According to the government of the most populous nation on earth, BTC is drawing money out of their economy. The blame has been squarely placed on investors who are using the digital asset as a “fleeing asset,” in a cooling global economy. A remarkable shift from initial comments that Bitcoin was an “escape” asset. The US and China now seem to have averted the escalation of the trade war between them, as talks resume.

The two nations have been involved in a heavily contested bilateral trade dispute whose effects have been hefty. United States President Donald Trump has as a result of the tiff, doubled his nation’s import tariffs on Chinese products worth $200 billion in May.

Additionally, he has threatened to impose higher tariffs on $325 billion more of the East Asian products, which is just about everything else China exports to the States. On the other hand, Chinese President Xi Jinping has retaliated with an increased tariff on $60 billion worth of U.S. goods. The Chinese state media has also hinted that their government could hold back exports of rare earth elements to the US.

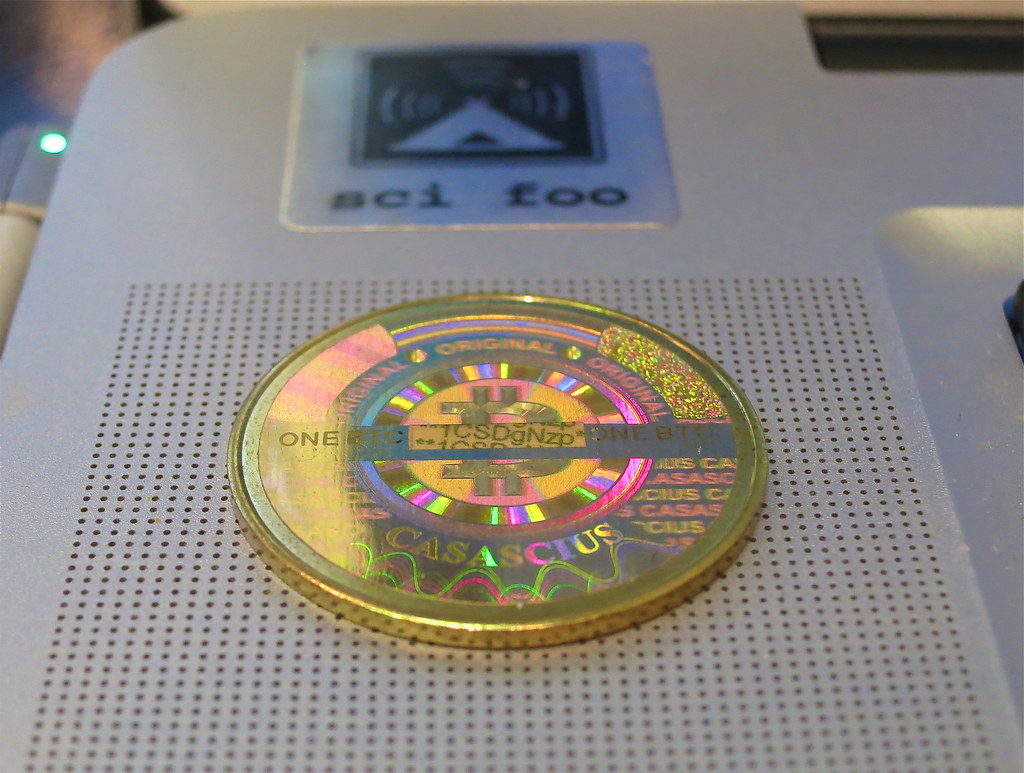

Investors Shifting to Bitcoin (BTC)

Christine Lagarde, the Managing Director of the International Monetary Fund (IMF) has sounded a warning bell, on the effects of the trade wars on global economic growth. The IMF has implied that the trade skirmishes could slash the global GDP by 0.5 percent or $445 billion. Financial data from China also shows that its economy is slowing down.

The Chinese government’s alarm over Bitcoin’s use as a fleeing asset is therefore justifiable. The prospects of a weakening Yuan are driving Chinese investors to BTC and the USD. As an illustration since the tariff’s raise, the Yuan’s value has fallen 2 percent against the dollar. There are fears therefore that Xi Jinping will devalue the currency further to keep the nation’s goods competitive for the US market despite the tariffs.

The comments, however, points to a changing attitude towards Bitcoin by the Chinese government. The communist government has been very handed in its intervention against crypto enthusiasm in the past. BTC’s stands of permissionless decentralization are very much in conflict with the East Asian government’s aims. China was the first nation on earth to slap regulations on crypto trading, even banning exchanges.

Chinese Government Stance on Bitcoin (BTC) Evolving

Naming BTC a “fleeing asset” shows that the government is beginning to accept the potential of the token. Crypto veterans say the escalation of the trade wars between the two major economies has been good for crypto. Besides the current injection of equity into Bitcoin by institutional investors, the shaky global economy has also turned the eyes of investors towards Bitcoin and gold.

Dovey Wan, the co-founder of Primitive Ventures, has said that “Bitcoin is winning the trade war while China and US is a lose-lose.”

XBTO CEO Philippe Bekhazi has additionally noted that:

“I’ve talked to a bunch of traders on the ground in Hong Kong. There’s a booming business in stable coins because people are getting money out of China and Hong Kong.”

This bid to escape the native currency has been highly frowned upon by the Chinese government. As a result, it has taken stringent measures to prevent it, and the digital savvy population is, therefore, turning to Bitcoin.