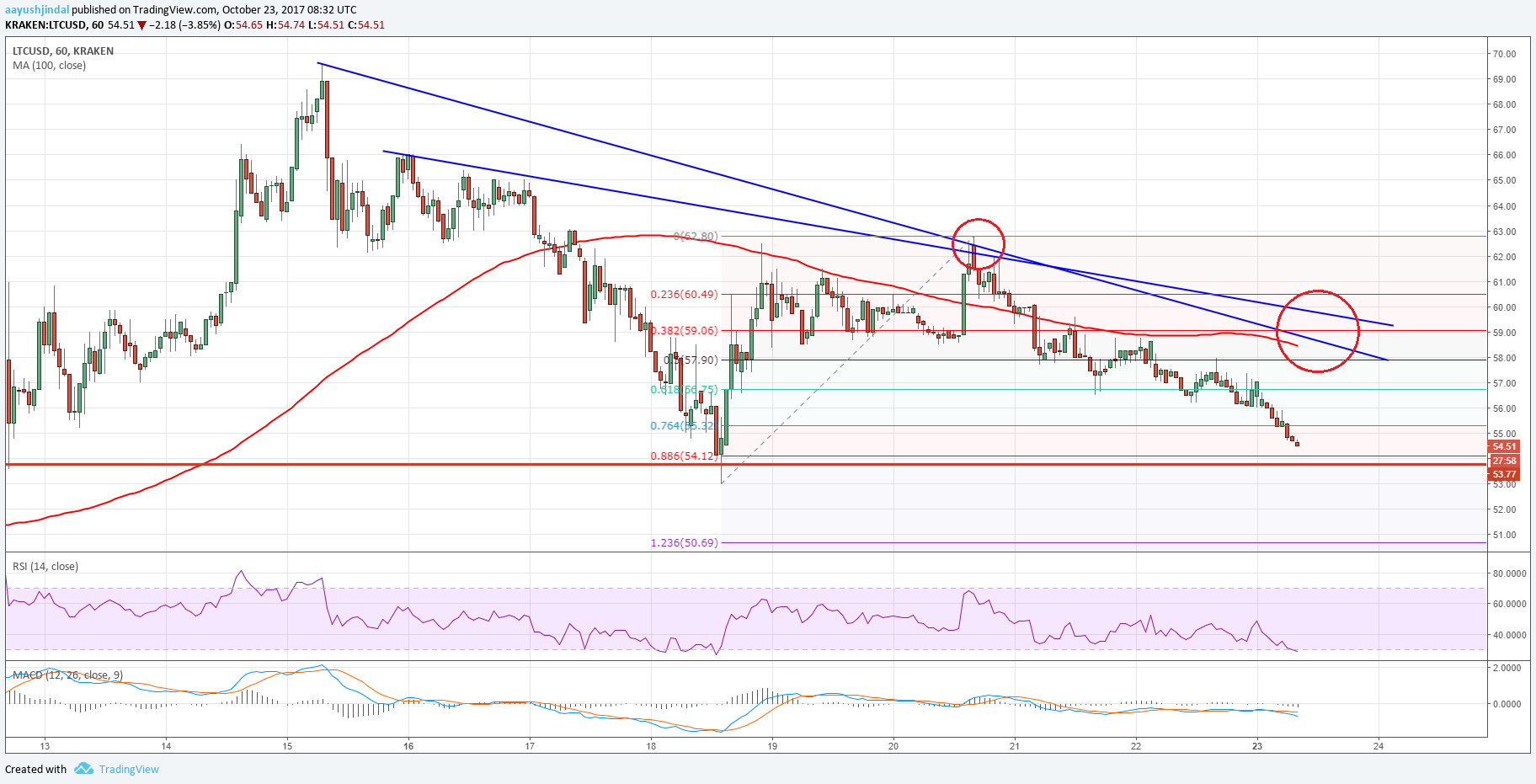

Litecoin price failed to hold the $60.00 support against the US Dollar. LTC/USD might continue to decline towards $53.00 or even $50.00.

Key Talking Points

- Litecoin price failed to hold an important support area at $62.00-60.00 against the US Dollar.

- There are two bearish trend lines forming with resistance at $59.00 on the hourly chart of LTC/USD.

- The pair is likely to extend declines toward $52.00 and $50.00 in the near term.

Litecoin Price Forecast

After a nice upside move towards $70.00, Litecoin price faced strong sell offers against the US Dollar. The price started a downside move and breached a couple of important support levels such as $64.00, $62.00 and $60.00.

The downside move was such that the price even broke the 50% Fib retracement level of the last wave from the $53.00 low to $62.80 high, and settled below the 100 hourly simple moving average. At the moment, the price is approaching the $53.50 support area, which is a short-term support.

On the upside, there are two bearish trend lines forming with resistance at $59.00 on the hourly chart of LTC/USD (data feed of Kraken exchange). These trend lines are important near $59.00-60.00 since these are aligned with the 100 hourly SMA.

A break above the $60.00 resistance and the 100 hourly SMA is required for buyers to step in and push the price back towards $65.00.

On the flip side, the price is already below the 76.4% Fib retracement level of the last wave from the $53.00 low to $62.80 high. Therefore, there are chances of at least a retest of the $53.00 swing low.

If sellers remain in action, Litecoin price could even trade towards the 1.236 extension of the last wave from the $53.00 low to $62.80 high at $50.69.

The overall short-term trend for LTC/USD is bearish as long as the pair is below $60.00. An increase in the bearish pressure would easily drag the price back toward the $50.50-50.00 support, which is a major buy zone in the near term.

Trade safe traders and do not overtrade!

Read Also: