The crypto-markets have continued to decline into the weekend due to the delay of the Bitcoin ETF by the SEC. The total market capitalization is threatening on getting to levels below $200 Billion. Current levels are at $209 Billion.

A quick analysis of Bitcoin (BTC) shows that the King of Crypto has been falling in value from mid December and from peak levels of $20,000. It then touched a new low on June 29th when it was valued at around $5,880. This marked 6 months since BTC started free-falling in the markets with a decline of 70.6% in the same time period. The current value of BTC at $6,145 indicates that we could witness levels below $6k once again. This possibility has caused panic in the crypto-verse but Bitcoin has survived worse periods of turmoil and come out victorious as shall be elaborated.

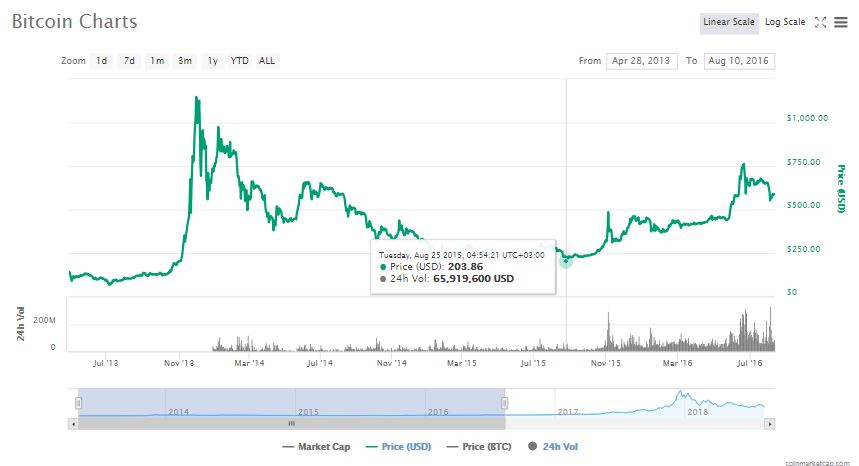

November 2013 – August 2015

Zooming back in time to November 2013, BTC had experienced a massive bull-run to new highs of $1,149. The King of Crypto would then start declining due to the prolonged Mt. Gox saga that was slowly unfolding in the background. BTC would not show signs of recovery up until August 2015 and at levels of $203. Doing the math, that was a drop of 82.3% in a period of 21 months.

From August 2015, BTC would gradually increase to the levels we witnessed last December. This was a period of 28 months of constant gains in the markets. Therefore, we can use the past to sort of have a general feel of what is happening and what we are patiently waiting for.

A Brief Summary of the Mt. Gox Saga

Mt. Gox exchange was launched on July 18th 2010 by Jed McCaleb (founder of Ripple and Stellar). Mt. Gox was short for “Magic: The Gathering Online eXchange”. By March 2011 it had been purchased by French developer and BTC enthusiast Mark Karpelès.

On June 19th, 2011, the first security breach happened. This breach caused the price of BTC to fraudulently drop to $0.01 after a hacker used credentials from a Mt. Gox auditor’s compromised computer to transfer a large number of bitcoins illegally to himself. Consequently accounts worth approximately $8,750,000 in BTC were affected. Mt. Gox managed to ‘fix’ the issue.

By April 2013 to early 2014, the exchange was processing 70% of all BTC trades online. On 2nd May 2013, CoinLab filed a $75 million lawsuit against Mt. Gox, alleging a breach of contract. The companies had formed a partnership in February 2013 which would soon turn sour.

On an unrelated issue, Mt. Gox suspended withdrawal in US Dollars on June 20th, 2013. On August 5th, 2013, the exchange announced that it was incurring losses due to crediting deposits which had not fully cleared, and that new deposits would no longer be credited until the funds transfer was fully completed.

In November 2013, Wired Magazine reported that customers were experiencing delays of weeks to months in withdrawing cash from their accounts. The article said that the company had “effectively been frozen out of the U.S. banking system because of its regulatory problems”. This was the beginning of the end of Mt. Gox.