Bitcoin Stable At $3,400, Altcoins In Similar Position

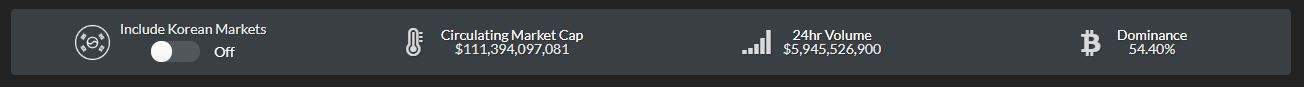

Interestingly, after a multi-week bout of lower lows, the crypto market at large stabilized on Tuesday and Wednesday, as Bitcoin (BTC) found itself trading in a tight range between $3,300 and $3,500. Since Ethereum World News’ previous market update, released not 24 hours ago, the aggregate market capitalization of all cryptocurrencies has barely budged, up by $1.4 billion (~1.2%) to $111.39 billion in comparison to yesterday’s $109.9 billion.

Like crypto asset values, volumes posted by exchanges have begun to slow, with 24-hour volumes per Live Coin Watch amounting to $5.9 billion, down $1 billion from the $6.9 billion tallied by the platform yesterday. CoinMarketCap statistics have echoed the dissipation of volume, as its 24-hour volume statistic has fallen from $13 billion to $11 billion, where it remains now.

Although BTC underwent a small uptick on Tuesday night/Wednesday morning, with the asset moving as high as $3,460 on Coinbase, Bitcoin has been relatively laid back, failing to break out or fall throughout any key levels of support or resistance. Many eyes are looking to BTC’s year-to-date lows, and the resistance situated at $4,000 as levels of interest.

At the time of writing, Bitcoin has found itself at $3,380 on Coinbase and $3,440 as a global average, making it clear that the asset has found a semblance of stability in the $3,400 range. BTC is currently 0.57% in the past 24 hours.

XRP, Ethereum (ETH), and Litecoin (LTC) followed BTC with precision over the past day, posting gains that were all under a mere 1%. Notable outliers included EOS, which posted a 4.13% gain after a dismal week, Bitcoin Cash (BCH) and Bitcoin SV (BSV) — as the two both lost 2% — and Tezos (XTZ), as the asset surged by 15.42% presumably due to the fact that Huobi Global announced support for the up-and-coming network.

Analyst Compares Crypto To Nasdaq Boom (And Bust)

Speaking with MarketWatch’s William Watts, the outlet’s deputy markets editor, Russ Mould, an investment director at British investment platform AJ Bell, drew lines between the Dotcom boom at the turn of millennia to 2017/2018’s crypto boom & bust.

Mould claimed that crypto’s performance throughout 2018 “looks like many that we’ve seen before across a wide range of asset classes,” adding that the status of the market today propagates “vicious bear traps,” sending crypto “HODLers” even further into the ground. He explained that the Nasdaq, in the midst of its collapse in 2003, tried to break out multiple times, but failed miserably — not too different than Bitcoin’s stints at $10,000, $6,200, and $3,500 today.

Mould isn’t the only analyst to make such connections between two of history’s largest bubbles. In a post titled, “What Bear Markets Look Like,” Twitter angel investor Fred Wilson, who heads Union Square Ventures, noted that just like technology stocks in 2002/2003, cryptocurrencies have posted a more than 80% loss in a year’s time.

The prominent investor added that cryptocurrencies, even BTC, could head lower from here. Giving his statement some rationale, Wilson explained that once Amazon (AMAZ) declined to 20 percent of its all-time high, the then-startup saw its public valuation experience another 50 percent haircut, summating to a jaw-dropping 90 percent loss.

AMAZ’s debacle in the early 2000s may have been nothing but a blip on its multi-decade chart, but Wilson, a Bitcoin believer himself, is visualizing how cryptocurrencies could fall further, even while they have ground-breaking potential and seemingly endless upside.

Still, Wilson, a legendary venture capitalist, ended his aforementioned blog post with an optimistic tone, writing:

“I think some crypto asset (and possibly a number of crypto assets) will have a price chart like Amazon’s current one in 18 years. But we will have to do what Amazon did, hunker down and build value and survive, for quite a while to get there. And I think things will get worse before they get better.”

Title Image Courtesy of Alejandro Alvarez on Unsplash