Latest Bitcoin Cash News

Thing is investors are unfazed and even as speculators rush to the exits research data from Chainanalysis show that most were stockpiling days before prices plummeted ahead of the disastrous hash rate war of the third week of November 2018.

Read: Bitcoin (BTC) is Set to Become the World’s Reserve Currency, Max Keiser Says

Luckily, both parties—SV and BCH backed by Bitmain realized how expensive it was and instead of fighting “to death”, finances declared a cease-fire by the eighth day. A truce has been struck and with replay protection in place, both coins are advancing their causes with decent market valuations.

In the midst of all these, news has it that the South African government is following the state of New York route creating a regulatory task group to study digital assets and blockchain technology in detail. The objective will be to create a “unified intergovernmental regulatory framework” that will better place the South African government to appropriately respond to blockchain based solutions as cryptocurrencies and other digital assets.

Also Read: Cryptocurrency Lenders Thriving in Bear Market

This will also smooth kinks allowing tax authorities to update current tax returns form allowing for the inclusion of crypto gains and losses in 2019. This is a bold move in a country where up to 47 percent of the populace plan to invest in cryptocurrencies.

In a letter, Tito Mboweni, the Minister of Finance said:

“Work is under way within SARS to consider the amendment of the tax forms for the 2019 tax season in order to cater for the description of other assets (which will include cryptocurrencies) by means of a specific description field on the form.”

Bitcoin Cash (BCH) Price Analysis

General Overview

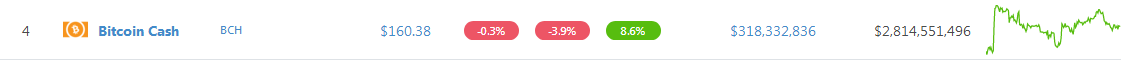

At fourth, BCH is one of the top performers in the last two weeks. Though it is up 8.6 percent from last week’s close, we expect bulls to reassert themselves, generating enough momentum that will propel prices above important resistance zones and buy triggers.

Trend and Candlestick Formation: Bearish, Breakout Pattern

Despite recent corrections, traders are bullish and as history shows, unidirectional declines like those of 2018 are often followed by bounce backs. As a result, it is likely that prices will edge higher more so if bulls clear $230 as the second phase of a breakout pattern pans out. In that case, a retest of $400 will be highly likely. If not and BCH finds resistance against the USD with prices dropping below $150, then Nov-Dec bears trend would have resumed and BCH risk dropping to 2018 lows.

Volumes: Bullish

A standout in the last few days is the resumption of activity days after it tapered ahead of Nov 15 hard fork. Note that recent volumes are better than those of Q3-4 pointing out that traders are back and there is trading happening.

For bulls to be in charge then gains above $230 and ideally should be at the back of above average volumes. It will not only mark the end of a strong bear run—if volumes are above 250k—and the beginning of an uptrend which traders had earmarked for early November. Otherwise

Our ideal BCH/USD trade plan assuming bulls prevail and rally above $230 is as follows:

Buy: $230

Stop: $180

Target: $400

All charts Courtesy of Trading View—Streams from CoinBase

This is not Investment Advice. Do your own Research.