Bitcoin (BTC) Moves Under $3,800, Crypto Market Cap At $120B

Another day, another bout of crypto market tumult. In the past 24 hours, cryptocurrencies at large have continued to move in a dramatic fashion, with leading assets, such as Bitcoin (BTC) and Ethereum (ETH), posting mid-single-digit losses that have sent investors’ Blockfolios into the red.

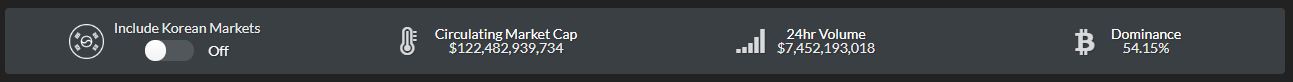

Since Ethereum World News’ previous market update, the aggregate value of cryptocurrencies has fallen to $122 billion, from ~$130 billion, with this move being backed by $15 billion ($7.452 billion adjusted) in 24hr volumes, as per Live Coin Watch. This market cap move represents a ~6.5% decline, a relatively slim loss when compared to BTC’s dismal performance in November alone.

Although volumes have declined since the peak of November’s sell-off, BTC continues to move in an intriguing manner, recently falling under $3,800 in a slow and steady sell-off, which is an evident far cry from the ~-15% days seen in mid-November. Regardless, the fact of the matter is that BTC remains under $4,000, a purported technical, psychological, and fundamental support level, and isn’t poised to undergo a bullish breakout anytime soon.

At the time of press, BTC has fallen to $3,780 on BitFinex (~$3,725 on other exchanges), and continue to find a solid foothold at the price level. And, again, as incessantly stated previous, as bitcoin has continued to collapse, so has altcoins. ETH is down 5.43%, nearing the notable $100 price level. Stellar Lumens (XLM) has posted a 7.61% loss, which follows the asset’s stellar performance last week. Bitcoin Cash (BCH) has found itself at $125, down 11% in the past 24 hours.

However, the most interesting price action came by the way of ZCash (ZEC), which fell by 10%, even though it was added onto Coinbase Consumer (Coinbase.com) on Wednesday. This, of course, is in direct contradiction to the so-called “Coinbase Effect,” whereas assets undergo an influx of buying pressure and hype due to even a fleeting mention from the aforementioned startup.

Interestingly, the crypto market’s most recent leg lower comes amid stock market turmoil, with the Standard & Poor’s 500 (S&P) index falling by a jaw-dropping 3.24% in the past American trading session (December 4th). And, as noted by a number of analysts, including Tom Lee of Fundstrat, the performance posted by equities markets may have begun to affect cryptocurrencies, contrary to popular belief.

“More Upside Than Downside”

Although this continued downward trend has worried a multitude of retail traders, some of which have capitulated in recent weeks, analysts have sought to find a silver lining. Speaking with MarketWatch’s Aaron Hankin, Jani Ziedens of CrackedMarket, noted:

Bitcoin continues flirting with the [$4,000] level as it struggles to find its footing following the latest selloff… But given how far we fell, at this point there is more upside than downside. That said, few things move as far and as fast as cryptocurrencies.

This statement could have been made in reference to claims made by optimist crypto traders, who have claimed that seeing that BTC’s performance in November was bleak — there’s no other way to put it — it is likely that cryptocurrencies have been oversold, and bears are getting weary.

And while this cry for “more upside than downside” is just speculation or a logical guess at best, there has undoubtedly been growing sentiment regarding the fact that the cryptocurrency market is poised to hit its bottom within weeks.

Moreover, many have claimed that 2019’s developments, like Bakkt and a possible Bitcoin-backed ETF, will catalyze the arrival of newfound bullish sentiment and momentum, which will drive the cryptocurrencies to new highs once again.

Title Image Courtesy of Bruno van der Kraan on Unsplash