon be capable of offering blockchain-based securities, under the oversight of the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).

By acquiring Keystone Capital, Coinbase is in line to receive a raft of government licenses. These licenses are the broker-dealer (B-D), an alternative trading system (ATS), and a registered investment advisor (RIA).

Coinbase has always erred on the side of caution concerning the digital assets that it offers to its customers. Despite the plethora of cryptocurrencies in the market, the platform only offers four – BTC, ETH, BCH, and LTC. Coinbase has so far not listed ICO tokens or even XRP for that matter due to unclear regulatory provisions. By obtaining these licenses, the platform will finally be able to increase the scope of its offerings to its over 20 million users.

Expanding to Non-Cryptocurrency Markets

With other cryptocurrency exchange giants like Binance, OKEx, and Huobi pursuing their service expansion agenda, Coinbase is taking significant steps to ensure that it isn’t left behind. The company recently announced the launching of four new products targeted at institutional investors.

Following our recent announcement of the Coinbase suite of institutional products, we believe this is an important moment for the crypto ecosystem and yet another indication of the maturation of the crypto economy. If approved, these licenses will set Coinbase on a path to offer future services that include crypto securities trading, margin and over-the-counter (OTC) trading, and new market data products.

If the deal sails through, Coinbase can transcend the cryptocurrency market into the mainstream financial world. Coinbase says it is optimistic about working with regulators, investors, and other stakeholders to tokenize traditional asset classes. The platform envisages a future where distributed ledger technology (DLT) becomes an essential part of the financial market. Coinbase is confident that blockchain offers some useful solutions such as non-stop trading, instant transaction settlements, as well as secure asset custody framework.

Coinbase recently announced that it was opening a new office in Japan. The platform remains the largest cryptocurrency exchange service in the United States.

Do you think other cryptocurrency exchange platforms will emulate Coinbase in acquiring broker-dealer licenses? Keep the conversation going in the comment section below.

Images courtesy of Ethereum World News archives and Everipedia (https://everipedia.org/wiki/asiff-hirji/).