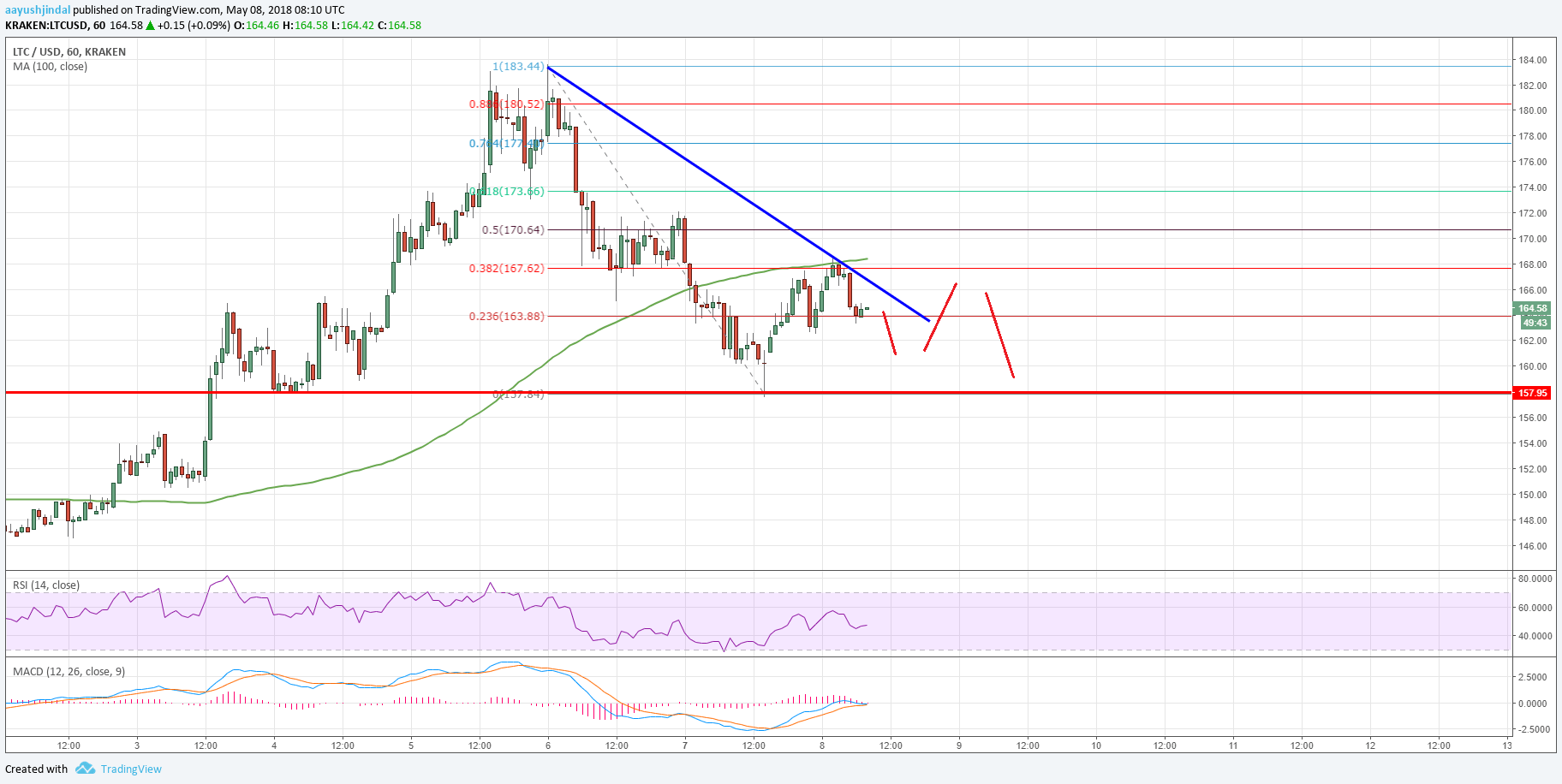

Litecoin price corrected lower and tested the $157 level against the US Dollar. LTC/USD now has to break the 100 hourly SMA to gain upside momentum.

Key Talking Points

- Litecoin price is holding the $156-157 support area very well (Data feed of Kraken) against the US Dollar.

- There is a key bearish trend line forming with current resistance at $166 on the hourly chart of the LTC/USD pair.

- The pair has to move above the $168 resistance and the 100 hourly simple moving average to gain momentum.

Litecoin Price Forecast

Yesterday, we saw a downside correction in litecoin price from well above the $180 level against the US dollar. The LTC/USD pair declined and traded below the $180, $170 and $166 support levels.

Looking at the chart, the price even broke the 50% Fib retracement level of the last leg from the $142 swing low to $183.44 high. However, the downside move was prevented by the $156-157 area.

A support base was formed at $157.50 and the price started an upside move. It traded above the 23.6% Fib retracement level of the last decline from the $183.44 high to $157.50 low.

However, there is a strong resistance near the $167-168 zone. More importantly, there is a key bearish trend line forming with current resistance at $166 on the hourly chart of the LTC/USD pair. Additionally, the 100 hourly SMA is at $168, and is acting as a strong barrier for buyers.

Moreover, the 38.2% Fib retracement level of the last decline from the $183.44 high to $157.50 low acted as a resistance. Therefore, it is quite clear that the price has to move above $168 resistance and the 100 hourly simple moving average to extend the current move.

A close above the $168 resistance may open the doors for a run towards the $180 level. On the downside, the $157.50 low is a short-term support.

As long as litecoin price is above the $156 support, LTC/USD could move higher in the near term.

Trade safe traders and do not overtrade!