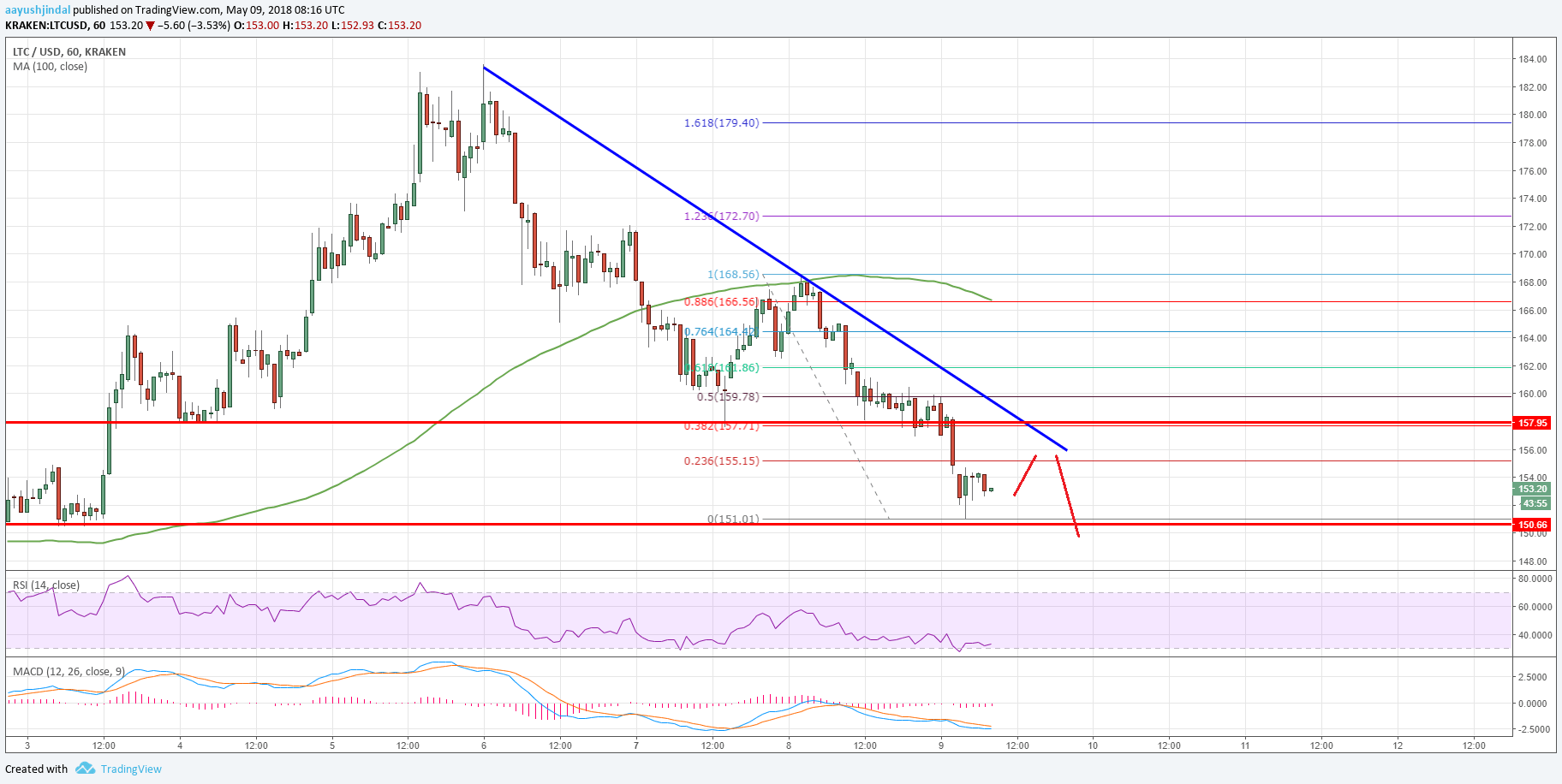

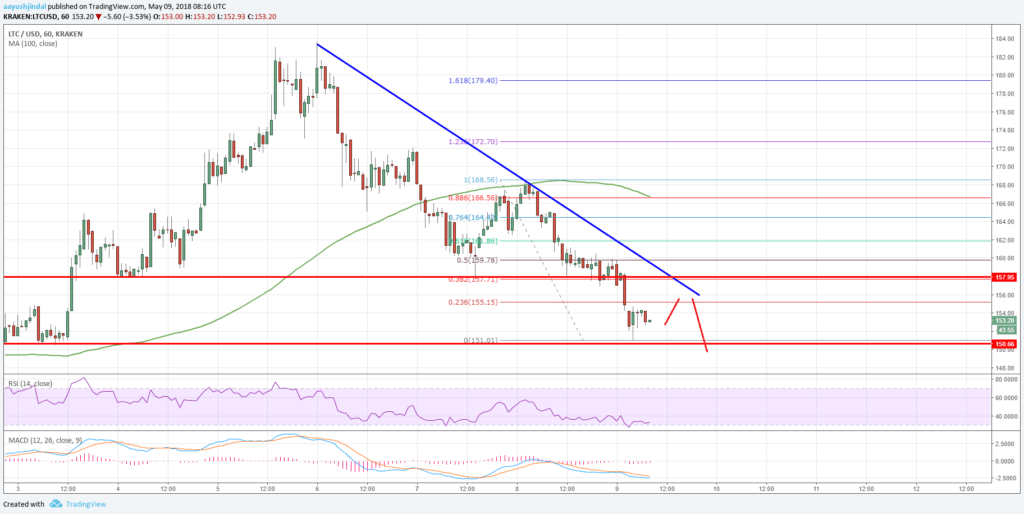

Litecoin price declined further and broke the $156 support against the US Dollar. LTC/USD may correct higher, but upsides may be capped by the $157 level.

Key Talking Points

- Litecoin price is struggling to recover and it recently broke the $160 support (Data feed of Kraken) against the US Dollar.

- Yesterday’s highlighted major bearish trend line is still intact with current resistance at $157 on the hourly chart of the LTC/USD pair.

- The pair must stay above the $150 support to avoid further declines in the near term.

Litecoin Price Forecast

There was a start of a fresh downside wave from the $180 swing high in litecoin price against the US dollar. The LTC/USD pair declined and broke a few supports such as $170 and $165.

Looking at the chart, the price came under bearish pressure and it even broke the $160 support level to settle below the 100 hourly simple moving average. The downside move was such as the price even failed to hold the $156 and $155 support levels.

It declined close to the $150 support and a low was formed at $151.01. At the moment, the price is consolidating and is trading below the 23.6% Fib retracement level of the last drop from the $168.56 high to $151.01 low.

There are many barriers on the upside, including the previous support at $156. More importantly, yesterday’s highlighted major bearish trend line is still intact with current resistance at $157 on the hourly chart of the LTC/USD pair.

The trend line resistance is close to the 38.2% Fib retracement level of the last drop from the $168.56 high to $151.01 low. Therefore, in the short term, if the price corrects higher, the $156 and $157 levels are likely to prevent upsides.

On the downside, the recent low of $151.01 is a short term support. The most important support is at $150.00, which must hold if litecoin has to recover. A failure to hold the $150 support may push the price towards $145.

Trade safe traders and do not overtrade!

*The market data is provided by TradingView.