JPMorgan Chase & Co., one of the biggest American multinational investment banks is showing an apparent change of rhetorics towards crypto but, above all, towards the use of blockchain technologies as tools to improve the global economic system.

Although a few months ago, its CEO Jamie Dimon made some harsh statements against Bitcoin, accusing it of being a “fraud” —a fact that catalyzed a bearish trend in bitcoin according to several analysts— a later rectification in a much sober tone was seen as a small victory for the overall image of the crypto ecosystem.

In an interview with the Wall Street Journal, when asked about it, Dimon said:

[Those were claims] Which I regret making. The Blockchain is real; you are going to have crypto-dollars and yens and stuff like that …

The Bitcoin was, always to me, what the governments are gonna feel about Bitcoin when it gets really big, and I just have a different opinion of the people, I’m not interested that much on the subject at all.

BLOCKCHAIN: AN EXCELLENT BUSINESS OPPORTUNITY

After such declarations, it seems his interest in blockchain technologies has only been increasing. Yesterday, JPMorgan filed an application with the U.S. Patent and Trademark Office (USPTO) in which they propose the use of DLTs to quickly and safely process intra -and inter- bank payments:

ABSTRACT

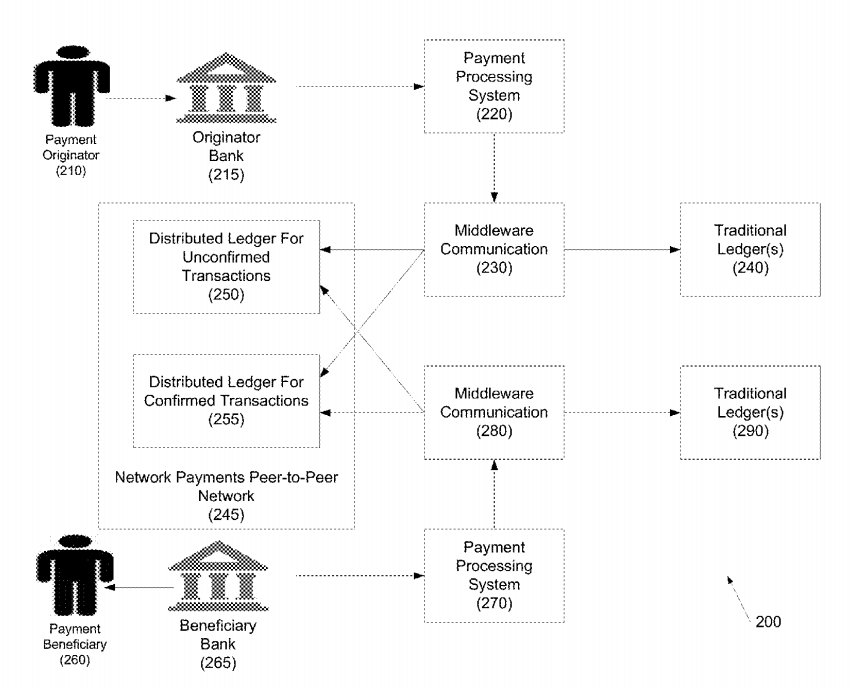

Systems and methods for the application of distributed ledgers for network payments as financial exchange settlement and reconciliation are disclosed. In one embodiment, a method for processing network payments using a distributed ledger may include: (1) a payment originator initiating a payment instruction to a payment beneficiary; (2) a payment originator bank posting and committing the payment instruction to a distributed ledger on a peer-to-peer network; (3) the payment beneficiary bank posting and committing the payment instruction to the distributed ledger on a peer to peer network; and ( 4) the payment originator bank validating and processing the payment through a payment originator bank internal system and debiting an originator account.

This ambitious project covers both on-chain and off-chain payments processing, allowing customers to healthily and smoothly migrate their systems, should they adopt JPMorgan’s technology.

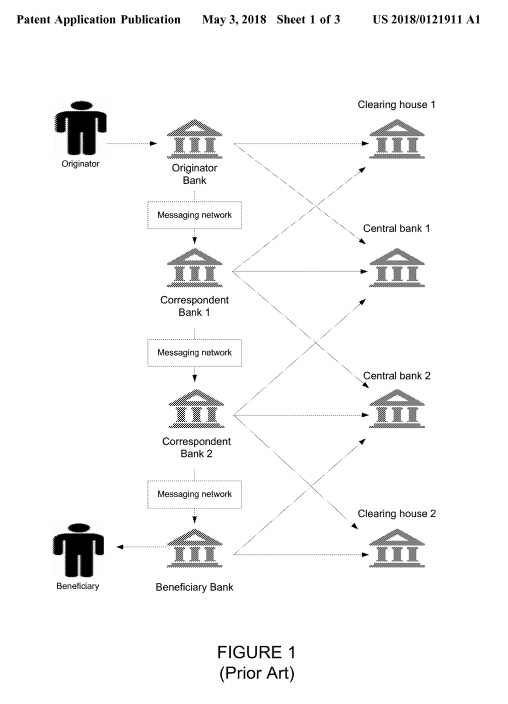

With this patent they aim to simplify the messaging system typical of traditional clearing systems such as SWIFT, which rarely allow a direct relationship between 2 customers, having to go through a chain of intermediaries to conciliate a transaction.

To achieve such a level of efficiency, the patent relies on the use of a private blockchain to record transactions allowing immediate verification of balances without requiring third-party processing as a “bridge” between operations.

3 BIG PLAYERS RELY ON BLOCKCHAIN TO MAKE TRADITIONAL BANKING BETTER:

JPMorgan’s business strategy increases its investment spectrum, and if successful, its vision would allow a considerable improvement not only in the provided services but also in its daily processing capacity. However, to consolidate its position, JPMorgan needs to upgrade its infrastructure to achieve the project’s goals while also focusing on some serious competitors out there:

- Ripple Inc. is perhaps the most robust option in the world of blockchain technologies today and the leading contender to beat for any Fintech or company seeking to bring banking closer to blockchain technologies. Its payments solutions and constant strategic alliances have earned it an essential place in the Top 3 of the most market-capped cryptocurrencies. Beyond the speculation of their XRP token, the work they have been doing since the beginning gives them the solidity and confidence necessary to have a preferred position among essential clients such as Western Union, Moneygram or the Central Bank of Saudi Arabia.

- SWIFT, the world’s leading provider of interbank clearing and payment services, also announced that it would be developing its own blockchain technology to provide its customer base with a faster and more reliable solution when transferring their accounts.A global implementation of this project would unite practically the entire international banking system through blockchain technologies.