The traffic of the Chicago Board Options Exchange’s website is overwhelming – which reflects directly the growth in interest by the public in BTC and cryptocurrencies in general with their exploding prices.

The price of January bitcoin futures, which the exchange started trading this weekend, fell $245, or 1.3 percent, on Tuesday to $18,300, highlighting the cryptocurrency’s extreme volatility. Such contracts let investors speculate on bitcoin by allowing them to lock in a price to sell the agreement at a future date.

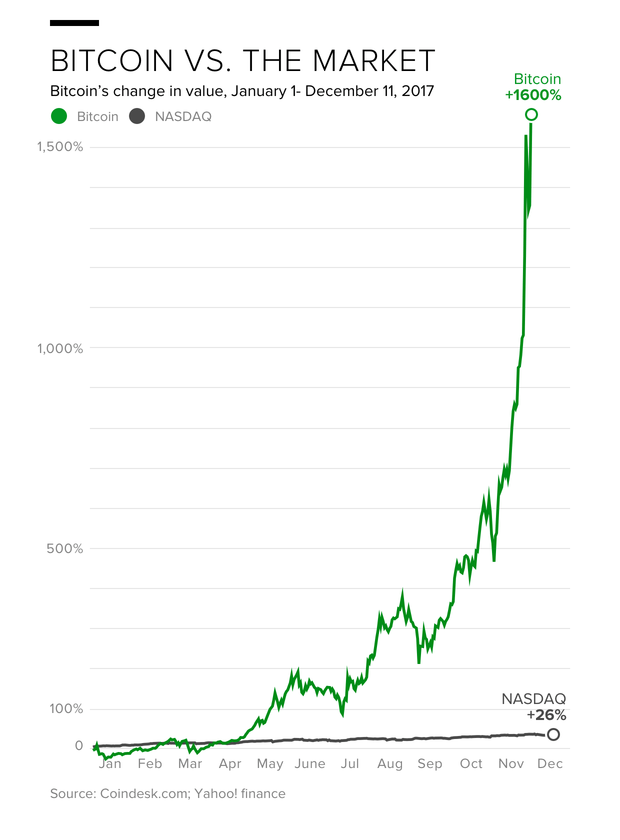

Bitcoin price has climbed over 1,600% in 2017 as it is trading above $16,400, while Ethereum year was brilliant as it soared over 10k percentage points in price from $7.00 to its all time high now of $748.08.

A growing number of companies also are raising funds through “initial coin offerings,” or ICOs, complete with celebrity endorsements ranging from boxing legend Floyd Mayweather to Hollywood star Jamie Foxx.

The startling run-up in prices for cryptocurrencies, which remain largely unregulated, has the Securities and Exchange Commission on its guard. The agency’s chairman, Jay Clayton, is advising potential investors on to exercise caution.

“Investors should understand that to date no initial coin offerings have been registered with the SEC,” he said in a statement Monday on the agency’s website. “The SEC also has not to date approved for listing and trading any exchange-traded products (such as ETFs) holding cryptocurrencies or other assets related to cryptocurrencies.“

“If any person today tells you otherwise, be especially wary,” Clayton added.

Anyone thinking of investing in an ICO or buying digital currency should ask a number of questions, according to the SEC. These include:

- Is the product legal?

- Is it subject to regulation, including rules designed to protect investors?

- Does a given product comply with those rules?

- Is a company offering an ICO or crypto product licensed to do so?

- Are there substantial risks of theft or loss, including from hacking?

“Please also recognize that these markets span national borders and that significant trading may occur on systems and platforms outside the United States,” Clayton said. “Your invested funds may quickly travel overseas without your knowledge. As a result, risks can be amplified, including the risk that market regulators, such as the SEC, may not be able to effectively pursue bad actors or recover funds.”

The first day of Trading Bitcoin futures for the CBOE was on Sunday while the rival CME is planned out to initiate the exchanges on Dec 18.